Self Checkout

This Working Group is focused on the rapidly changing world of customer checkout, in particular the various ways in which shoppers can now do this with little or no active engagement with store team members.

With retailers becoming increasingly concerned about growing levels of retail loss associated with various types of self-checkout systems, this Working Group is driving industry-leading research on better understanding the scale and nature of the problem, and perhaps as importantly, how they can be better managed and controlled.

The Group is critically reviewing the role a combination of Design, Guardianship, Technologies, and Store Processes can play in the ongoing transformation of the checkout environment in retailing.

Research papers

Our research papers offer groundbreaking insights and actionable outcomes to help retailers and their partners better manage the many ways in which profits can be negatively impacted by all forms of retail loss. Produced by some of the leading academic experts in the field of retailing and loss prevention, they are all free to download.

Our Meetings

ECR Retail Loss Group regular working group meetings provide an opportunity to network with industry peers, hear updates on the latest research and sector initiatives, and development new skills and insights. All retailers, CPGs and academics can participate at no cost.

Innovation Challenges

Blog Self Checkout

Podcast Self Checkout

FAQs Self Checkout

Recent research has begun to classify the different ways in which SCO systems can create losses for retailers. These are:

Non-scanning: this can happen in a number of ways including, passing the item across the Fixed SCO scan area ensuring the barcode cannot be read and placing it in the bagging area (when weight-based security systems (see below) are not present or are set to tolerate one or more items not being scanned), or placing it directly into a bag next to the bagging area.

Mis-scanning: there are two main ways in which this typically happens. In the first, the user places a particular item on the weigh scale, such as a kilo of grapes and then chooses a cheaper item from the list of options available, such as carrots or onions. The second form is the mis-representation of items of a similar weight but differing values.

Walk-aways/Non-payment: this form of loss occurs at Fixed SCO machines when a user has scanned some or all of their items correctly and triggers the completion of the transaction but does not make payment, simply walking away with the items.

Product switching: a variant of mis-scanning is also possible with Scan and Go. In this scenario the user scans a particular variant of a product but then places it back on the shelf and replaces it with a more expensive type.

Multiple Variety Errors: this form of error corrupts store inventory records, which over time could lead to out of stocks and an eventual loss in sales. In this situation, the user has selected a product which is available in a number of varieties or flavours, such as a tins of cat food – chicken, beef, fish etc. The consumer simply scans the same variety several times to speed up the process and places them in the bagging area.

Promotion Errors: similar to the previous scan error, this does not necessarily generate an immediate financial loss for the retailer but does corrupt inventory records. In this situation the promotion is a buy-one-get-one free offer where the user only scans one item because they assume the second one is free and therefore does not need scanning.

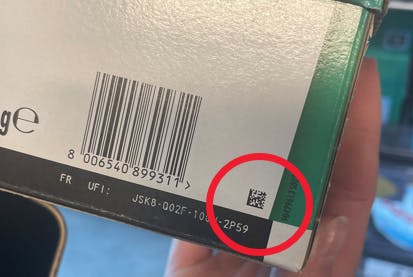

Barcode Switching: this form of loss occurs where a user obtains a different (usually cheaper priced) barcode for a product and scans the barcode as the product is moved across the Fixed SCO scan area.

Coupon Frauds: In this scenario the use of promotional coupons is abused by the user, typically by using the same coupon multiple times, leading to lost margin.

Double-scanning: This type of error is in many respects a double-edged sword for retailers. On the one hand, when a consumer accidentally scans the same item once or more, then they will be paid for the same product more than once, generating a significant profit. On the other hand, the same behaviour will also adversely impact on stock accuracy – store systems will potentially over order double-scanned items, which could lead to a range of adverse outcomes.

Up until recently, there has been little or no published research on the scale of losses associated with SCO systems. However, the 2018 ECR Report, available elsewhere on this website, is the first time estimates of losses were surmised. The study looked at losses for Fixed SCO and for Scan and Go systems:

Fixed SCO: data comparing stores with and without Fixed SCO found that levels of loss were higher in the former than the latter, with some Grocery case studies recording losses in the region of 90% to 100% higher. One case study, focused on the difference between stores using SCO with and without a weight checking system, found that losses where there was no weight system were 147% higher than stores not using any SCO technology.

