Global Study on Self-checkout in Retail

Use, Impact and Control

Table of Contents:

Languages :

- Self-Checkout Loss: Three Ways to Rethink SCO Design

- Self-Checkout in Retail: Measuring the Impact on Loss

This report, published in 2022, provides a summary of the findings from an online survey of retailers from around the world focussed upon their use of various forms of self-checkout and pay (SCO) systems, concerns about their impact upon retail losses, and the approaches being adopted to better manage and control these technologies.

In total 93 retailers took part in the survey drawn from 25 countries (respondents were mainly employed in the Loss Prevention function). Most responses came from European retailers (51), followed by North American (29) and Australasian (11). Nearly three-quarters were Grocery retailers with the rest being a mixture of non-grocery, including pharmacy, DIY, department stores and apparel retailers. The total sales for all respondents in 2019-20 was more than €2.237 trillion, accounting for approximately 13% of global retail sales. In terms of overall sales value, 8 of the top 10, and 14 of the top 20 largest retailers in the world took part in this study.

The research can be summarised as follows:

• Fixed SCO was deployed by 96% of Grocery respondents and 77% of Non-grocery respondents.

• Respondents estimated that SCO systems accounted for as much as 23% of their total unknown store losses, with malicious losses representing 48%.

• Two-thirds of respondents were of the view that the problem of SCO-related losses was becoming more of a problem in their businesses (66%).

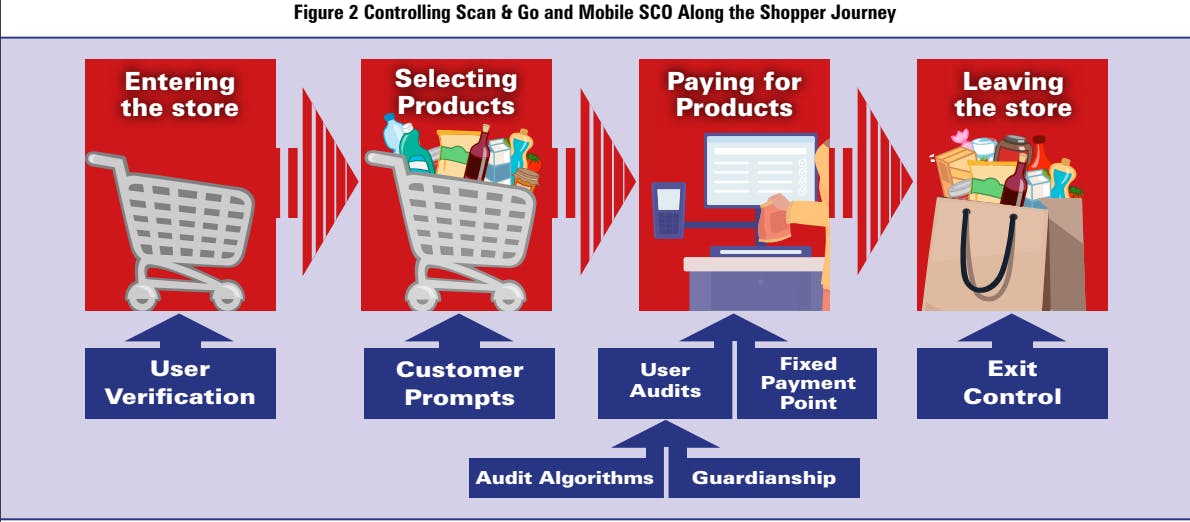

• To address this issue, respondents were utilising a wide range of interventions organised around four themes: Technologies; Guardianship; Design; and Processes. In addition, the control of some SCO systems were focussed upon four key areas in the shopper journey: entering the store; selecting products; checking out; and leaving the store.

• For Fixed SCO systems the use of weight controls was not only the most deployed intervention, but it was also regarded as the most effective approach deployed thus far.

