Self-Checkout in Retail: Measuring the Impact on Loss

Measuring the Loss

Table of Contents:

- Abstract

- Foreword

- Executive Summary

- Introduction

- Background

- - The Rise of SCO Technologies

- - Utilisation of SCO and Risk

- - Competing Expectations: The Role of Loss Prevention

- Understanding SCO-related Losses

- - Key Drivers of Lost Profits

- - Challenges of Measuring SCO Losses

- Impact of SCO on Retail Losses

- - Losses Associated with Fixed SCO Systems

- - Losses Associated with Scan and Go SCO Systems

- Controlling SCO: Keeping Shoppers Honest and Accurate

- - Minimising Product-driven Errors

- - Amplifying Risk and Enhancing Detection

- Controlling Fixed SCO

- - Capable Guardianship

- - Utilising Technologies

- - Designing the Fixed SCO Environment

- Controlling Scan and Go/Mobile SCO

- Conclusions

- Developing a Framework to Manage SCO in Retailing

- Appendix: Methodology

- - The Collecting of Quantitative Data

- - The Collecting of Qualitative Data

- - Confidentiality and Presentation of Data

- - Limitations

Languages :

This report, published in 2018, focusses upon quantifying the risks associated with three forms of self-scan and checkout technology (SCO): Fixed (the consumer scans at a designated machine) Scan and Go (the consumer is provided with a scan gun by the retailer) and Mobile Scan and Go (the consumer users their own mobile device to scan items) (1). In addition, it provides a critical review of the various ways in which these risks might be controlled and managed.

It is based upon data collected from 13 retail companies and two SCO technology providers. Interviews were carried out with 73 key stakeholders from these companies and 11 store visits were conducted to review the technologies in use. In addition, a range of data points were collected from participating retailers, including: 140 million Scan and Go transactions; 17 million transaction audits; 486,000 items found not to have been scanned; video analytics of €72 billion of Fixed SCO transactions; and comparative shrinkage (2) data from thousands of retail stores. It is the most comprehensive study to date on the scale and extent of losses associated with SCO technologies.

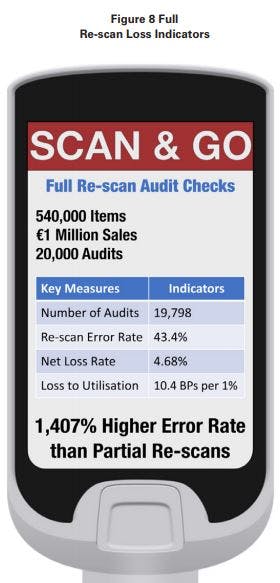

The study provides the first ever independent assessment of the losses associated with various types of SCO systems. Developing a loss to use indicator, it suggests that for Fixed SCO systems retailers can expect that every 1% of transactional value will generate an additional 1 Basis Point of shrinkage (unknown stock loss). Given this, for a store with 50% of transactions being processed through Fixed SCO, it can expect its shrinkage losses to be 75% higher than the average rate found in Grocery retailing. For Scan and Go SCO the study found that the expected losses were likely to be much higher, in the region 10.4 Basis Points of additional loss for every 1% of transactional value. Moreover, the study found that utilising partial audit rescans to identify non-scanned products was highly unreliable – on average only 2.88% of audits found an error compared with full audit checks which found on average an error in 43.4% of baskets.

The research offer valuable insights on how retailers might begin to try and control the losses associated with SCO systems. Four key areas are explored: the role of guardianship, the utilisation of various technologies, changes in store processes, and the impact of how the SCO environment is designed. A detailed framework is also provided aimed at helping retail organisations develop more co-ordinated, cross organisational strategy for the management of SCO.

Abstract

This report, published in 2018, focusses upon quantifying the risks associated with three forms of self-scan and checkout technology (SCO): Fixed (the consumer scans at a designated machine) Scan and Go (the consumer is provided with a scan gun by the retailer) and Mobile Scan and Go (the consumer users their own mobile device to scan items) (1). In addition, it provides a critical review of the various ways in which these risks might be controlled and managed.

It is based upon data collected from 13 retail companies and two SCO technology providers. Interviews were carried out with 73 key stakeholders from these companies and 11 store visits were conducted to review the technologies in use. In addition, a range of data points were collected from participating retailers, including: 140 million Scan and Go transactions; 17 million transaction audits; 486,000 items found not to have been scanned; video analytics of €72 billion of Fixed SCO transactions; and comparative shrinkage (2) data from thousands of retail stores. It is the most comprehensive study to date on the scale and extent of losses associated with SCO technologies.

The study provides the first ever independent assessment of the losses associated with various types of SCO systems. Developing a loss to use indicator, it suggests that for Fixed SCO systems retailers can expect that every 1% of transactional value will generate an additional 1 Basis Point of shrinkage (unknown stock loss). Given this, for a store with 50% of transactions being processed through Fixed SCO, it can expect its shrinkage losses to be 75% higher than the average rate found in Grocery retailing. For Scan and Go SCO the study found that the expected losses were likely to be much higher, in the region 10.4 Basis Points of additional loss for every 1% of transactional value. Moreover, the study found that utilising partial audit rescans to identify non-scanned products was highly unreliable – on average only 2.88% of audits found an error compared with full audit checks which found on average an error in 43.4% of baskets.

The research offer valuable insights on how retailers might begin to try and control the losses associated with SCO systems. Four key areas are explored: the role of guardianship, the utilisation of various technologies, changes in store processes, and the impact of how the SCO environment is designed. A detailed framework is also provided aimed at helping retail organisations develop more co-ordinated, cross organisational strategy for the management of SCO.

Foreword

The ECR Community Shrinkage and On-shelf Availability Group is delighted to have had the opportunity to support this important and ground-breaking study. It provides an upto-date review of the potential impact of self-scan and self-pay technologies on levels of retail loss. In addition, it also offers insights into how retail businesses can begin to go about addressing the risks posed by them.

For many of our members and other retailers around the world who use these systems, I’m sure this will be a timely and welcome report. Retailing is becoming ever more dependent upon a host of technologies, many of which are increasingly focussed upon making the customer journey more ‘friction-free’. Consequently, it is important to understand not only the positive benefits of these business decisions but also the less desirable outcomes as well. I believe this report will certainly help those who have a responsibility for ensuring that their organisations continue to reap the benefits that self-scan technologies can bring to retailing while doing so within a sustainable business model.

I very much hope you enjoy reading this report and utilising its findings to better understand how self-scan and self-pay systems might be impacting upon your retail losses, but also how you can develop practicable ways to effectively manage these technologies in your particular environment. Finally, I would like to thank all those companies that agreed to support this study – your contribution to helping the broader retail community better understand this important issue is very much appreciated

John Fonteijn

Chair of the ECR Community Shrinkage and On-shelf Availability Group

Executive Summary

Background

This report is focussed upon quantifying the risks associated with three forms of self-scan and checkout technology (SCO): Fixed (the consumer scans at a designated machine) Scan and Go (the consumer is provided with a scan gun by the retailer) and Mobile Scan and Go (the consumer users their own mobile device to scan items) (1) . In addition, it provides a critical review of the various ways in which these risks might be controlled and managed.

It is based upon data collected from 13 retail companies and two SCO technology providers. Interviews were carried out with 73 key stakeholders from these companies and 11 store visits were conducted to review the technologies in use. In addition, a range of data points were collected from participating retailers, including: 140 million Scan and Go transactions; 17 million transaction audits; 486,000 items found not to have been scanned; video analytics of €72 billion of Fixed SCO transactions; and comparative shrinkage (2) data from thousands of retail stores. It is the most comprehensive study to date on the scale and extent of losses associated with SCO technologies.

Impact of SCO on Retail Losses: Fixed SCO

Data comparing stores with and without Fixed SCO found that levels of loss were higher in the former than the latter, with some Grocery case studies recording losses in the region of 33% to 147% higher. One case study, focused on the difference between stores using SCO with and without a weight checking system, found that losses where there was no weight system were 147% higher than stores not using any SCO technology.

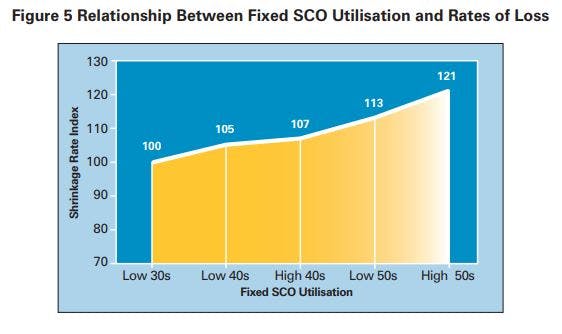

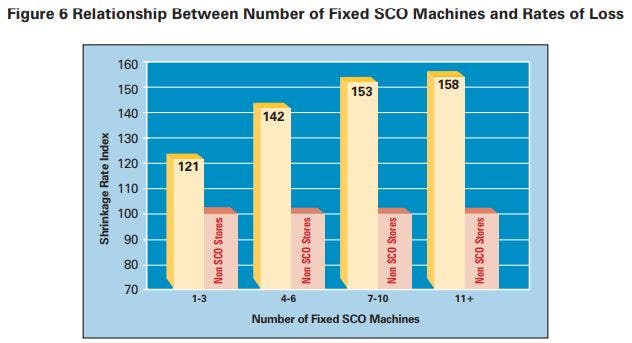

Utilisation data (number of transactions processed through SCO) showed that stores with higher rates had higher levels of shrinkage. Stores where 55-60% of transactions went through Fixed SCO can expect their shrinkage losses to be 31% higher. Similarly, data looking at rates of loss and the number of SCO machines in use found that stores with higher numbers of machine also had higher rates of loss. Stores with the average number of SCO machines (for the case-study retailer), could also expect to see shrinkage losses 31% higher than an estimated industry average (3) , while those utilising an above average number of machines could expect the rate of loss to be at least 60% higher or more.

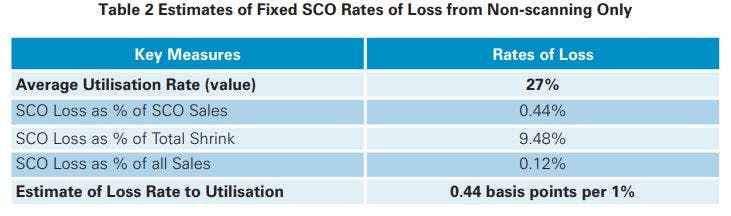

Technology monitoring and video analysis data looking at €72 billion of transactions found that non-scanning at Fixed SCO machines accounted for 0.44% of SCO sales, amounting to 9.5% of all store-recorded shrinkage. The data suggested that non-scanning behaviours alone (not including mis-scanning, walk-aways etc) are likely to add 0.5 Basis points of loss per 1% of Fixed SCO utilisation.