Utilisation data (number of transactions processed through SCO) showed that stores with higher rates had higher levels of shrinkage. Stores where 55-60% of transactions went through Fixed SCO can expect their shrinkage losses to be 31% higher. Similarly, data looking at rates of loss and the number of SCO machines in use found that stores with higher numbers of machine also had higher rates of loss. Stores with the average number of SCO machines (for the case-study retailer), could expect to see shrinkage losses 31% higher than an estimated industry average, while those utilising an above average number of machines could expect the rate of loss to be at least 60% higher or more.

Technology monitoring and video analysis data looking at €72 billion of transactions found that non-scanning at Fixed SCO machines accounted for 0.44% of SCO sales, amounting to 9.5% of all store-recorded shrinkage. The data suggested that non-scanning behaviours alone (not including mis-scanning, walk-aways etc) are likely to add 0.5 Basis points of loss per 1% of Fixed SCO utilisation.

Together the various data sets strongly indicate that previous assumptions that Fixed SCO do not generate additional losses for retailers are incorrect – the losses are real and, in some cases, significant. Based upon the available evidence it is estimated that for each 1% of Fixed SCO utilisation, a retail store should expect their shrinkage losses to increase by at least 1 Basis point. This estimate does not consider other forms of loss that SCO systems are likely to be generating, such as lost margin and lost profits due to out of stocks caused by increased errors in stock inventory records. At this time, it is not possible to put a concrete figure on these losses.

Given this, for a store with 50% of transactions being processed through Fixed SCO, it can expect its shrinkage losses to be 77% higher than the average rate found in Grocery retailing. None of this data takes into account the likely productivity savings retailers can accrue from using this technology.

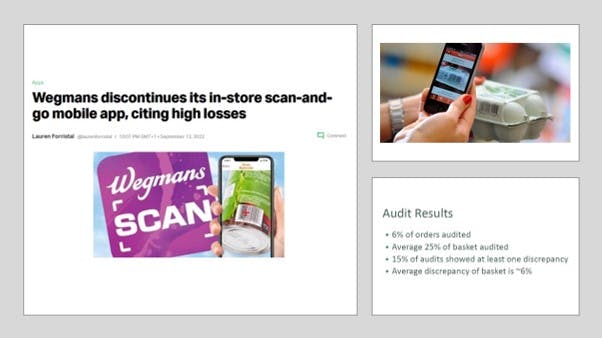

Scan and Go Systems: analysis of 140 million transactions, found that the average utilisation rate of this technology was still relatively low – 2.43% of all transactions. Of this total, 12% or 17 million were subject to a Partial Re-scan Audit (only a small proportion of items are checked). Of those, 2.87% were found to contain at least one error, generating an overall inventory error rate of 0.52% of Scan and Go sales. When over-scans were taken into account, the net loss was calculated as 0.31% of Scan and Go SCO Sales, equivalent to a 2 Basis point increase in losses for every 1% of utilisation.

However, analysis of 20,000 random Full Re-scan Audits (every item is checked) showed an overall error rate of 43.4% – 1,412% higher than the Partial Re-scan Audit data. When this error rate is used to calculate net losses, it shows that the rate is as much as 3.88% of all Scan and Go SCO sales, generating a Loss to Utilisation Ratio of 11 Basis points per 1%. Taken together, stores using this technology (at current utilisation rates) could see overall losses in the region of 3.3% of all sales, undoubtedly raising questions about the overall viability of this approach.

Further analysis of Full Re-scan Audit data, using probability statistics, showed that as the size of shoppers’ baskets increased then the likelihood of an error occurring also increased. When a shopper has 50 items in their basket, then there is a 60% chance they will make at least one error, while for those with 100 items there is almost a 9 in 10 chance they will make an error.

The ECR study also shared data from one retailer comparing stores with and without Scan and Go SCO, which showed that those with the technology had a rate of shrinkage 18% higher than those that did not, suggesting a Utilisation to Loss Ratio of 6 Basis points.

While there is much more research required to understand how SCO supervisors can impact upon the levels of loss generated by SCO, the ECR research considered the following factors to be important:

Customer Engagement: making not only eye contact but also verbally interacting with the SCO users was considered important, but doing this in a way that was non-confrontational and service-focussed

Delivering Customer Training: using non-accusatorial techniques was considered an important skill for SCO supervisors to develop, to enable an errant shopper to not lose face yet at the same time recognise that they had been identified.