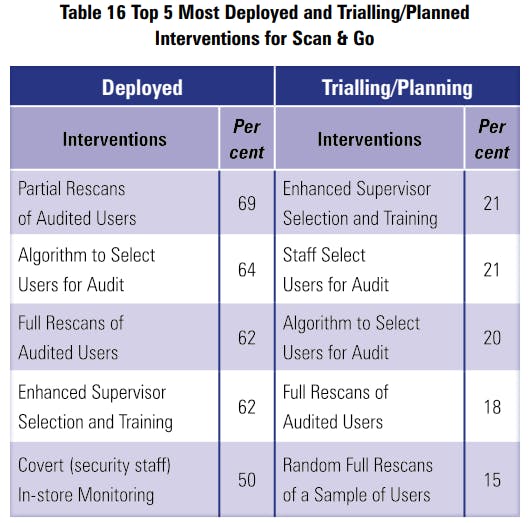

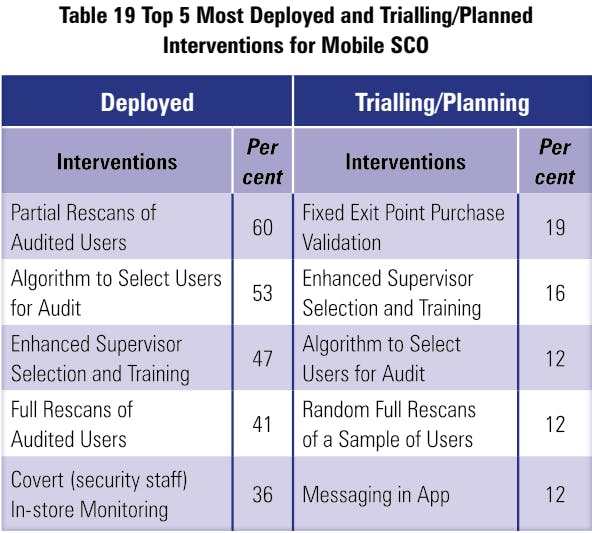

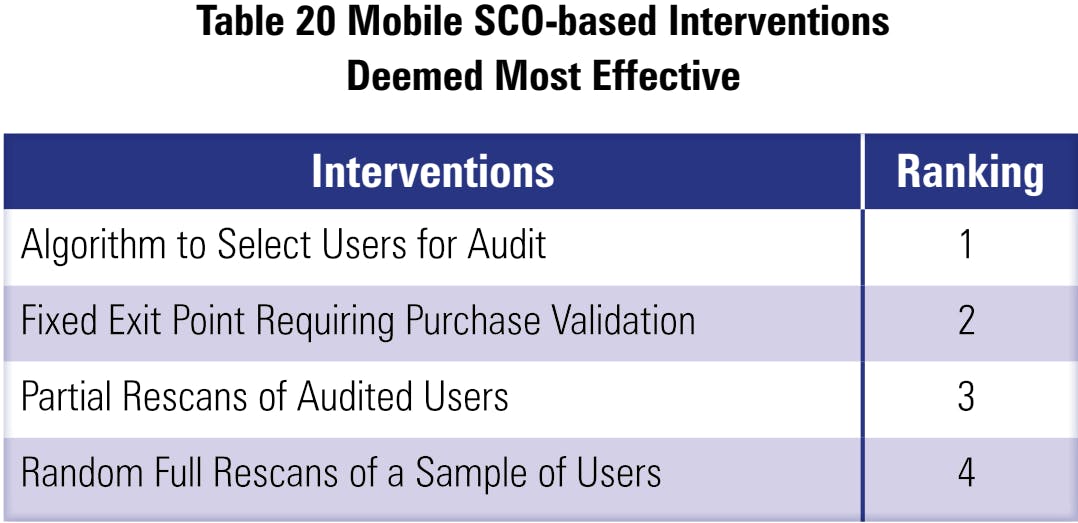

• In terms of Scan & Go and Mobile SCO systems, partial rescan audits were the most deployed intervention, with algorithm-driven audit selection regarded as the most effective, followed by using fixed exit points requiring purchase validation to open.

• In terms of future developments to control Fixed SCO systems, there was a clear trend towards growing interest and investment in a range of analytic-driven interventions, including identifying non-scanning, product recognition and barcode switching alerts.

• For Scan & Go, enhanced supervisor selection and training, and the option for staff to manually select customers for an audit check, were the most popular new controls being trialled.

• For those offering Mobile SCO, introducing some form of exit validation process was the most common intervention currently under consideration.

It seems clear that SCO systems will continue to be a significant and growing part of the retail environment. It is highly likely for the foreseeable future that Fixed SCO will remain the dominant technology, supplemented by growing use of Scan & Go and perhaps more limited use of Mobile SCO.

Many retailers have now developed a considerable amount of experience in managing various types of SCO systems and this can now be seen in the breadth of interventions and approaches being adopted to better control and manage them.

As with much in retailing, managing SCO effectively will be about balancing often competing priorities – improving customer service and convenience against limiting retail losses. To achieve this outcome, retailers will need to ensure that there is a cross-functional approach in place, a clear agenda for innovation, and an appetite for investment.

They will also need to recognise that organisational choices can have both positive and negative outcomes, with the former needing to be properly balanced against the latter to ensure they remain a genuine driver of business profitability.

Abstract

This report, published in 2022, provides a summary of the findings from an online survey of retailers from around the world focussed upon their use of various forms of self-checkout and pay (SCO) systems, concerns about their impact upon retail losses, and the approaches being adopted to better manage and control these technologies.

In total 93 retailers took part in the survey drawn from 25 countries (respondents were mainly employed in the Loss Prevention function). Most responses came from European retailers (51), followed by North American (29) and Australasian (11). Nearly three-quarters were Grocery retailers with the rest being a mixture of non-grocery, including pharmacy, DIY, department stores and apparel retailers. The total sales for all respondents in 2019-20 was more than €2.237 trillion, accounting for approximately 13% of global retail sales. In terms of overall sales value, 8 of the top 10, and 14 of the top 20 largest retailers in the world took part in this study.

The research can be summarised as follows:

• Fixed SCO was deployed by 96% of Grocery respondents and 77% of Non-grocery respondents.

• Respondents estimated that SCO systems accounted for as much as 23% of their total unknown store losses, with malicious losses representing 48%.

• Two-thirds of respondents were of the view that the problem of SCO-related losses was becoming more of a problem in their businesses (66%).

• To address this issue, respondents were utilising a wide range of interventions organised around four themes: Technologies; Guardianship; Design; and Processes. In addition, the control of some SCO systems were focussed upon four key areas in the shopper journey: entering the store; selecting products; checking out; and leaving the store.

• For Fixed SCO systems the use of weight controls was not only the most deployed intervention, but it was also regarded as the most effective approach deployed thus far.

• In terms of Scan & Go and Mobile SCO systems, partial rescan audits were the most deployed intervention, with algorithm-driven audit selection regarded as the most effective, followed by using fixed exit points requiring purchase validation to open.