Together the various data sets strongly indicate that previous assumptions that Fixed SCO do not generate additional losses for retailers are incorrect – the losses are real and, in some cases, significant. Based upon the available evidence it is estimated that for each 1% of Fixed SCO utilisation, a retail store should expect their shrinkage losses to increase by at least 1 Basis point. This estimate does not consider other forms of loss that SCO systems are likely to be generating, such as lost margin and lost profits due to out of stocks caused by increased errors in stock inventory records. At this time, it is not possible to put a concrete figure on these losses.

Given this, for a store with 50% of transactions being processed through Fixed SCO, it can expect its shrinkage losses to be 75% higher than the average rate found in Grocery retailing. None of this data takes into account the likely productivity savings retailers can accrue from using this technology nor any possible reductions in loss as a consequence of employing fewer staff.

Impact of SCO on Retail Losses: Scan and Go SCO

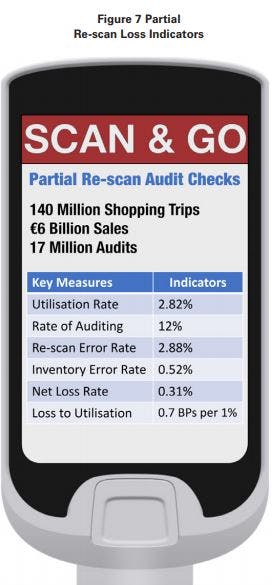

Analysis of 140 million transactions, found that the average utilisation rate of this technology was still relatively low – 2.82% of all transactions. Of this total, 12% or 17 million were subject to a Partial Re-scan Audit (only a small proportion of items are checked). Of those, 2.88% were found to contain at least one error, generating an overall inventory error rate of 0.52% of Scan and Go sales. When over-scans were taken into account, the net loss was calculated as 0.31% of Scan and Go SCO Sales, equivalent to a 0.7 Basis point increase in losses for every 1% of utilisation.

However, analysis of 20,000 random Full Re-scan Audits (every item is checked) provided by one case-study company paints a very different picture. It showed an overall error rate of 43.4% – 1,407% higher than the Partial Re-scan Audit data. When this error rate is used to calculate net losses, it shows that the rate is as much as 4.68% of all Scan and Go SCO sales, generating a Loss to Utilisation Ratio of 10.4 Basis points per 1%. Taken together, stores using this technology (at the utilisation rate found in this study) could see overall losses in the region of 0.96% of sales – a 43% increase.

Further analysis of Full Re-scan Audit data, using probability statistics, showed that as the size of shoppers’ baskets increased then the likelihood of an error occurring also increased. When a shopper has 50 items in their basket, then there is a 60% chance they will make at least one error, while for those with 100 items there is almost a 9 in 10 chance they will make an error.

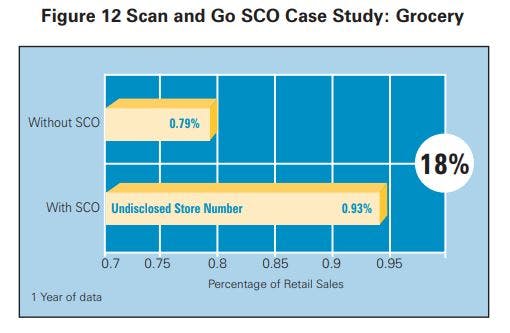

One retailer shared data comparing stores with and without Scan and Go SCO, which showed that those with the technology had a rate of shrinkage 18% higher than those that did not, suggesting a Utilisation to Loss Ratio of 5 Basis points for each 1% of utilisation.

Controlling SCO: Keeping Shoppers Honest and Accurate

Controlling Fixed SCO

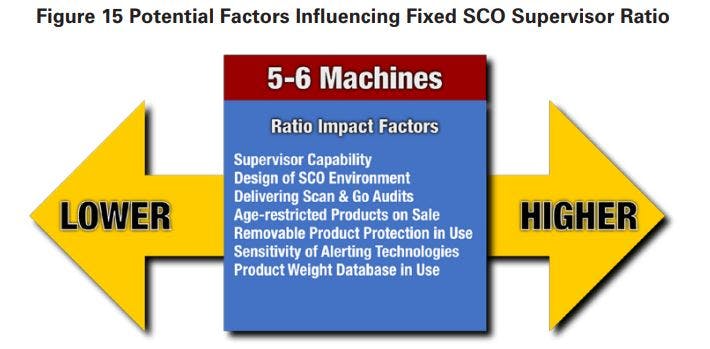

Guardianship: this was considered to be the most important factor by respondents but also difficult to ensure compliance at store level. The key was ensuring suitable, properly trained and motivated Supervisors were used and that they were operating in an environment which facilitated rather than hindered their duties. Overall, respondents to this research thought the optimal Supervisor to SCO machine ratio was 5-6 although this could flex depending upon the SCO environment in place.

Technology: Scan Verification Technologies were most prevalent – weight-based checking and video analysis of customer scanning behaviours. The former was the most established although opinions varied on its applicability with some deciding to turn it off because of its impact on the customer experience. Others had taken the decision to adapt and refine it to better fit their retail context and achieve an acceptable balance between risk amplification and minimising customer friction. Given the challenges of controlling Fixed SCO systems, the latter approach would seem a good option to adopt.

Product Verification Technologies were not used at all in the case-study companies although some were beginning to trial them. Designed to help mitigate against mis-scanning errors and help speed up the checkout process, these technologies could make a real contribution to managing SCO losses and improving the customer experience, but as yet further work is required to make them a viable prospect.

Design: developing effective ways to amplify risk and enhance detection in the SCO environment – creating Zones of Control – is important. Key was the location of the SCO area within the store, how customers were channelled through this space, the location and sight lines of the SCO supervisor, and the use of risk amplifiers such as CCTV and signage.

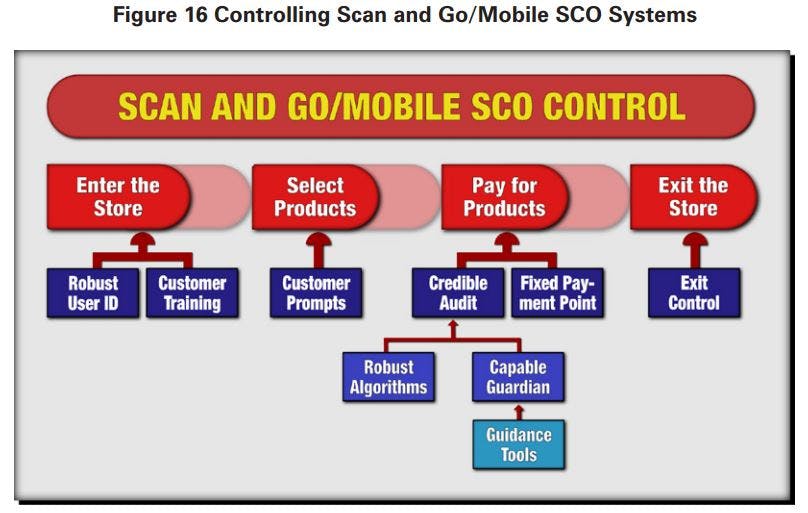

Controlling Scan and Go/Mobile SCO

In comparison with Fixed SCO systems, Scan and Go/Mobile SCO currently offers far fewer opportunities to amplify risk and enhance detection – the majority of current controls are focussed upon six process-based factors.

Robust User Identification: ensuring that retailers had a clear verifiable way of understanding who was registering to use their systems.

Establishing User Expectations: retailers should only be offering this facility to those who clearly understood the ‘rules of the game’ – that it is a privilege and not a right to access this way of shopping and that it comes with clearly defined expectations on the part of the retailer, including that on the first use a shopper will be audited.

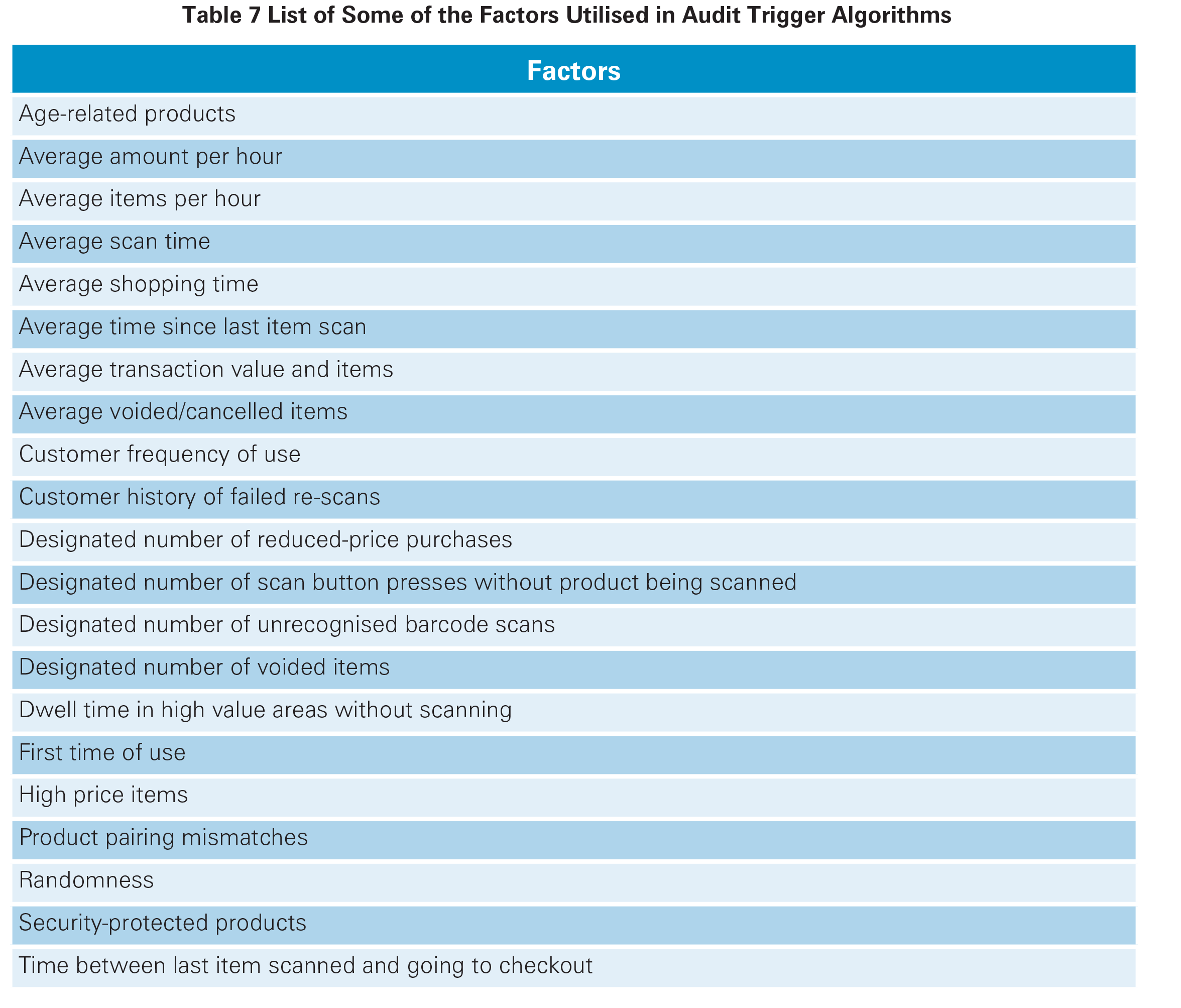

Delivering Credible Audits: delivering deterrence and detection of errant users through the use of consumer behaviour-driven algorithms and utilising capable guardians. The latter need to be supported with data-driven tools to ensure they are equipped to identify items most likely to have not been scanned.