Customer Prioritisation: when SCO spaces get busy then the supervisory role becomes even more critical in managing customer expectations and keeping friction to a minimum.

Occupying the SCO Space: ensuring that supervisors occupied a central and visible location within the SCO environment was considered important in amplifying risk and improving their capacity to deal with alerts more quickly.

Having Awareness of Risk: because of the unique risk characteristics of SCO spaces, it was also deemed important to ensure that SCO supervisors were given sufficient training to understand what they should be specifically looking for and how to react accordingly.

Protecting the Brand: In some Fixed SCO environments, audits of customers using Scan and Go/Mobile SCO systems can also be carried out, and these events can often be viewed as an explicit personification of a retailer’s overt distrust of the user – this as a moment of tension for both the consumer and the SCO supervisor, particularly when un-scanned product is identified. It was felt that a well-trained SCO supervisor was critical at this moment.

Experience Counts: there was clear and unambiguous support for the notion that only experienced staff should be employed in SCO environments. In addition, emerging evidence suggests that SCO supervisors should be selected who are able to multi-task well and make good decisions when prioritising activities.

Keeping Customers Honest and Accurate: the SCO environment is potentially rich with opportunities for both malicious and non-malicious losses to occur, and so the role of the SCO supervisor is fundamentally about keeping the customer honest and accurate – to gently guide them away, through good customer service and vigilance, from the opportunities that they may be presented with to makes errors and/or abuse the system.

Because the level of losses associated with SCO have only recently begun to be understood, retailers are still developing their palette of options to try and manage them more effectively. The ECR research identified two key approaches: Minimising Product-driven Errors, and Amplifying Risk and Enhancing Detection:

Minimising Product-driven Errors: focussing upon ensuring that packaging and barcode issues do not generate scanning problems; reducing the number of product set-up issues which may make scanning difficult; and ensuring the removal/deactivation of product protection technologies is efficient and reliable.

Amplifying Risk and Enhancing Detection: the ECR research concluded that three components were important: Guardianship: ensuring there are suitable, properly trained and motivated SCO Supervisors operating in an environment which facilitates rather than hinders their duties; Technologies: A range of systems designed to identify discrepancies in weight versus what has been scanned by the consumer; automatically identify when a consumer has not properly scanned an items; and systems which can identify products to reduce the risk of mis-scanning; Design: developing effective ways to amplify risk and enhance detection in the SCO environment, such as creating Zones of Control.

Numerous retailers around the world are now trialling technologies to try and identify when a consumer has not scanned an item. The most common is a weight-based security check where the system monitors the weight of all the items placed in the checkout area and compares that with the weight of all the items that have been scanned. If an item has not been scanned but placed in the checkout area, it will in theory trigger an alert. While regarded by many as a good form of security, they can generate a considerable number of false interventions, particularly if the weight-based product database is not kept up to date.

Retailers are also trying video-based systems to identify scan avoidance. Using overhead cameras, the system tracks the movement of products across and around the scan area and compares that with product registrations on the Electronic Point of Sale (EPOS) system. If an item is ‘seen’ to move across the scan area but is not recorded on the EPOS system, then an alarm can be triggered. This is challenging technology to make work accurately and early iterations often generated high levels of false positives and negatives. However, providers of more recent versions of this technology claim that the level of accuracy is now much improved and can be used to prompt users to rescan items which have not been registered on the EPOS system without recourse to generating a response from a member of staff.

A relatively common way in which consumers can abuse SCO systems is to misrepresent what a product is when it is being weighed – the ‘grapes for onion’ scam. Here the consumer places, say a bag of grapes on the weigh scale, but ‘tells’ the system they are in fact onions, which are much cheaper than grapes. Some retailers are beginning to try technologies that will ‘identify’ what the product is that is placed on the weight scale, or in some circumstances what it is not. In this example, the system ‘knows’ what onions look like and so when the user presses this option, the system generates an alert to say it hasn’t ‘seen’ onions. Again, this is challenging technology to get to work in a complex environment, especially when a store could have as many as 50,000 different items and there is little tolerance for delay while scanning.