• In terms of future developments to control Fixed SCO systems, there was a clear trend towards growing interest and investment in a range of analytic-driven interventions, including identifying non-scanning, product recognition and barcode switching alerts.

• For Scan & Go, enhanced supervisor selection and training, and the option for staff to manually select customers for an audit check, were the most popular new controls being trialled.

• For those offering Mobile SCO, introducing some form of exit validation process was the most common intervention currently under consideration.

It seems clear that SCO systems will continue to be a significant and growing part of the retail environment. It is highly likely for the foreseeable future that Fixed SCO will remain the dominant technology, supplemented by growing use of Scan & Go and perhaps more limited use of Mobile SCO.

Many retailers have now developed a considerable amount of experience in managing various types of SCO systems and this can now be seen in the breadth of interventions and approaches being adopted to better control and manage them.

As with much in retailing, managing SCO effectively will be about balancing often competing priorities – improving customer service and convenience against limiting retail losses. To achieve this outcome, retailers will need to ensure that there is a cross-functional approach in place, a clear agenda for innovation, and an appetite for investment.

They will also need to recognise that organisational choices can have both positive and negative outcomes, with the former needing to be properly balanced against the latter to ensure they remain a genuine driver of business profitability.

Foreword

This is the fourth report the ECR Retail Loss Group has produced on the topic of Self-checkout and pay systems (SCO) in retailing. The first was over a decade ago while more recent studies have been completed in 2018 and 2020. This sustained and ongoing interest in SCO technologies reflects both their increasing importance to retailing and the extent to which concerns have grown about their impact upon business profitability and how they can be better controlled and managed.

This new study is the first part of a major initiative focussed upon developing a detailed understanding of not only what approaches retailers are adopting to manage the various types of SCO system they are operating, but also offer insights into how they are being used and their effectiveness. It is a major undertaking based upon a global survey of retailers, detailed insights from SCO supervisors, and extensive case studies from a wide range of retailers. The overall goal is to provide the retail industry with new knowledge, insights and practices that will enable it to meet the twin goals of improving consumer convenience and business profitability.

I would like to thank Professor Adrian Beck for carrying out this research – as ever we are extremely grateful for his industry knowledge and research expertise. I would also like to thank Everseen Ltd for the additional research grant that supported this study. As with all the research undertaken on behalf of the ECR Retail Loss Group, it would not be possible without the active support and involvement of the retail community – thank you for taking the time to share your thoughts and experiences – by working together we are much more likely to Sell More and Lose Less!

Finally, can I encourage you to not only read and share this and the other studies carried out for the ECR Retail Loss Group, but also agree to take part in the future work of the Group – further details can be found at: www. ecrloss.com.

John Fonteijn

Chair of the ECR Retail Loss Group

Executive Summary

This report provides a summary of the findings from an online survey of retailers from around the world focussed upon their use of various forms of self-checkout and pay (SCO) systems, concerns about their impact upon retail losses, and the approaches being adopted to better manage and control these technologies.

In total 93 retailers took part in the survey drawn from 25 countries. Most responses came from European retailers (51), followed by North American (29) and Australasian (11). Nearly three-quarters were Grocery retailers with the rest being a mixture of non-grocery, including pharmacy, DIY, department stores and apparel retailers. The total sales for all respondents in 2019-20 was more than €2.237 trillion, accounting for approximately 13% of global retail sales. In terms of overall sales value, 8 of the top 10, and 14 of the top 20 largest retailers in the world took part in this study.

Key Findings

- Fixed SCO was deployed by 96% of Grocery respondents and 77% of Non-grocery respondents.

- Respondents estimated that SCO systems accounted for as much as 23% of their total unknown store losses, with malicious losses representing 48%.

- Two-thirds of respondents were of the view that the problem of SCO-related losses was becoming more of a problem in their businesses (66%).

- To address this issue, respondents were utilising a wide range of interventions organised around four themes: Technologies; Guardianship; Design; and Processes. In addition, the control of some SCO systems were focussed upon four key areas in the shopper journey: entering the store; selecting products; checking out; and leaving the store.

- For Fixed SCO systems the use of weight controls was not only the most deployed intervention, but it was also regarded as the most effective approach deployed thus far.

- In terms of Scan & Go and Mobile SCO systems, partial rescan audits were the most deployed intervention, with algorithm-driven audit selection regarded as the most effective, followed by using fixed exit points requiring purchase validation to open.

- In terms of future developments to control Fixed SCO systems, there was a clear trend towards growing interest and investment in a range of analytic-driven interventions, including identifying non-scanning, product recognition and barcode switching alerts.

- For Scan & Go, enhanced supervisor selection and training, and the option for staff to manually select customers for an audit check, were the most popular new controls being trialled.

- For those offering Mobile SCO, introducing some form of exit validation process was the most common intervention currently under consideration.

Call to Action

It seems clear that SCO systems will continue to be a significant and growing part of the retail environment. It is highly likely for the foreseeable future that Fixed SCO will remain the dominant technology, supplemented by growing use of Scan & Go and perhaps more limited use of Mobile SCO.

Many retailers have developed a considerable amount of experience in managing various types of SCO systems and this can now be seen in the breadth of interventions and approaches being adopted to better control and manage them.

As with much in retailing, managing SCO effectively will be about balancing often competing priorities – improving customer service and convenience against limiting retail losses. To achieve this outcome, retailers will need to ensure that there is a cross-functional approach in place, a clear agenda for innovation, and an appetite for investment.