Utilising Fixed Payment Points: While current Mobile Scan and Go SCO systems require the user to go to a fixed point to confirm payment, concerns that developing iterations of Mobile Scan and Go SCO will allow the user to pay on their mobile device at any location were raised. This was considered extremely risky as it removes a key control point within the SCO shopping journey.

Communicating with Users: A number of respondents described ways in which they were considering the communication of risk-related messages to users, particularly with Mobile Scan and Go SCO through the associated App.

Exit Control Strategies: Some retail companies already use or are thinking about introducing designated exit areas where Mobile Scan and Go SCO users must go to leave the store. These often require the user to scan a code generated upon payment that opens the exit gate.

Minimising Product-driven Errors

Packaging and Barcode Issues: respondents flagged up a range of issues relating to barcodes on some products that made them difficult to scan; others were concerned about the use of multiple barcodes on the same product. Retailers should consider meeting with suppliers to review product design issues that may be contributing to SCO-related problems.

Set-up Issues: a number of case-study companies recognised that errors within their own organisations were creating problems, particularly relating to the regular updating of product inventory systems, especially when items were sourced locally.

Product Protection Issues: ensuring that not only tagged items were consistently de-tagged but also that Scan and Go/Mobile SCO users were reliably informed about which items needed to be de-tagged was considered a real concern by respondents.

Controlling the SCO Environment Dynamically

Just as risk is not evenly distributed across the retail landscape, the use of strategies to manage SCO systems should also be tailored to the circumstances in which it is being used. Different operating environments may well not only require a different palette of interventions but also variable tolerance settings depending upon the circumstances.

Compliance is Key

Store teams need to be clearly guided on why agreed practices and policies relating to the control of SCO systems need to be rigorously and consistently enforced, such as the maximum number of Fixed SCO units per supervisor. The provision of unambiguous data on the impact SCO-related losses are having on the business will be a key first step in achieving this goal.

Conclusions

The extent of the losses presented in this report suggest that retail businesses, and their partners, need to rebalance their assessments of the benefits that can accrue from investing in SCO-related technologies – the ROI calculation needs to fully take account of what the negative impacts might be.

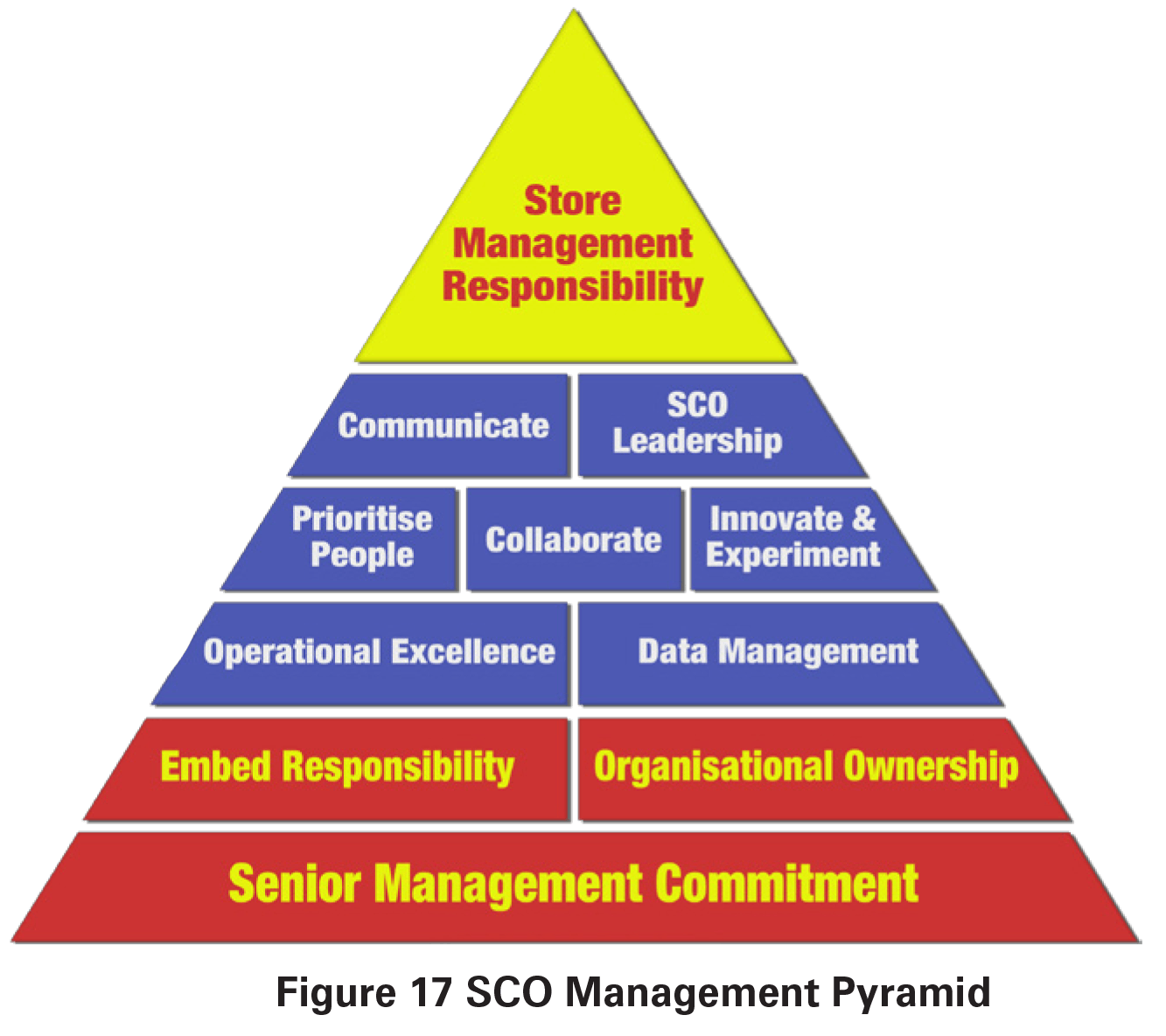

Developing a Framework to Manage SCO in Retailing

Using a variant of an existing loss prevention model, the research developed a framework for how retail businesses can go about developing an organisation-wide approach to managing the risk associated with use of SCO systems, focussing upon 11 key themes:

- ensuring there is senior management commitment focussed on understanding all the outcomes of investing in SCO;

- developing cross-functional organisational ownership and embedded responsibility for the control of SCO;

- establishing a clear set of data management protocols to fully understand the impact of various types of SCO technologies on the business;

- prioritising operational excellence in how SCO is developed and managed;

- committing to a programme of innovation and experimentation to improve control;

- forging better collaboration between different retail functions and with SCO technology providers to not only understand the risk side of the SCO equation, but also develop and evaluate interventions that may help mitigate the identified risks;

- recognising and prioritising the role people can play in actively managing and controlling SCO systems;

- striving to develop SCO leadership that can articulate all aspects of its use within retailing, including not only the possible benefits but also the possible risks;

- ensuring that there is communication with all parts of the business on all aspects of SCO; and

- delivering store management responsibility by providing them with data to understand the challenges, the training, resources and technological tools to create an environment that minimises risk, and incentivisation to ensure that they remain compliant.

Taken together, these factors offer an approach to begin to develop a more coherent and coordinated strategy to begin to better manage the risks associated with SCO systems in retailing, one that continues to recognise the benefits, but also takes more account of the growing challenges that they now seem to be presenting.

Introduction

The use of self-scan and checkout (SCO) technologies has grown considerably in the past 15 years, predominately, but not exclusively in the Grocery sector, where customer and product volumes, and space utilisation issues, make it a particularly appealing proposition (4) . For many retailers it has provided a significant opportunity to reduce their core costs at a time of increasing competition, and as new iterations of the technology have evolved, there would seem to be a growing appetite amongst certain groups of users to prefer this mode of shopping (5) .

A fundamental component of the SCO proposition is the transfer of responsibility for the accurate scanning of products and ensuring correct payment is made from staff employed by the retailer to the consumer. Since the very early days of retailing incidents of customers stealing product have been recorded and indeed a whole industry has been established trying to manage this problem as incremental changes in the retail environment have increased the risk of losses occurring (6) . For many of those tasked with ensuring that retailers sell more products than they lose, the emergence of SCO technologies has been viewed as a concern, not least in the difficulty in imposing strong enough controls over the way in which it may be used and abused (7) .

It is within this context that the current research was formulated. It set out to deliver two key objectives: quantify the risks associated with different forms of SCO technology; and review the various ways in which these risks might be controlled and managed.

The research is based upon data collected from 13 major retail users of SCO technologies, with a combined turnover of €586 billion. It makes use of both qualitative data – interviews with 73 key stakeholders in 13 retail companies and two SCO technology providers – and various types of quantitative data – over 140 million Scan and Go SCO transactions; 17 million audit checks, video analysis of €72 billion of Fixed SCO transactions together with the review of 486,000 items found not to be scanned. In addition, rates of loss between thousands of stores using and not using various SCO systems was analysed (further details about the methodology can be found in Appendix I).

This report is broken down into a further five Sections. The next looks at the background and context to the development and use of SCO systems in retailing. Section three moves on to consider how SCO-related losses impact upon retail profitability and the challenges retailers face trying to accurately measure them, while Section four presents the available data on the actual impact SCO technologies may be having, looking first at Fixed SCO before moving on to concentrate on the data available on Scan and Go SCO. Section five moves on to provide a review of the various ways in which SCO technologies might be controlled and managed, while the final Section brings together the key conclusions that can be drawn from this study.

Background

The Rise of SCO Technologies

While opinions vary on who was the original inventor of the first retail self-scan machine, most agree that they began to be tested and used in the late 1980s/early 1990s. From this point in time, the pace of adoption has gradually increased although not to the same degree across all geographic retail markets, with the US and some countries in Europe becoming areas of particular use while less mature retail markets such as Africa and parts of Asia have seen more limited utilisation thus far. Within the last five years the pace of adoption in certain countries has been extremely rapid, with a number of retailers now offering self-scan only stores, while for many others, Fixed SCO in particular, is now a fundamental part of their business proposition (8) .