When first introduced the initial driver for many adopters was undoubtedly labour saving and increased productivity, with much of that saving being associated with the introduction of fixed self checkouts (SCO ) systems, which had the capacity to remove a considerable amount of labour from the traditional staffed checkout model. However, the retail picture has evolved considerably, and the use of SCO systems is now increasingly viewed as part of a broader picture of offering greater consumer choice. In many respects what can be seen is the evolution of a ‘push’ and ‘pull’ approach to the use of SCO technologies in retailing. In the first instance, retailers quickly realised that it provided an incredibly effective way to reduce their staffing costs – one of the largest outgoings a retail business faces, but as the technology became more established and some consumers began to prefer it as a way to shop, then it has emerged as an increasingly expected and indeed essential option within the modern retail space.

Grocery retailers in particular have been using a range of technologies for many years to enable consumers to take greater control over the checkout and pay process of the shopping journey. These technologies, which are called different things in different markets, such as: Self-checkouts (SCO), Assisted Self-checkouts, Self-checkout Systems, Self-service Checkouts, and Scan and Payment Systems, were first seen in the late 1980s/early 1990s although their use has only really become much more extensive in the last 5-7 years. The technology essentially gives responsibility for the scanning of items that wish to be purchased to the consumer, including in some circumstances, weighing fresh food. In addition, the consumer is then given the responsibility to make the payment for the products that they have scanned.

It is hard to get reliable data on the extent to which retailers are using Self-checkout technologies. The most common type currently in use is Fixed Self-checkouts, followed by Scan and Go systems and then Mobile Scan and Go and Amazon Go style technologies. The Grocery sector, where customer and product volumes, and space utilisation issues make it a particularly appealing proposition, are by far and away the sector most likely to use this technology thus far. However, other types of retailing are also beginning to use SCO, including the Home Improvement sector, some apparel retailers and convenience stores.

A fundamental component of the SCO proposition is the transference of responsibility for the accurate scanning of products and ensuring correct payment is made from staff employed by the retailer to the consumer. In many respects this is a radical leap of faith in the capacity of the consumer to do this both accurately and honestly. Since the very early days of retailing, incidents of customers stealing product have been recorded and indeed a whole industry has been established trying to manage this problem as incremental changes in the retail environment have increased the risk of losses occurring. For many of those tasked with ensuring that retailers sell more products than they lose, the emergence of SCO technologies has been viewed as a concern, not least in the difficulty in imposing strong enough controls over the way in which it may be used and abused.

While there is now a wide range of types of SCO technology available, there are essentially three main forms:

Fixed self-scan machines or robots: this is where the consumer brings their chosen products to a fixed point in the store and proceeds to scan them either using the barcodes present on the items or by choosing the item type from a list of possible options provided by the machine displayed on an interactive screen. The consumer can then pay for their items either with cash or by some form of payment card.

Scan and Go Systems: this is where the consumer is provided with a ‘scan device by the retailer which can be used while shopping to scan the barcodes of items they wish to purchase. At the end of the shopping journey, the user is then required to go to a fixed point and dock their scan device in a terminal, which then processes the transaction and takes payment from the consumer.

Mobile Scan and Go Systems: the third main variant in use now, and one that has only recently begun to be offered by retailers, is similar to the Scan and Go system described above except that instead of using a scan device provided by the retailer, the consumer uses their own mobile device, utilising a bespoke App provided by the retailer (or a third party), and the camera functionality built into the device, to scan and record products they wish to purchase. This also provides the option for the consumer to pay for their items anywhere in the store via their mobile device.

Other forms of SCO technologies are available, with new approaches being developed all the time, including the use of RFID. More recently the Amazon Go system, which was unveiled towards the end of 2016 in their Seattle Headquarters store in the US, uses a network of cameras, sensors and weight pads to enable a consumer to pick up any items and exit the store without any need for barcode scanning or interaction with a payment system. The prospective consumer needs to be registered with Amazon and to have downloaded a bespoke App before entering the store. Upon arrival, the user has to scan a unique code generated by the App on their mobile device to gain access to the store, and then they are free to select items and then simply leave the store, receiving an electronic receipt within 20 minutes. A number of other companies are also beginning to offer technologies similar to this approach

Main office

ECR Community a.s.b.l

Upcoming Meetings

Join Our Mailing List

Subscribe© 2023 ECR Retails Loss. All Rights Reserved|Privacy Policy

![[Self] Checkout In Person Meeting - June 21st & 22nd](https://images.prismic.io/ecr-group-staging/2280d59d-72d5-4d87-ae26-309fc622b783_Image%2031.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&w=100&h=34)