They will also need to recognise that organisational choices can have both positive and negative outcomes, with the former needing to be properly balanced against the latter to ensure they remain a genuine driver of business profitability.

Introduction

Context

This is the first of three reports focussed upon developing a better understanding of the ways in which retailers are trying to manage and control the losses associated with various types of self-checkout systems (SCO)1 . It builds upon earlier work carried out on behalf of the ECR Retail Loss Group, including a study in 2018 that offered some of the first ever insights into the scale and extent of the problem of SCO-related losses2 , and a study in 2020 looking at how good design principles can be utilised to address some of these problems3 .

Growth

While SCO technologies are not necessarily a recent development within retailing – early forays into enabling consumers to scan and pay for their items without recourse to a member of retail staff can be seen in the late 1980s/early 1990s – in the last 10 years the pace of development and adoption has quickened considerably, especially in the Grocery sector4 . Today, anecdotal evidence suggests that in some forms of retailing, as much as 80% of customer transactions in supermarkets might be processed through variants of SCO technologies5 .

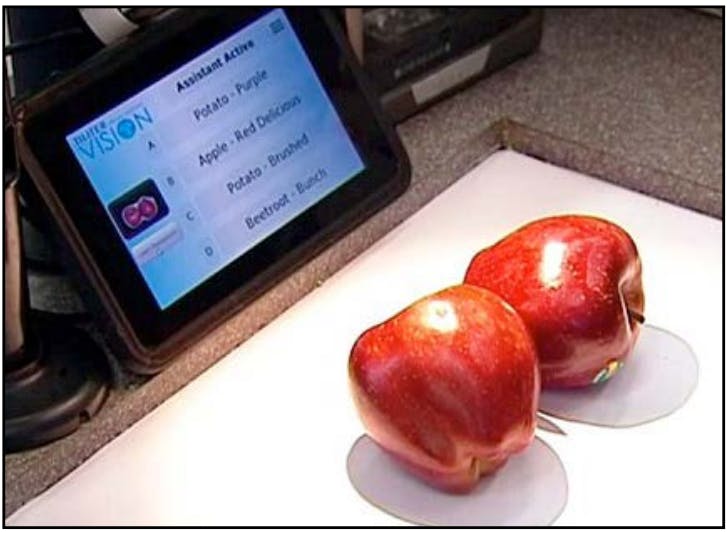

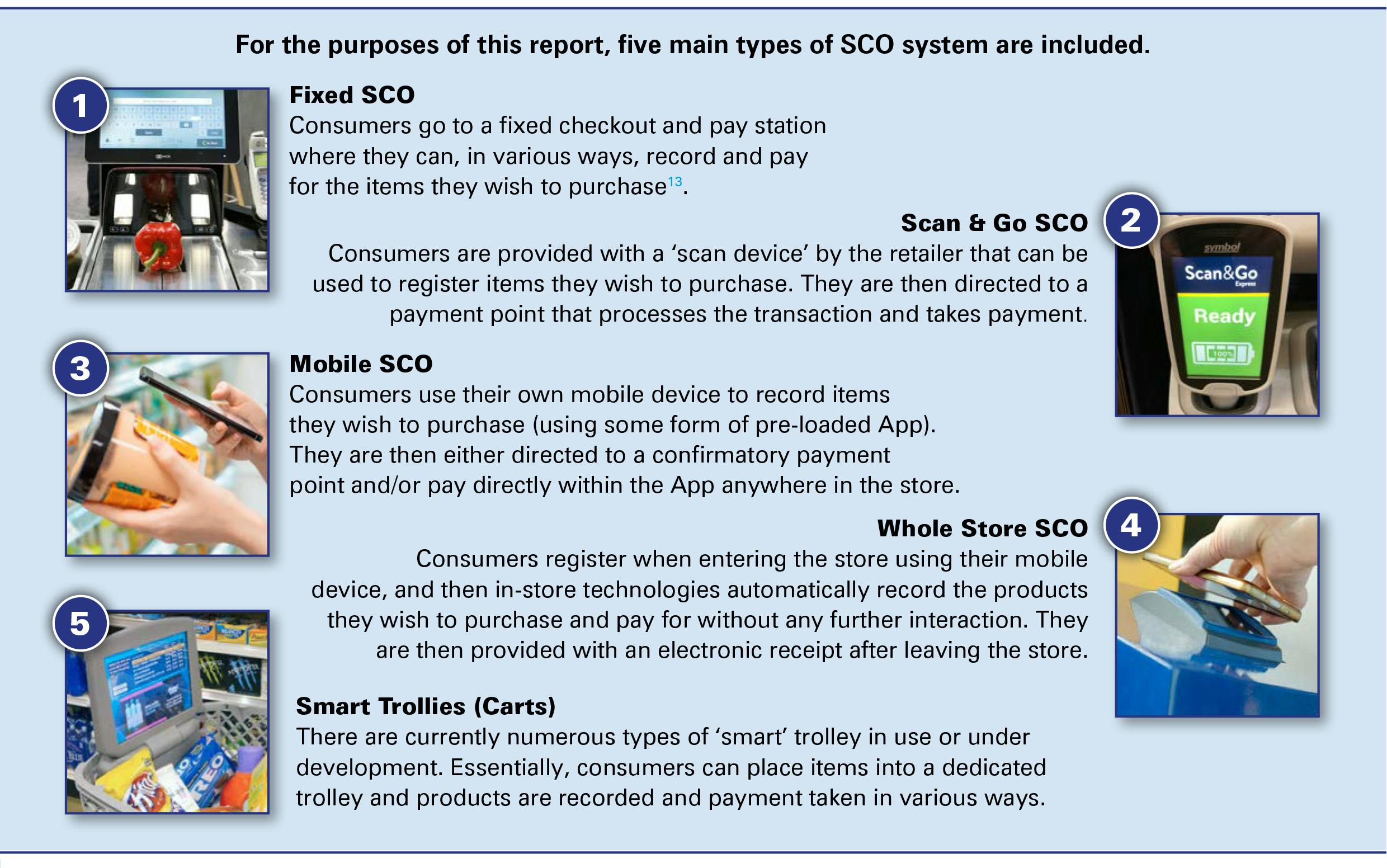

In addition, there are now far more ways in which SCO is being realised in a broader range of retail environments. As will be evidenced later in this report, while Fixed SCO machines6 remain the most dominant type of system currently in operation, retailers are now also offering their shoppers a myriad of alternatives, including Scan & Go (where the consumer is provided with a device to scan items they wish to purchase), Mobile SCO (where the consumer uses their own handheld device to scan and in some cases pay for their items), Smart Trolleys, some of which can automatically detect items placed within them, and Whole Store SCO systems, where once a shopper has registered and scanned themselves into a store, they can pick up items and leave without any need for further scanning or interaction with a payment point (such as Amazon Go, Tesco’s GetGo and Aldi’s Shop&Go stores).