Types of Systems and Approaches in Use

While there are numerous forms of SCO technologies available in the market place, there are three main types in use at the moment and they are the primary focus of this report.

Fixed self-scan machines. This is where the consumer brings their chosen products to a fixed point in the store and proceeds to scan them either using the barcodes present on the items or by choosing the item type from a list of possible options provided by the machine displayed on an interactive screen. The consumer can then pay for their items either with cash or by some form of payment card. Throughout this report they will be referred to as Fixed SCO systems or technologies.

Scan and Go Systems. This is where the consumer is provided with a ‘scan gun’ by the retailer which can be used while shopping to scan the barcodes of items they wish to purchase. At the end of the shopping journey, the user is then required to go to a fixed point and dock their scan gun in a terminal, which then processes the transaction and takes payment from the consumer. Throughout this report they will be referred to as Scan and Go SCO systems or technologies.

Mobile Scan and Go Systems. The third main variant in use now, and one that has only recently begun to be offered by retailers, is similar to the Scan and Go system described above except that instead of using a scan gun provided by the retailer, the consumer uses their own mobile device, utilising a bespoke App provided by the retailer (or a third party), and the camera functionality built into the device, to scan and record products they wish to purchase. This also provides the option for the consumer to pay for their items anywhere in the store via their mobile device. Throughout this report they will be referred to as Mobile Scan and Go SCO systems or technologies (9) .

Other forms of SCO technologies are available, with new approaches being developed all the time, including the use of RFID (10). More recently the Amazon Go system, which was unveiled towards the end of 2016, uses a network of cameras, sensors and weight pads to enable a consumer to pick up any items and exit the store without any need for barcode scanning or interaction with a payment system (11). The prospective consumer needs to be registered with Amazon and to have downloaded a bespoke App before entering the store. Upon arrival, the user has to scan a unique code generated by the App on their mobile device to gain access to the store, and then they are free to select items and then simply leave the store, receiving an electronic receipt within 20 minutes.

Utilisation of SCO and Risk

From the very outset of the use of SCO systems retailers have recognised that they might increase their exposure to retail losses by generating a range of new opportunities for loss to occur, both malicious and non malicious, and for these opportunities to be encountered by a larger proportion of the shopping community than seen previously. Previous research has shown how opportunity can play a key role in the decision-making of would-be offenders . It suggests there are four key factors that are typically considered: the perceived risk (how likely is it that I will be caught?); the relative ease with which the offence can be committed (how easy is it for me to do this?); the benefit of undertaking the offence (what will I get from doing this and is it worth it?); and the likely consequences if they were to be caught (what will happen to me if they catch me?). If a wouldbe offender decides that the risk is low, that it is easy to do, well worth the effort and even if they were to be caught the consequences would be low, then they are highly likely to go ahead and offend.

For retailers trying to control shop theft, generating perceived risk and reducing the ease of offending have been key factors to focus upon (the other two have traditionally been beyond their spheres of influence or desire to impact upon ). Certainly, when it comes to more opportunistic thieves, if the perceived risk can be elevated and the ease of offending reduced, then they are much less likely to be tempted to move along the crime continuum.

What seems evident is that the emerging SCO environments being introduced by retailers around the world are potentially making it much more challenging to impact upon these key decision-making factors. The reality could be that SCO abusers feel it is a low risk endeavour, which is easy to do, reaps rich rewards, and even if they are caught, leads to little or no sanctions being applied. Given that, it may not be surprising that more and more shoppers may be tempted to take advantage of the opportunities presented to them by SCO systems.

Competing Expectations: The Role of Loss Prevention

While many loss prevention functions in retail businesses are familiar with, and used to, being labelled the ‘sales prevention’ team by their colleagues occupying more customer facing roles, the reality is that most retail businesses are now beginning to recognise the need to understand the often-delicate balance between sales and losses – that seemingly positive sales can easily be undone by high levels of loss accrued across the business. As a number of respondents put it: ‘we have been swept up with the mood of do whatever we can to reduce customer friction; [we] haven’t done enough to understand the impact on leakage [retail losses] results’[R5]; ‘consideration of risk has been secondary in our thinking to be honest – improving capacity has been more important’[R10]. As detailed in the next section, a lack of data across all the participating retailers in this study on the impact various SCO systems might have on retail profitability had frequently led to often fraught relationships between those tasked with utilising SCO to reduce labour costs and consumer friction and those employed to manage retail risk. For the former, this lack of reliable risk-related data had often been seen as a green light to continue implementing yet further friction-reducing strategies, while for the latter, this apparently ‘cavalier’ approach to managing risk was generating a growing sense of panic and concern about accountability and control.

Understanding SCO-related Losses

Key Drivers of Lost Profits

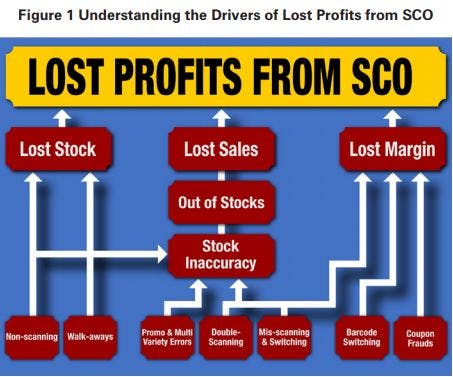

Detailed below are the various ways in which respondents to this research described how they thought their SCO systems were generating losses (Figure 1). They identified three main forms of loss: the direct loss of stock, the direct loss of margin, and the indirect loss of sales driven by out of stocks which in turn are caused by the generation of stock inaccuracies.

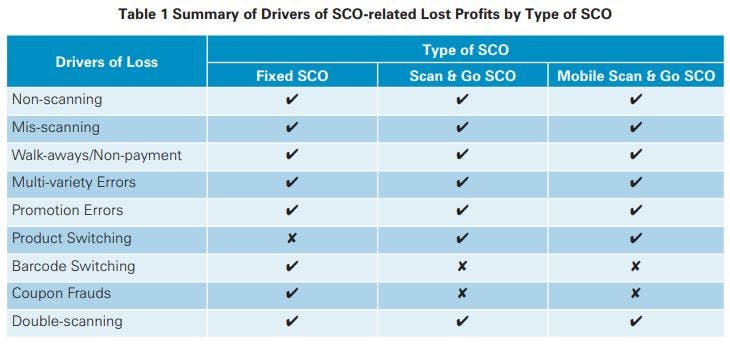

Across the three variants of SCO, the following methods were most frequently cited (summarised in Table 1):

Non-scanning: this can happen in a number of ways including, passing the item across the Fixed SCO scan area ensuring the barcode cannot be read and placing it in the bagging area (when weight-based security systems are not present or are set to tolerate one or more items not being scanned), or placing it directly into a bag next to the bagging area.

Walk-aways/Non-payment: this form of loss occurs at Fixed SCO machines when a user has scanned some or all of their items correctly and triggers the completion of the transaction but does not make payment, simply walking away with the items.

Promotion Errors: similar to the previous scan error, this does not necessarily generate an immediate financial loss for the retailer but does corrupt inventory records. In this situation the promotion is a buy-one-get-one free offer where the user only scans one item because they assume the second one is free and therefore does not need scanning.

Multiple Variety Errors: this form of error corrupts store inventory records, which over time could lead to out of stocks and an eventual loss in sales. In this situation, the user has selected a product which is available in a number of varieties or flavours, such as a tins of cat food – chicken, beef, fish etc. The consumer simply scans the same variety several times to speed up the process and places them in the bagging area.

Double-scanning: This type of error is in many respects a double-edged sword for retailers. On the one hand, when a consumer accidentally scans the same item once or more, then they will be paid for the same product more than once, generating a significant profit. On the other hand, the same behaviour will also adversely impact on stock accuracy – store systems will potentially over order double-scanned items, which could lead to a range of adverse outcomes.

Mis-scanning: there are two main ways in which this typically happens. In the first, the user places a particular item on the weigh scale, such as a kilo of grapes and then chooses a cheaper item from the list of options available, such as carrots or potatoes. The second form is the mis-representation of items of a similar weight but differing values.

Product switching: a variant of mis-scanning is also possible with Scan and Go. In this scenario the user scans a particular variant of a product but then places it back on the shelf and replaces it with a more expensive type.

Barcode Switching: this form of loss occurs where a user obtains a different (usually cheaper priced) barcode for a product and scans the barcode as the product is moved across the Fixed SCO scan area.

Coupon Frauds: In this scenario the use of promotional coupons is abused by the user, typically by using the same coupon multiple times, leading to lost margin.

Challenges of Measuring SCO Losses

One of the key findings of this research has been the degree of difficulty obtaining reliable, robust and verifiable data on the losses associated with various types of SCO systems used by retailers. In part this is a function of the type of data that needs to be collected, but it is also, in some respects, indicative of the business culture within which SCO systems have evolved.

Retailers calculate their stock loss, typically called ‘shrinkage’ or ‘shrink’, through measuring the difference between the amount of stock they think they should have (the remainder between actual goods purchased minus those sold) and what they actually have, usually ascertained through regular physical audits/stock counts. The difference is their ‘shrinkage’ number, which is often, but not exclusively, calculated as a percentage of sales.

The difficulty lies in trying to understand the cause of any missing stock, particularly when stock audits are carried out infrequently (often annually). The time lag between a loss event happening and it eventually being recorded can be considerable, making identification of the cause extremely challenging. Within the context of SCO, this inability to easily and accurately measure what the true causes of shrinkage are makes it difficult to understand what proportion of loss it may be accountable for – in effect, how much of the shrinkage pie is a direct consequence of its introduction and use?

However, it is not impossible and data collection methods can and have been developed to try and achieve a much clearer understanding of the likely losses associated with various types of SCO system. But, in order for this to happen, clear data collection protocols need to be put in place to ensure that any SCO-related losses are accurately captured. It seems clear from this study that many of the contributing companies had either failed to put them in place and/or had not enabled the process of collation and analysis to be routinised, made transparent and perhaps most importantly, viewed by others in the organisation as grounded in robust and reliable methods:

as a shrinkage team we were not sophisticated enough to measure it and appreciate the impact of changes. For years everybody knew there was cost associated with SCO but because no one had truly measured it, it was one of those numbers that the Operations Team could dismiss or refute[R2].

The problem of measuring SCO-related losses not only impacts upon the ability to understand the scale of the problem, but it also impacts upon the capacity to measure the effect of any interventions introduced to try and minimise these losses.