The considerable growth in the use of SCO systems has been fuelled by three major factors: 1) a desire by many retailers to reduce their labour costs – get consumers to undertake tasks previously done by employees; 2) enable bricks and mortar retailers to better compete with online shopping by reducing some of the key friction points in their shopper journeys; 3) the growing capability of SCO technologies, telecommunication networks, and computing to work more reliably, across more platforms and locations, and at relatively lower costs. Taken together, in many parts of the world, SCO is now spreading across many forms of retailing, including grocery, DIY, fashion, convenience, beauty, and pharmacy to name but a few.

Concerns

As has been documented in previous ECR Reports, despite the claims of several of the larger providers of SCO systems, their introduction has not always been an unbridled win for the retailer, nor indeed the shopper. Certainly, early iterations of these systems were met with considerable opprobrium from some quarters, regarding them as an unwarranted irritant in the shopping journey – slowing the process down and epitomised by the omnipresent announcement of ‘unexpected item in the bagging area’!7

In addition, many of these systems have been found to generate an increase in retail losses – the opportunities they present for both malicious and non-malicious activity is now relatively well documented – non-scanning of items, mis-representation of products, barcode switching, walkaways and so on. Taken together, an ECR Report estimated that for each 1 per cent of retail sales processed through Fixed SCO, a retailer will suffer an increase in unknown loss of 1 basis point. This means that if 50% of sales value goes through this type of system, then a retailer could see an additional loss of 0.5% of their retail sales. With some estimates suggesting that unknown losses (shrinkage) for a Grocery retailer might be in the region of 1.50% of retail sales per year, this would represent a 30% increase in losses8 . More significantly, estimates for other types of SCO system losses were even more concerning – Scan & Go and Mobile could see the rate of losses rise higher, possibly as much as 7-10 basis points of loss for each 1% of transaction value9 .

Control

Despite these considerable losses, for many retailers, the proverbial Genie is now out of the bottle and few SCO adopters are realistically envisaging a future that does not see it featuring as a major part of their checkout environment10. It is therefore no longer a question of will SCO be a significant part of the landscape of many parts of the retail industry, but more how can it be effectively managed and controlled to ensure it does not become an unacceptably large drain on business profitability? In this respect, there has been growing interest in, and development of, a wide range of interventions/approaches designed to try and mitigate the risks posed by SCO systems11.

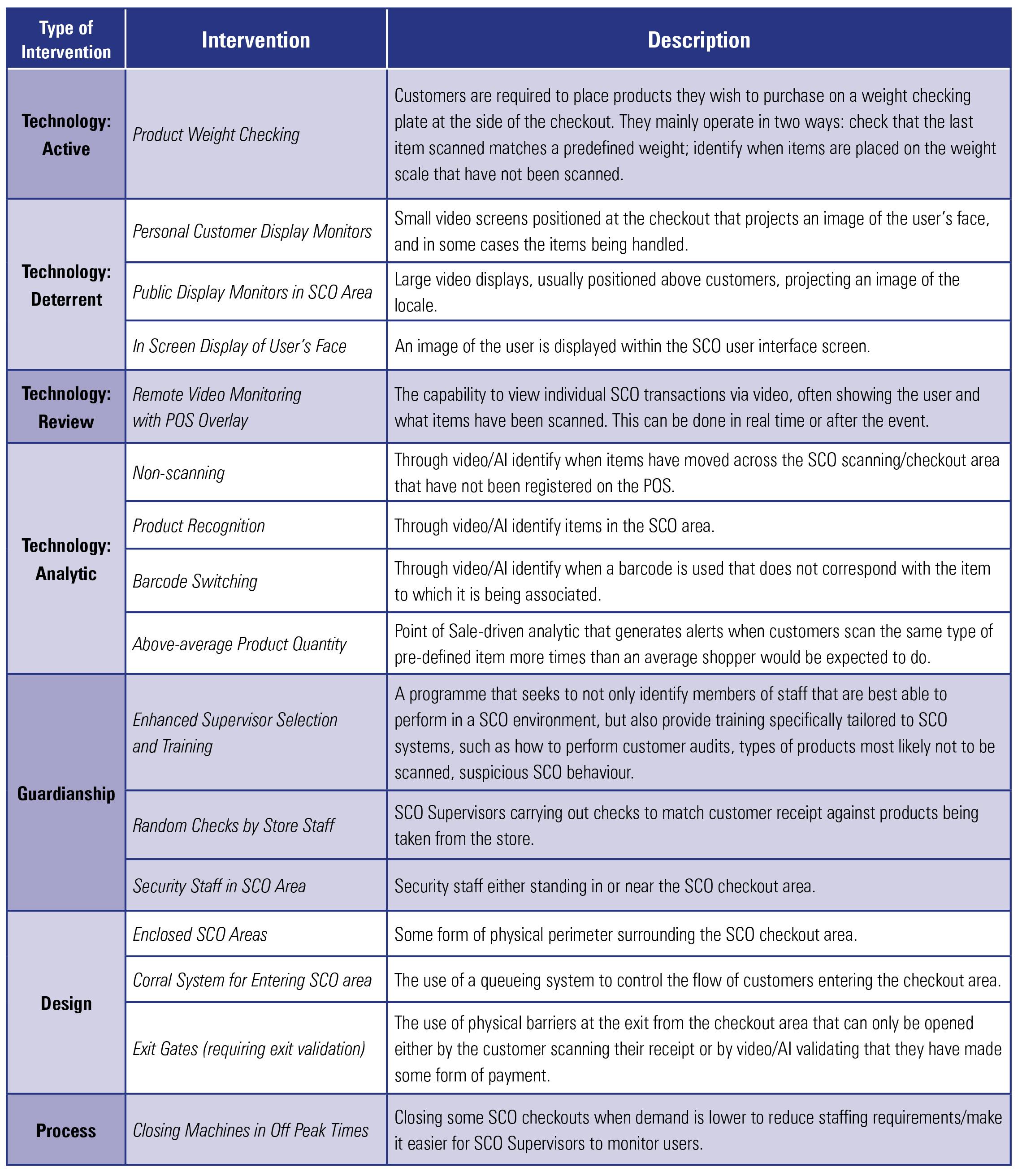

These have largely been focussed upon key points within the shopper journey: registration, entering the store, selecting product in-aisle, the checkout area, and exiting the store. In addition, they have coalesced around four broad themes: the application of various types of technologies, such as video technologies and weightbased interventions; changes in the way in which guardianship is delivered, such as changes to the selection and training of SCO supervisors; adjustments to store processes, such as closing Fixed SCO machines in off peak times; and changes to the design and layout of stores and SCO-specific environments, such as the use of Corrals and exit control gates.

Objectives

The purpose of this first of three reports is to contribute to the development of knowledge and understanding on how these various interventions impact upon the management of SCO-related losses. This report is based upon a global survey of retailers that are currently using or planning to use any form of SCO-related technology. Its focus is to understand the following:

- The extent to which retailers are using the various types of SCO systems currently available.

- How some of these systems are operationalised.

- Perceptions of the levels of loss and concern relating to the utilisation of SCO systems.

- The extent to which various types of intervention are being deployed and trialled by retailers.

The two subsequent reports will focus upon:

- A survey of SCO supervisors to understand what can be learnt from their experiences.

- A series of detailed retail case studies on the use and evaluation of various types of intervention.

By using a three-pronged approach, it is hoped that this research will help retail users of SCO systems to better manage and control the losses associated with them.

Methodology

The data for this report is derived from a global online survey of only those retailers that are either currently using or trialling any form of SCO system, or those that are planning to use them soon. Every effort was made to try and contact as many companies in as many countries as possible, including translating the research instrument into: French, German, and Spanish. In addition, representative retail trade bodies were contacted across the globe to encourage them to make their local retailers aware of the survey. Other retail groups were also contacted such as the ECR Community, the Retail Industry Leaders Association and The National Retail Federation in the US, and the Profit Protection Future Forum in Australia, to encourage their members to respond. In addition, social media postings were made on sites such as LinkedIn urging retailers to take part.

A total of 93 retailers provided useable data, drawn from 25 countries (respondents were mainly in the Loss Prevention function). Most responses came from European retailers (51), followed by North American (29) and Australasian (11)12. Perhaps unsurprisingly given the adoption curve of SCO systems, 72% of responses were from the Grocery sector, with the rest being a mixture of non-grocery, including pharmacy, DIY, department stores and apparel retailers.

The total sales for all respondents in 2019-20 was more than €2.237 trillion, accounting for approximately 13% of global retail sales. Moreover, in terms of overall sales value, 8 of the top 10, and 14 of the top 20 largest retailers in the world took part in this study.

Any survey of this type cannot claim to be wholly representative of the views and experiences of global retailing – the sample is skewed towards larger retailers operating principally in North America, Europe, and Australasia, with those in Asia, Africa and Latin America underrepresented. While this is likely to be largely a function of language and accessibility, it could also be due to a lower level of penetration of SCO systems in these markets at this time. Either way, the data presented in this report needs to be understood within this context and caution taken when interpreting the findings.

Throughout this report, the five types of SCO systems described above will be referred to using these titles (e.g., Fixed SCO, Scan & Go SCO and so on). All currency values are quoted in Euros using an exchange rate calculated on the 8th February 2022. In some of the tables presented below, percentages may add up to more than 100% due to rounding.