So, while the challenges of measuring SCO-related losses are real and apparent, it is also evident across some of the case-study companies that an organisational mindset had been established that viewed SCO technologies through what might be regarded as rose-tinted glasses: ‘senior management have been naive in the execution of SCO, we haven’t done enough benchmarking to understand the impact long term’[R5].

Certainly for some, it was felt that the challenges of measuring the risk provided some in the business with an opportunity to side line this issue in favour of rapidly rolling out this technology: ‘been a little bit frustrating working with the development team – they won’t believe data which might show that losses have gone up and are inclined to blame other factors for the change’[R12]; ‘there was no conversation about risk when the technology was first brought in; it was a technology that grew so fast in terms of nobody was really able to measure it’[R2].

Indeed, one respondent was clear that if that investment had been made at the very beginning of their SCO journey, then it may have been a very different picture: ‘if the business had had the data back then, it may have been a very different approach to the roll out’[R1]. Perhaps more positively, there were clear signs in some of the companies taking part in this study that attitudes were beginning to change, with a growing realisation that there were negative outcomes associated with SCO technologies and that these now needed to be measured more accurately and consistently.

"senior management have been naive in the execution of SCO, we haven’t done enough benchmarking to understand the impact long term"

"if the business had had the data back then, it may have been a very different approach to the roll out"

Impact of SCO on Retail Losses

Losses Associated with Fixed SCO Systems

With and Without Comparisons

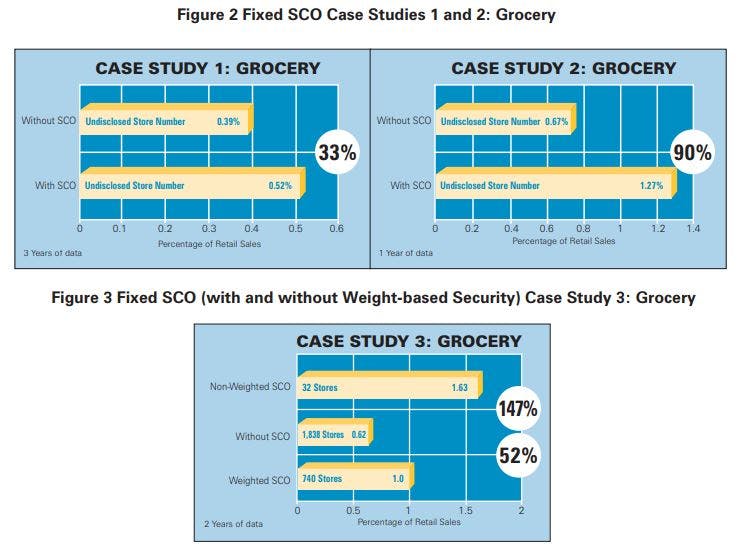

Detailed below in Figures 2 to 4 are the four Before and After Case Studies, detailing the differing rates of loss (measured as their rate of shrinkage as a percentage of overall sales) between stores with and without Fixed SCO systems. Where it was made available, the number of stores upon which the data is based is also provided, as is the timeframe over which the data was collected. All of this data needs to be treated with some caution – it was not possible to accurately ascertain whether the different store groups were adequately matched to ensure that other confounding factors may better explain the differing rates of loss found. Neither was it possible to differentiate between the approaches being adopted to manage and control the Fixed SCO systems. In this respect, the data presented below can really only be used to provide an indicator of the likelihood of Fixed SCO systems to generate additional loss – it would be unwise to try and draw an overall average from these four case studies.

What can be seen is that in all four cases losses were higher in stores that were using SCO compared to those that were not. In the three Grocery case studies, the differences were considerable – between 33% and 147% higher. One of the Grocery case studies was able to provide a further breakdown of their losses between two types of Fixed SCO machine they were using – those with a weight-based checking functionality and those without. In this case, the losses for non-weight checking machines was much higher – 147% higher than stores with no Fixed SCO machines at all. For the stores with a weight-based system then the difference was calculated at being 52% higher than stores without any form of Fixed SCO. It does need to be noted, however, that the number of stores in which the non-weighted Fixed SCO machines were in operation, was relatively low – only 32 stores compared with 740 for weight-based Fixed SCO and over 1,800 with no SCO machines at all.

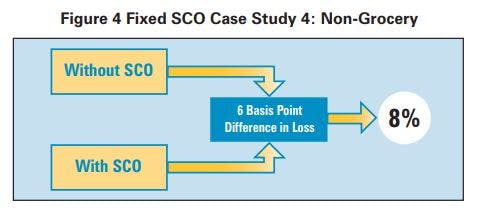

For the fourth case study, which was a non-grocery business, the difference while still higher in non-Fixed SCO stores, was much more modest at 8%. This company did, however, operate a significantly different Fixed SCO environment than found in most Grocery stores – a maximum of four machines per store, closely monitored by a SCO supervisor.

So, the main conclusion to be drawn from the data from these four case studies is that arguments suggesting that the introduction of Fixed SCO technologies make little or no difference to rates of retail loss are incorrect, particularly but not exclusively in Grocery retailing. It is also worth noting that this data is only measuring loss by using the declared shrinkage number – the other forms of loss associated with SCO outlined earlier – lost margin and lost profit from out of stocks – are not included in this analysis, which inevitably means they are an underestimate. However, it is also worth noting that none of this analysis considers the likely savings retailers may have accrued through the introduction of Fixed SCO technologies, in particular, labour costs, which will undoubtedly offset these increased losses, but to what extent is not known.

SCO Utilisation

Studies Another way to look at the possible impact of Fixed SCO technologies on levels of shrinkage is to analyse whether rates of loss are associated with the amount of transactions that are processed through them – do stores that have higher rates of SCO utilisation also have higher rates of loss? Only two retailers were able to share any data on this and in order to ensure their anonymity, the loss data has been transformed into an index score, where 100 represents the lowest utilisation rate provided. Detailed in Figure 5 is the results of this analysis, based upon data from just over 2,000 stores covering two years. As with the previous data it is important to note that it was not possible to carry out any detailed analysis to ensure that stores with differing rates of utilisation were comparable – it was not possible to run regression analysis to include other potentially confounding factors.

As can be seen, a clear trend emerges – those stores that have higher levels of Fixed SCO utilisation tend to have higher levels of loss. Compared with stores with utilisation rates (the total number of all transactions being processed through Fixed SCO) in the low 30% range, those in the low 40s typically had rates of loss that were 5 Basis points higher, and those that had utilisation rates in the high 40s were likely to see a 7 Basis point increase in their loss. Once utilisation rates went into the 50% range, then losses increased further – between 13 and 21 Basis points higher. If data from a recent ECR study is used, which suggested that average shrinkage losses in Grocery are in the region of 0.67% of sales, then a 21 Basis point increase would mean a 31% rise in their loss number when Fixed SCO systems account for between 55-60% of store transactions (15).

Another way to consider the impact of utilisation is to look at any possible differences in loss between stores with differing numbers of Fixed SCO machines in operation – do losses increase when the number of machines increase? Only one retailer was able to provide any reliable data on this issue, and again, to protect their identity, the data has been indexed. It is based upon information from over 2,500 stores covering one year (Figure 6).

As with the previous utilisation data, the trend is very clear – as the number of machines increase, then the rate of loss also increases. When indexed against stores with no Fixed SCO machines in use, stores with between 1-3 machines had rates of loss 21 Basis points higher, and this grew considerably as the number of machines increased. For those stores operating between 7-10 machines, then they were experiencing a rate of loss 53 Basis points higher than stores with no Fixed SCO machines. This trend was largely consistent across the various store types that were combined to generate this data, although for some formats the number of stores with no Fixed SCO was low. If the ECR shrinkage average of 0.67% is used again together with the loss rate for the most common number of machines in use in this retailer (1-3), then the difference in loss is likely to be 31% higher. If the next highest SCO utilisation rate is used (4-6), then these stores are likely to experience a rate of shrinkage that is 62% higher than the ECR average.

Taken together, the two utilisation studies offer further data to show that Fixed SCO technologies do have an effect on retail store losses and that the more they are used, the higher the rate of loss that is likely to occur. When combined, the data indicates that for those companies heading towards 50% or more of their transactions being processed through an average of between 1-6 Fixed SCO machines per store, then they can expect their shrinkage losses to increase between 30%-60% compared with the ECR average.

Technology Monitoring and Video Review Analysis

Measuring Fixed SCO losses in any detail is not easy – as discussed earlier, trying to capture data points measuring the absence of something – in this case non-scanning by consumers – is at best problematic. There are, however, at least two possible approaches to try and address this problem. The first is to utilise one of a number of companies that now offer video-based analytical tools that, through linking with till EPOS systems, try to capture non-scanning events. The idea is that a combination of algorithms and human observers monitor customer movements around the till area and try to identify when products appear to move across this space without registering on the EPOS system. Initially used on staffed checkouts to capture incidents of non scanning and sweethearting (16), they are now being used by some retailers in their SCO environments as well.

The second possible approach to capture non-scanning activity at Fixed SCO machines is to carry out a video based audit whereby trained observers carefully watch a sample of SCO users over a period of time to try and identify non-scanning events. Like the previous system, they will also have a data feed from the EPOS system to help them carry out their analysis. Obviously, this is a less automated and far more labour-intensive methodology to adopt and so is rarely used beyond generating benchmark data.

This study has received data from one company that has been utilising the first option and data from another company that undertook a benchmarking exercise using the second option (they observed all SCO transactions in 20 stores for one week). In order to anonymise these companies, the results from the two approaches have been combined in a single data set. What this type of data can provide is an estimate of the value of items that would appear to have not been scanned – it is not possible with any confidence, however, to surmise the reason for the non-scanning – malicious or non-malicious.

Unfortunately, it is simply not possible to share any further explanatory data about the nature of the data, such as quantity of non-scans nor the number of stores involved because this would likely make identification of the companies possible. But, to give a sense of the scale of the data set, the combined SCO sales were €72 billion. It is also worth noting that both of these companies had taken the decision to turn off their weightbased security systems, mainly to reduce the number of alerts. Outlined in Table 2 are the key data points from this analysis – it has been weighted to take account of the relative size of the two companies.

Measuring the impact of any SCO system is highly dependent upon taking into consideration the rate of utilisation – the number and/or value of transactions that are processed through a given form of checkout technology. This report, therefore takes this into account when calculating the likely impact of SCO systems on losses. It provides a loss rate to utilisation calculation based upon the actual value of losses provided by casestudy companies together with their declared rate of utilisation. This can then be used to calculate what each incremental increase in utilisation may generate in terms of additional losses – if a company has, say X% of their transactions through a given checkout system, then that is likely to generate Y amount of loss, measured in Basis points of loss. For the data above it was calculated that for every 1% of sales transaction value that is processed through Fixed SCO systems, there is likely to be a 0.44 Basis point increase in unknown loss from non-scanning.

However, there are a number of important caveats to make at this point. The data is only derived from casestudy companies where there was an absence of a weight-checking capability/deterrence. Both of these data sets were only focussed upon measuring the value of non-scanning events captured in the close vicinity of the Fixed SCO scanning area. The data does not record any other forms of SCO-related losses such as misscanning and walk-aways. Certainly, given concerns about the extent of the former in particular, then this data is likely to be an underestimate of the full extent of the losses generated by Fixed SCO systems.

Therefore, based upon the various available data sets on Fixed SCO, the evidence from the interviews and the researcher’s own reflections and experience, it would seem prudent to suggest that the actual loss for each 1% of Fixed SCO utilisation is more likely to be 1 Basis point of loss.

Estimating Losses Associated with Fixed SCO

As has been shown in this section, measuring Fixed SCO losses is possible, but not easy and all of the data sets collected as part of this research have methodological flaws undermining their efficacy. Given that, it is only possible to draw together some general conclusions and estimates about how much loss may be a consequence of Fixed SCO systems:

- Together the various data sets strongly indicate that previous assumptions that Fixed SCO technologies do not generate additional losses for retailers is incorrect – the losses are real and, in some cases, significant.

- Rates of loss appear to be linked with rates of utilisation – the more the technology is used, the higher the rate of loss that can be expected.

- Overall, stores where 50% or more of transactions are processed through Fixed SCO can expect their shrinkage number to increase by at least 30% and where this involves using more than 7-10 machines, it could be as high as 60%.

- Based upon the various available data sets, the evidence from the interviews and the researcher’s own reflections and experience, it would seem prudent to suggest that for each 1% of Fixed SCO utilisation, a retail store should expect their shrinkage losses to increase by 1 Basis point. This estimate does not consider other forms of loss that SCO systems are likely to be generating, such as lost margin and lost profits due to out of stocks caused by increased errors in stock inventory records. At this time, it is not possible to put a concrete figure on these losses. It also does not consider any reduction in losses that may have been achieved through reducing the number of staffed checkouts in the retail environment – no data is currently available to calculate this potential loss correction factor.

Losses Associated with Scan and Go SCO Systems

In contrast to Fixed SCO systems, Scan and Go SCO technologies do provide a number of opportunities to gather more routinely available and potentially very insightful data points relating to losses. For most companies using these systems, there is the capability to analyse data secured through the use of audits, which are carried out on users. These audits have been introduced to create some form of control over a system which, arguably, yet further stretches the retailer/customer trust continuum. Shoppers are (normally) informed that one of the conditions of using this system is that they may be subject to ‘random’ audits at any time to check whether they have been properly scanning all the items they wish to purchase.

These audits are undertaken at the end of the shopping journey, just prior to the payment process and are typically what are known as Partial Audit Checks – a member of staff is instructed by the system to check a small sample of items in a consumer’s basket/trolley to ensure that they have been scanned correctly. If an error is found, then they can either be subject to a full re-scan of all their items, and/or asked whether they want to add the items found to be un-scanned to their bill. The data from this auditing process, therefore, can give fascinating insights into the frequency with which shoppers are not scanning, and the types of items that are found not to have been scanned.

While Partial Re-scan data can be extremely useful, it is highly dependent upon the methodology developed to choose customers to be checked, and perhaps more importantly, the capability of the Audit Supervisor to find un-scanned items using a sampling method that can be influenced by a wide range of factors. For instance, the system may request that a Supervisor checks five items in a 100-item shopping journey – which items should they choose to check? Therefore, one retailer in this study has committed to carrying out full random audits of 1 in every 5,000 customers who use their Scan and Go SCO in order to generate a clearer picture of the extent to which errors may be being made by users. Detailed below are findings from both types of data.

In addition, one company has been able to provide some limited data on comparisons between rates of shrinkage in stores using Scan and Go and those that are not. Finally, one retailer was able to provide a list of all the items that they had found not to have been scanned as part of their auditing process. This list included product description, the total number of times that had not been scanned in a 12-month period and total value. Analysis of this data will also be presented below.

Partial Re-scan

Audit Data Five companies were able to share usable Partial Rescan Audit data. Between them they had processed a total of 140 million Scan and Go SCO shopping trips amounting to just over €6 billion in sales. Collectively, they had undertaken just over 17 million audit checks over a 12-month period. Detailed in Figure 7 is the summary data from these audits, which is weighted to take account of the relative size of each of the five companies.

Across the companies, the utilisation rate was relatively low – just 2.82% of all store transactions were accounted for by Scan and Go SCO. On average the companies were auditing roughly 1 in 8 users (12%) although this did vary between a low of 2% and a high of 17%. Of the audits undertaken just 2.88% were found to contain at least one error – which could be either an under-scan (the user had not scanned an item), or an over-scan (the user had scanned the same item twice or more). There was no data available on the incidence of mis-scans (grapes for carrots scams). Both types of error (under- and over-scan) have an impact on inventory accuracy although in terms of pure loss values, then over-scans can be used to offset the cost of under-scans.

What the data showed was that of the shopping journeys found to have an error of some kind, the sum of that error amounted to 0.52% of sales and that when the value of over-scans was taken into account, this generated a net loss rate of 0.31% all of sales. As with the Fixed SCO data, it was then possible to calculate what the likely increase in loss would be for each 1% of Scan and Go Utilisation, in this case 0.7 Basis points of shrinkage.

There are two important points to note, First, it is revealing to see the overall impact of shopper errors on inventory accuracy – equivalent to 0.52% of all Scan and Go sales, which will likely negatively impact upon on shelf availability and consequently lost sales. Secondly, the Utilisation to Loss ratio is, at face value, lower than that estimated for Fixed SCO systems. But, as mentioned earlier, the accuracy of Partial Re-scan data is open to debate because of the challenges of undertaking them accurately. It is therefore instructive to move on and consider what a sample of Full Re-scan data can reveal.

Full Re-scan Audit Data

Based upon a sample of nearly 20,000 full random audits (no algorithm- or Supervisor-driven selection) over a 12-month period, one Grocery case-study company was able to provide a set of data that offers powerful insights into what the actual losses associated with Scan and Go SCO might actually be (Figure 8).

As can be seen, the Full Re-scan error rate is profoundly different to that found with Partial Re-scans – 43.4% of all audits found an error compared with just 2.88% – 1,407% higher! This is an extraordinary statistic, which fundamentally questions the veracity of the Partial Re-scan process to accurately identify the true scale of losses associated with Scan and Go SCO. Using this data, it is possible to calculate that the net losses (taking account of over-scans) could amount to as much as 4.68% of retail sales through Scan and Go SCO.

Using this rate, it would suggest that for each one per percent of utilisation, retailers are likely to see a 10.4 Basis point increase in their losses. Moreover, at an average utilisation rate of 2.82% (see above), then it is possible that Scan and Go could be adding approximately 29 Basis point of loss to store shrinkage, which combined with the ECR average for Grocery losses (0.67%) would make overall losses in the region of 0.96% of sales – a 43% increase.

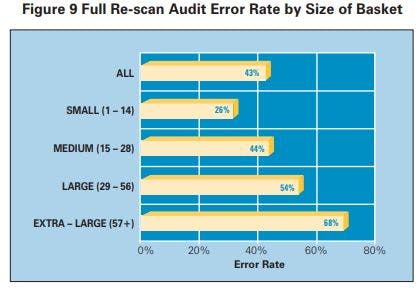

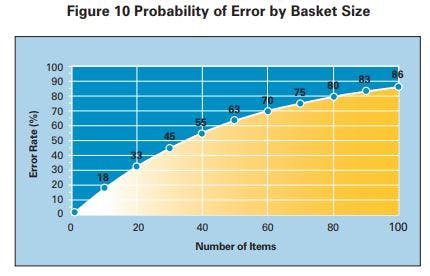

It was possible to do further analysis on the error rate found in the Full Re-scan data, looking particularly at the impact of the size of the basket on the likelihood for an error to be present (Figure 9).

As the size of the basket increases, then the likelihood of error also increases. For baskets with less than 15 items, the error was one in four (25.6%), while for large baskets (up to 56 items) it rose to one in two (54.1%), and for customers with 57 or more items, then over two-thirds were found to contain at least one error (67.7%). Indeed, using this data together with probability theory, it is possible to calculate the likelihood of an error occurring for a given basket size, which is provided in Figure 10.

As can be seen, the likelihood of an error occurring becomes much more likely as the size of a basket increases. If a customer has 20 items in their basket, then there is a 30% chance that they will have made some sort of error. When the basket size begins to get much bigger, then the probability of at least one error being made becomes much more certain – with 100 items, then there is almost a 90% chance there will be a problem with at least one item. This is a serious concern for retailers offering this form of SCO – it is designed for shoppers who mainly want the convenience it provides when doing large shopping trips. The reality is that there is a very strong probability that with every one of these large shopping trips, it is almost guaranteed that at least one scanning error has occurred.

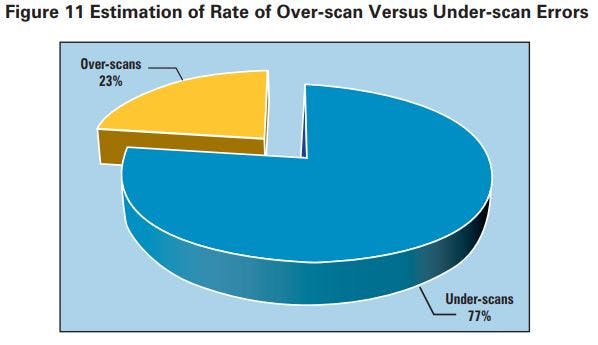

Rates of Under and Over Scanning

Audit data can also shed light on the extent to which customers are under versus over-scanning, although many Partial Re-scan operations are unlikely to easily capture the latter compared with the former (the Supervisor would need to complete a full re-scan to accurately identify when a user has scanned the same item twice or more). However, three companies were viewed as having sufficiently reliable data on rates of non and over scanning found as part of their auditing processes (Figure 11).

On average 77% of item errors were found to be due to non-scanning, with 23% being a result of over scanning on the part of the consumer. While there was some slight variation between the companies on the average value of an over-scanned versus non-scanned item, the difference was marginal. For the most part, user errors seem to generally tip in their favour!

With and Without Comparisons

Only one company had any shrinkage data comparing stores that were and were not using Scan and Go SCO systems, the results of which are detailed in Figure 12.

Caution needs to be employed when reviewing this data – the sample of stores is very low as is current rates of utilisation (less than 3% of transactions). However, given all of that, it is still interesting that they had found an 18% difference in rates of shrinkage between those stores that were using Scan and Go SCO and those that were not – a 14 Basis point difference in loss which would suggest a Loss to Utilisation Ratio of 5 Basis points (each 1% of utilisation equates to a 5 Basis point increase in loss). Once again, this data suggests that there are considerable risks associated with this technology.