The author would like to thank the 93 company representatives that agreed to provide data – your time and thoughts are very much appreciated.

Key Findings

This section of the Report is organised in to four parts.

- The extent to which respondents are using a range of SCO technologies in their businesses.

- How Scan & Go and Mobile SCO systems are being implemented, looking particularly at user registration and payment methods.

- Insights in to how respondents assess the impact of their SCO systems on retail losses.

- A review of the various ways in which respondents are trying to control and manage their SCO systems.

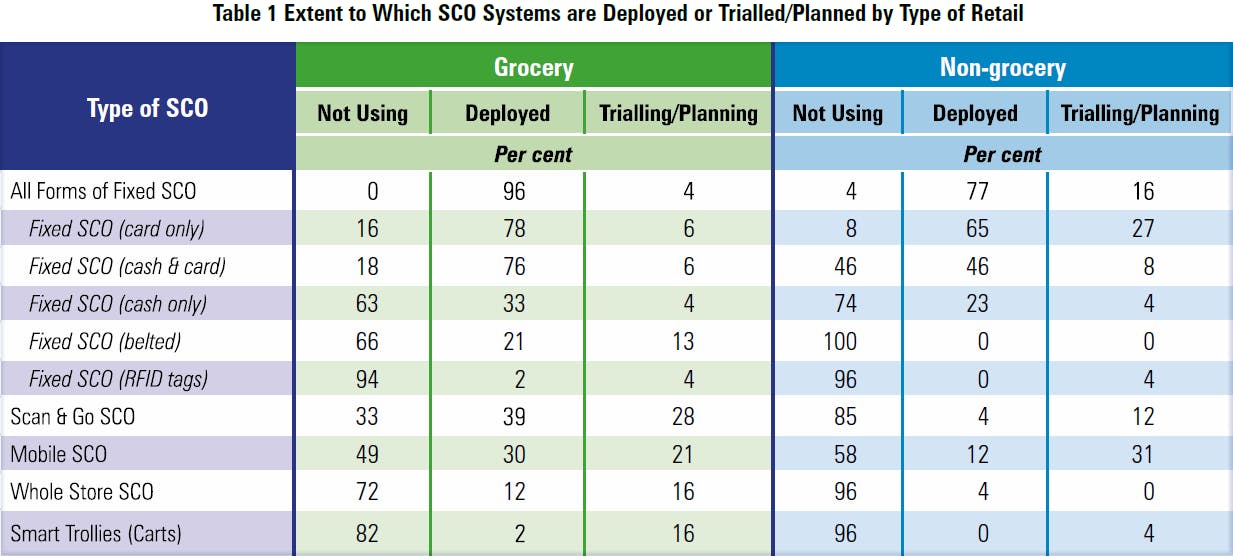

Utilisation of Self-checkout Systems

All respondents were asked to document the extent to which they were using SCO systems in their businesses, ranging from not using, deployed, currently being trialled, or plans in place to introduce soon. A summary of this data is provided in Table 1, which also provides a breakdown between Grocery and Non-grocery respondents.

As can be seen, the use of Fixed SCO systems is almost ubiquitous across both types of retailers – 96% of Grocery and 77% of Non-grocery respondents had deployed some form of SCO system. Only 4% of Nongrocery stated they were not using it nor had plans to introduce it soon. By far the most common forms of Fixed SCO in use for both types of retail were those which accepted only card payments or those which offered a combination of card and cash payments. Cash only variants were much less likely to be deployed – only one-third of Grocers (33%) and one-quarter of Non-grocers (23%) stated they were offering this option.

Perhaps not surprisingly, belted Fixed SCO systems were only present in Grocery retailers and there were only a very small number of retailers who were currently offering a Fixed SCO option that utilised RFID technologies, although a slightly larger number stated that they were either trialling or planning to introduce it soon. As documented in other ECR research, developing an RFID-driven SCO proposition requires a comprehensive and rigorous product tagging strategy to be in place, something which is currently difficult to achieve in many Grocery formats14.

With regards to Scan & Go systems (where shoppers are provided with a scan device by the retailer), these were more common in a Grocery environment – 39% had them deployed, with a further 28% trialling or planning to use them soon. In contrast, only 4% of Non-grocers had deployed Scan & Go with a further 12% trialling or planning their use shortly

Mobile SCO (where shoppers use their own device) offered a slightly different utilisation picture – over 4 in 10 Non-grocery retailers had either deployed or were trialling/planning to use this technology (43%). For Grocery respondents over one-half were in the same position, although a higher proportion had already deployed Mobile SCO in their retail stores (30%)

The final two types of SCO system under consideration were much less likely to be deployed – Smart Trollies had been deployed by just 2% of Grocers and none of the Non-grocers although a larger proportion did state they had trials underway or plans for use in the future (16% and 4% respectively). In terms of Whole Store SCO, some 12% of Grocery respondents had deployed this technology to some degree, with a further 16% in trial/planned use mode. For Non-grocery respondents, this technology was not very apparent, just 4% had deployed any such system with none having any trials or plans for future use. In many respects, this is understandable – current iterations of this technology are still at the testing/trial phase with only a small number of retailers investing at this stage.