Analysis of Non-scanned Items

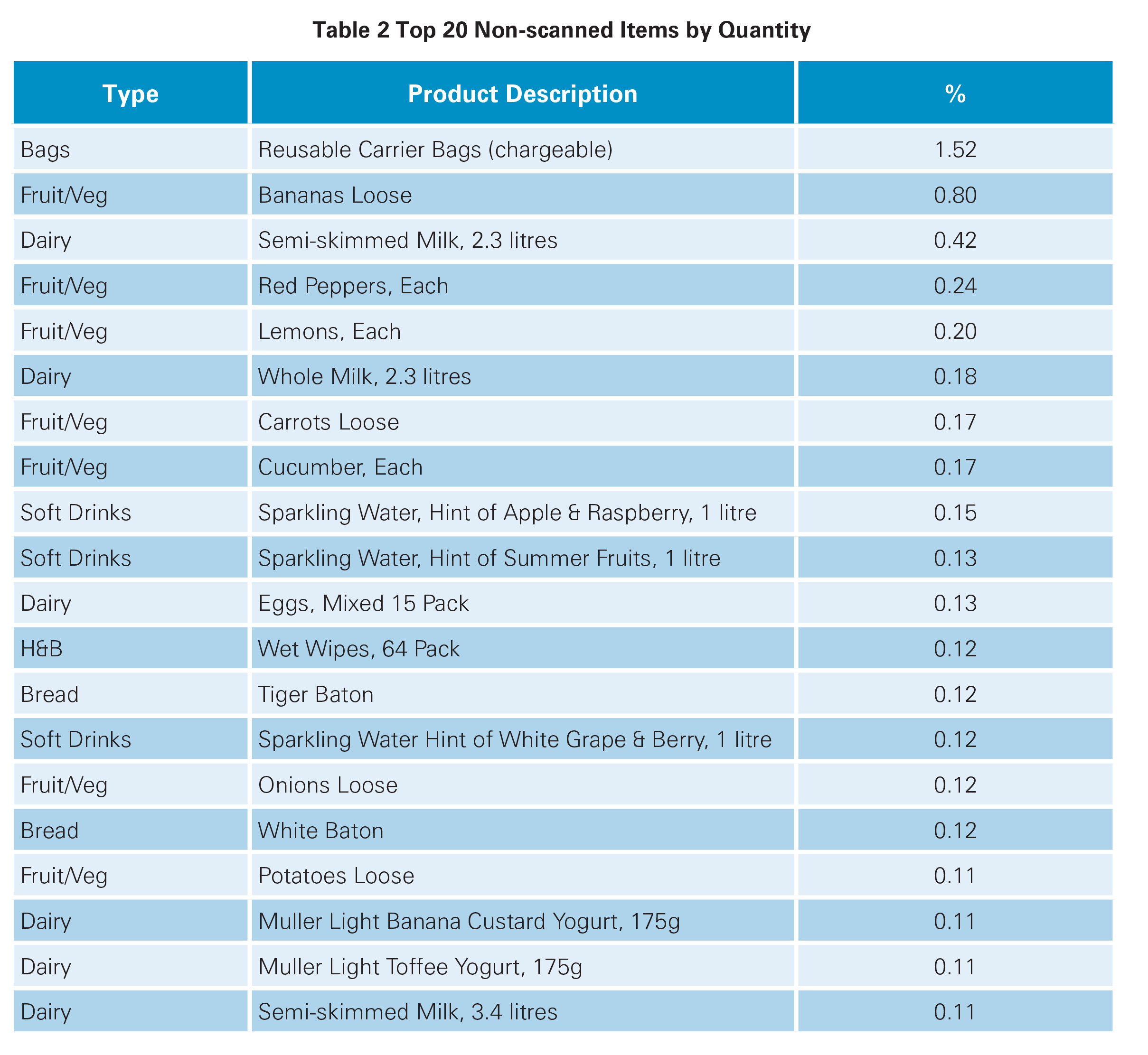

The final set of data available on Scan and GO SCO relates to the types of items found not to have been scanned when Audits are undertaken. One of the companies was prepared to share a detailed list of all the items that they had found – over a one-year period this amounted to over 52,000 separate SKUs, adding up to 486,000 items with a total value of just over €1.2 million (note, the data was provided by a UK Grocer).

Detailed in Table 2 are the top 20 items that were most frequently found to have not been scanned (by quantity). Across all 52,000 SKUs, the most frequently non-scanned item was various types of reusable carrier bag, accounting for 1.5% of items not scanned. This was followed by loose bananas, semi-skimmed milk and then a range of fruits and vegetables. Collectively, the top 20 items accounted for only 6% of all the items found not to have been scanned, indicating the breadth of items that end up not being scanned by SCO users. Of the top 20 non-scanned items, 85% were either fruit/vegetables or dairy products. It is difficult to offer much further interpretation of this data in this format beyond commenting on the frequency of non-scanning of re-usable bags – they are potentially a product with ‘ambiguous’ ownership – consumers may feel that they are free as part of their shopping journey, or perhaps more likely, that they should be free given that they are scanning all the items they wish to purchase.

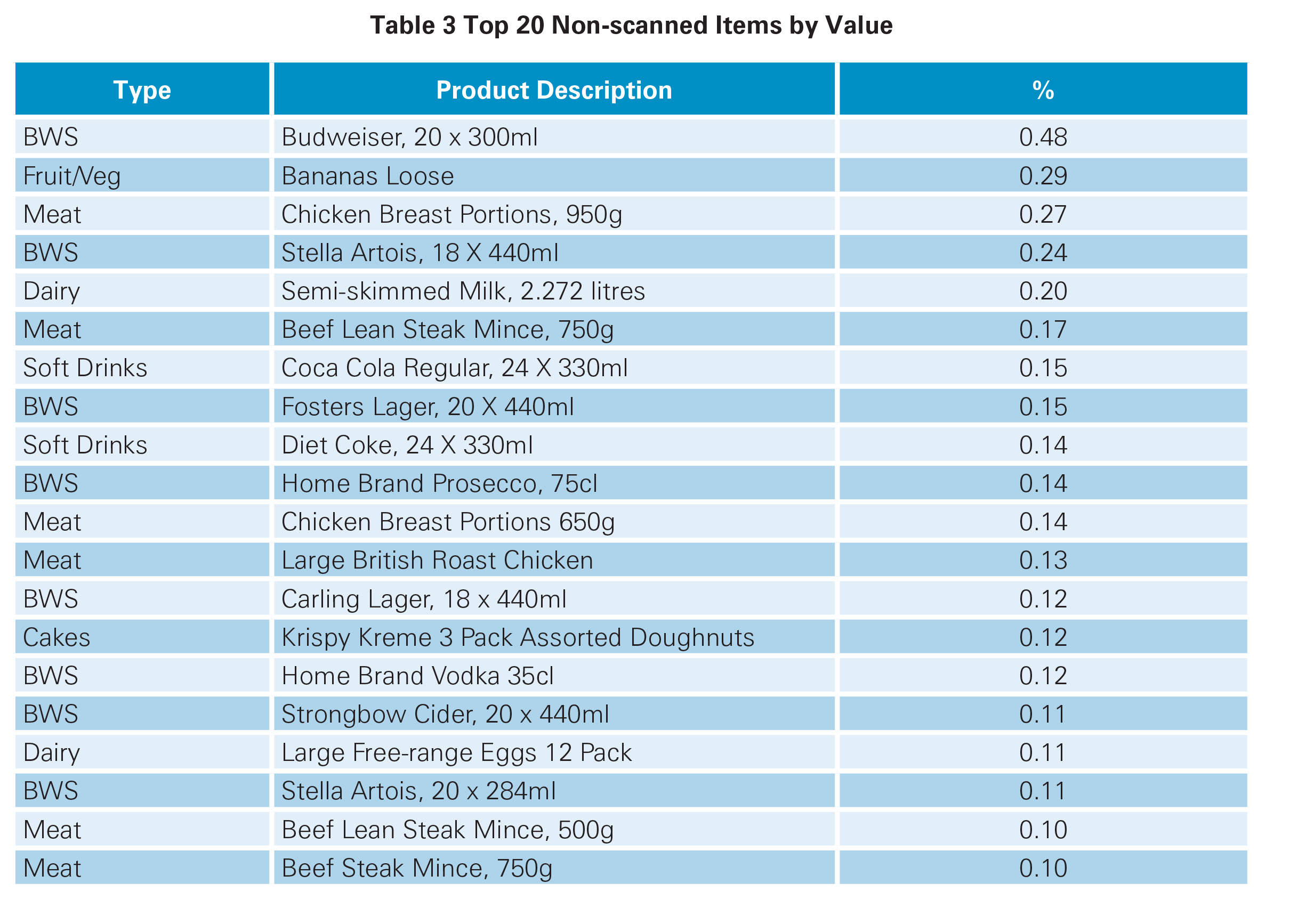

Table 3 presents the same type of data, but this time ranked by the total value of non-scanning rather than frequency. This provides a very different profile of products, with types of fruit/vegetables only appearing once on the list (Bananas in second place). Top of the list is 20 packs of bottles of Budweiser lager, accounting for 0.48% of the value of all non-scanned items. As can be seen, Beers, Wines and Spirits (BWS) account for 40% of the top 20 products, followed by a range of chicken and beef mince products, which accounted for 30% of the list. Together, BWS and Meats accounted for 80% of the top 20 products not scanned by value. Again, however, this top 20 list only accounted for 3.4% of the total value of all items found not to be scanned – highlighting the breadth of items not being scanned.

Discussions with the retailer providing this data suggested that the relatively high levels of non-scanning of packs of Budweiser in particular may be due to the application of multiple barcodes on the packaging, which was causing confusion and error. Only one item appears in both the frequency and value tables – loose bananas, suggesting that this is certainly a high-risk product when it comes to the use of SCO systems.

Estimating Losses Associated with Scan and Go SCO

The data suggests that Scan and Go Losses could be between 0.31% and 4.68% of sales, with the latter number probably being much near to reality than the former, although some caution is required as it is based only upon the experiences of one retailer. This could mean that for every 1% of Scan and Go Utilisation, retailers could be facing at least 0.7 and perhaps up to 10.4 Basis points of increased shrinkage. Even if the mid-point estimate is used from the data comparing stores with and without Scan and Go – 5 Basis points of loss per 1% of utilisation, this still represents additional losses for those companies sharing data of nearly €136 million. If the upper estimate is correct, then this is a frightening prospect that certainly brings into question the financial viability of the technology if such rates of loss were to prevail in the medium to long term. This may be further compounded by the relative inability, to any great extent, to recoup significant savings in staff costs through the introduction of this technology, as seen with Fixed SCO systems.

Controlling SCO: Keeping Shoppers Honest and Accurate

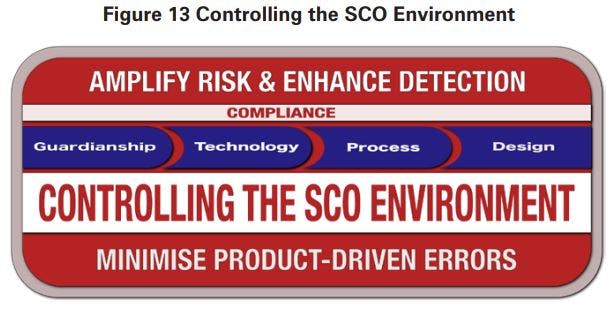

Outlined below is an overview of the various approaches that will be considered, organised around two key themes: minimising the impact of product-driven errors on the one hand, and the amplification of risk and enhancing detection on the other (Figure 13). Under the latter, four key areas are considered to be important although their capacity to control various types of SCO systems will vary: the role of guardianship, technologies, processes and design issues in amplifying risk and enhancing detection. Across these four areas, the importance of store-based compliance will also be critically reviewed – highlighting how each can be significantly undermined should it be compromised.

Minimising Product-driven Errors

The first key area to controlling losses through SCO is to try and minimise problems relating to the products on sale, particularly in the following three ways:

Packaging and Barcode Issues: respondents to this research highlighted numerous examples of where certain products and the way in which they were designed created confusion and scanning issues. Of particular concern was the use of multiple barcodes on some products creating significant errors. For instance, one alcohol-related product was displayed with both a shipment barcode and a product barcode visible – scanning the former did not record the sale but to a customer it could lead them to concluding it had scanned, or it simply would not scan and therefore was not their problem.

Set-up Issues: While product design and barcode issues were certainly generating concerns, a number of case-study companies also recognised that errors within their own organisations were creating problems. Such issues can cause not only direct losses (the shopper does not scan the item), but also considerable frustration for those using Scan and Go/Mobile SCO systems in particular.

Product Protection Issues: A number of respondents raised concerns about how product protection devices and technologies often conflicted with their SCO operations, not least how tags could be safely removed without compromising their role in securing high-risk products.

Amplifying Risk and Enhancing Detection

Previous research has considered the role risk amplification can play in deterring opportunistic retail thieves – elevating concerns about the likelihood of being caught17. However, given the relatively consequence-free environments that some SCO operations create, it also seems important to develop ways in which errant users can be identified and either prosecuted, or more likely, ‘educated’ about the retailer’s capacity to capture their wrongdoing and how to use SCO systems correctly.

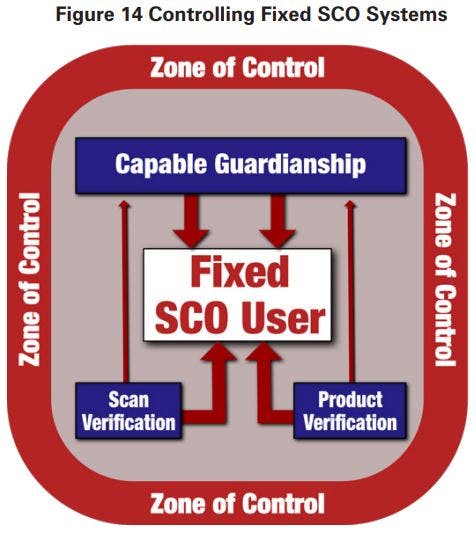

In addition, the capacity of detection is also relevant in terms of identifying when a consumer may have made an error or where there is a higher likelihood that an error may be made, such as choosing between similar types of fruit or vegetables at a weigh station. Relating to SCO, there are four areas within which risk can be amplified and detection made more likely: guardianship; technologies; processes; and the design of SCO spaces. The capacity of these factors to control SCO systems will vary depending upon the type of SCO in use, for instance, Fixed SCO is currently being controlled primarily through guardianship, technologies and design, while Mobile Scan and Go/Mobile SCO is more reliant upon process-based strategies. However, as new ideas emerge, then this picture is likely to change.

Controlling Fixed SCO

Figure 14 provides an overview of how Fixed SCO systems could be controlled.

Capable Guardianship

Across all types of interventions to control losses associated with Fixed SCO systems, the use and role of SCO supervisors was considered to be the most important by respondents to this research.

Effective SCO Supervision

Respondents considered the following themes to be important for effective SCO supervision:

Customer Engagement: making not only eye contact but also verbally interacting with the SCO users was considered important, but doing this in a way that was non-confrontational and service-focussed: ‘Anything that can make people think they are being watched and observed is good, but it has to be done in the right way – this is what is going to make the biggest difference’[R3]; ‘need to give SCO supervisors the confidence to step in when they see something suspicious’[R7].

"need to give SCO supervisors the confidence to step in when they see something suspicious"

Delivering Customer Training: using non-accusatorial techniques was considered an important skill for SCO supervisors to develop, to enable an errant shopper to not lose face yet at the same time recognise that they had been identified: ‘the rule of thumb is to put the attendant shoulder to shoulder with the shopper and turn a possible theft scenario into a coaching moment, so always make it non-confrontational, so make it as though the shopper has never tried to steal something rather the shopper has not correctly used the system’[R10]. Another respondent put forward a similar argument: ‘the fact that they [the shopper] have ended up with 10 yoghurts in their basket but only scanned three – let me help you with that as these items don’t seem to have scanned properly’[R14].

Customer Prioritisation: when SCO spaces get busy then the supervisory role becomes even more critical in managing customer expectations and keeping friction to a minimum. One respondent shared how they had developed training to help their supervisors manage often competing priorities: ‘we have a training programme for how you deal with multiple red lights on SCO and reading customer body language – who gets service first – mum with screaming kid versus bloke with a beer?’[R11]. Similarly, other respondents described how they encouraged SCO supervisors to scrutinise shoppers’ baskets as they entered SCO spaces to look for items that may require subsequent attention and/or be a known theft-risk.

"what you don’t want is the attendant hiding behind a podium and dealing with alerts remotely and not properly engaging with the shoppers"

Occupying the SCO Space: ensuring that supervisors occupied a central and visible location within the SCO environment was considered important in amplifying risk and improving their capacity to deal with alerts more quickly. A number of respondents highlighted their strategies to ensure they did not ‘hide away’ behind monitoring stations: ‘what you don’t want is the attendant hiding behind a podium and dealing with alerts remotely and not properly engaging with the shoppers; [we] can measure how many times a supervisor does remote cancellation of alerts to see whether some stores are above average’[R10].

Having Awareness of Risk: because of the unique risk characteristics of SCO spaces, it was also deemed important to ensure that SCO supervisors were given sufficient training to understand what they should be specifically looking for and how to react accordingly: ‘we are introducing more off the floor training to help them understand the risks present at SCOs – we need to make them aware of the various scams that we have seen at SCO’[R5]; ‘alerting staff to the exceptions is the key – how can you help them to look for the risky behaviours’[R10].

"alerting staff to the exceptions is the key – how can you help them to look for the risky behaviours"

Protecting the Brand: In some Fixed SCO environments, audits of customers using Scan and Go/Mobile SCO systems can also be carried out, and these events can often be viewed as an explicit personification of a retailer’s overt distrust of the user – ‘we are checking you because we are not sure you have scanned everything correctly’. Many respondents recognised this as a moment of tension for both the consumer and the SCO supervisor, particularly when un-scanned product is identified. It was felt that a welltrained SCO supervisor was critical at this moment: ‘The audit is a moment when you need to rebuild the brand with the customer – have empathy, educate them, make sure they are confident in using the technology’[R11].

Experience Counts: there was clear and unambiguous support for the notion that only experienced staff should be employed in SCO environments: ‘try and ensure only long-standing cashiers are used at SCO – the better personnel; what you definitely don’t want is the walking wounded’[R13].

"try and ensure only long-standing cashiers are used at SCO – the better personnel; what you definitely don’t want is the walking wounded"

Keeping Customers Honest and Accurate: as detailed earlier in this report, the SCO environment is potentially rich with opportunities for both malicious and non-malicious losses to occur, and so the role of the SCO supervisor is fundamentally about keeping the customer honest and accurate – to gently guide them away, through good customer service and vigilance, from the opportunities that they may be presented with to makes errors and/or abuse the system.

Number of Fixed SCOs per Supervisor

A perennial question discussed by retailers and their technology providers around the world is: what is the ‘right’ number of Fixed SCO machines that one supervisor should be expected to manage effectively? Perhaps not unsurprisingly, the number varied depending upon the retail context within which they were being used and the type of Fixed SCO technology employed. But, overall, of the 10 case-study companies who were prepared to suggest what they considered to be the ‘right’ number of machines to ensure they could be adequately supervised, there was remarkably little variance – between 5-6 machines was considered to be the appropriate number.

Of course, this does not mean that this was the number being utilised by these retailers and even where it was, there was always the challenge of store compliance with agreed directives (see below). For some respondents, the ratio could be altered depending upon the layers of complexity/requirements imposed upon the SCO space and their subsequent impact upon the capacity of the SCO supervisor to manage the ensuing interventions. For instance, where there was no weight-checking security functionality, age-related products and/or perhaps product protection devices installed, then it was felt the ratio could be higher.

For many, the challenge often cited was ensuring that agreed ratios were adhered to as customer velocity fluctuated through trading times although one approach to this problem was controlling the number of Fixed SCO machines that were open for use. In summary, use context would appear critical in determining the Fixed SCO Supervisor Ratio, with a number of factors influencing this context (summarised in Figure 15).

Utilising Technologies

Retailers taking part in this research were utilising relatively few technologies to try and manage the issue of SCO-related losses, although a number were looking at a range of them. There are two main areas where technologies have either been utilised already or are in trial and development mode: Scan Verification Technologies; and Product Verification Technologies.

Scan Verification Technologies

Weight-based Systems

Of the companies taking part in this research three had taken the decision to turn off their weight-based system, primarily because of a desire to prioritise the reduction of frustration for the user caused by alerts: ‘weight scales – it caused so many interventions that we took the decision to switch it off’[R9]. For another, they fully realised that this decision would likely negatively impact upon levels of loss but felt it was worth it: ‘do I expect those numbers [losses] to be positive, no doubt, but, we don’t want to turn the weight scales back on, that would be a failure point if we had to do that to get to the same level of loss’[R11].

Others have had a number of internal debates about whether they should follow suit although for the time being all remained committed to its use: ‘we did think about turning it off completely but it was seen as a step too far for the business at that time[R14]; ‘the weight system is a real battle for us because we know it causes such frustration, but we don’t want to switch it off, but it is a tough one to know what to do with’[R4].

"weight scales – it caused so many interventions that we took the decision to switch it off"