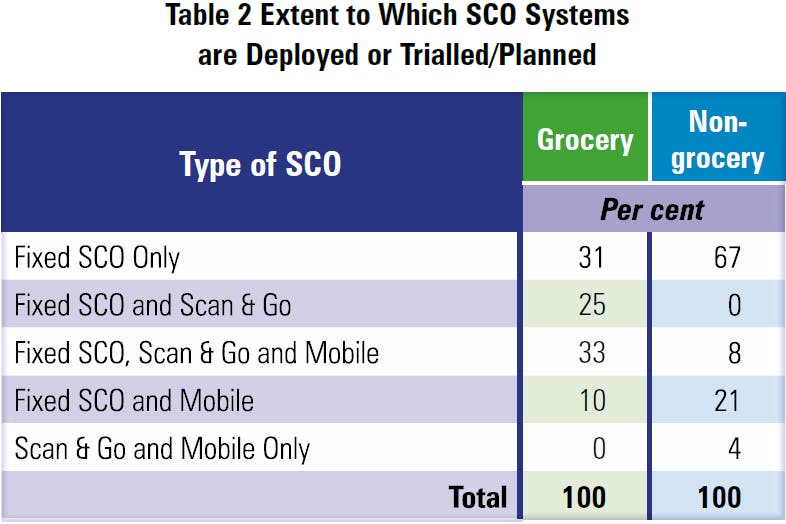

This data has been condensed to highlight the way in which respondents are utilising the main types of SCO systems covered by this research (Table 2).

The most common combination amongst Grocery retailers was a mixture of Fixed, Scan & Go and Mobile SCO (33%), followed by only a Fixed SCO operation (31%). Taken together, most Grocery respondents (58%) were committed to offering their consumers a Scan & Go option, while far fewer had opted for a Fixed and Mobile SCO option only (10%). Previous research has shown that the utilisation of Mobile SCO in a Grocery environment, especially for larger shopping transactions has been limited, not least by the challenges of the user experience15. For Non-grocers, most have a Fixed SCO only approach (67%) with a sizeable minority offering some form of Mobile SCO option alongside it (21%). The appetite for Mobile is more pronounced in the Non-grocery environment, perhaps a reflection of the likely smaller number of items in any given transaction compared with Grocery.

The data clearly shows the dominance of Fixed SCO systems both for Grocery and Non-grocery respondents – currently it is the technology consumers are most likely to utilise. However, the data also shows that both Scan & Go and Mobile technologies are not uncommon, with many retailers either trialling or planning to use them soon. With regards to Smart Trollies and Whole Store SCO systems, for the moment there are very few retailers that are actively deploying them although there would seem to be growing interest in both within the Grocery sector – an environment that would seem not only better suited to their use, but also one with a longer pedigree of utilising SCO.

Operating Scan & Go/Mobile Systems

Both Scan & Go and Mobile SCO systems require additional user elements beyond that typically found with Fixed SCO technologies, including forms of registration, and agreed methods for payment. Detailed below are the responses from retailers that were employing these technologies in their businesses.

Scan & Go Registration

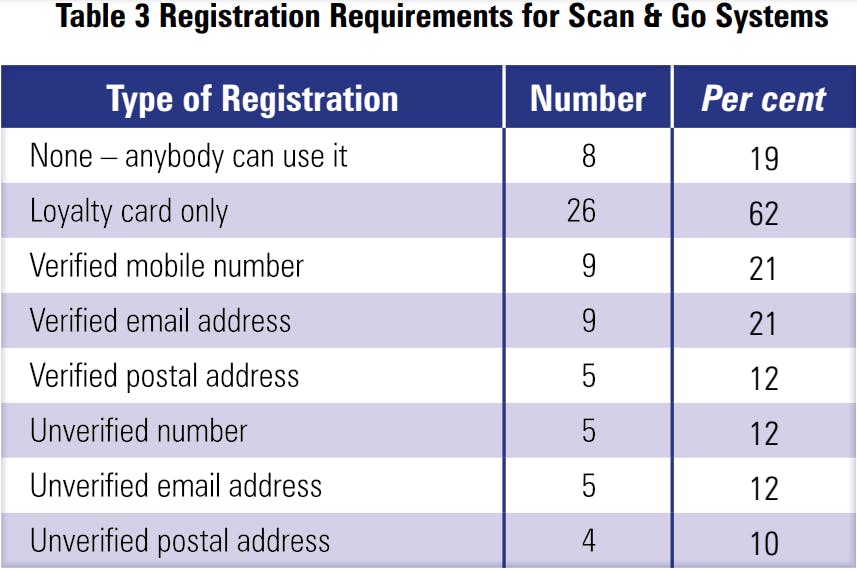

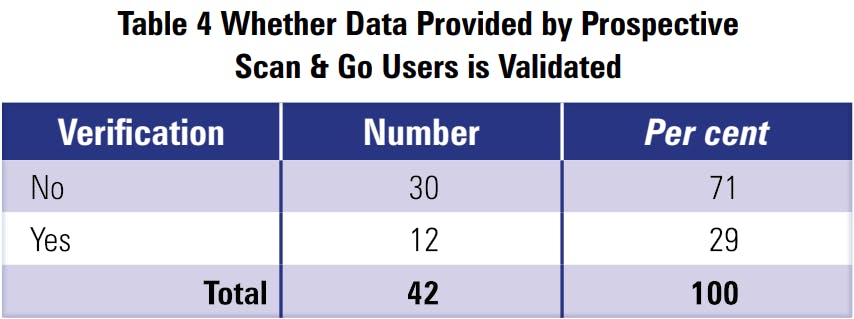

The first issue was the approach adopted by retailers to ‘register’ and verify the identity of those who wish to use their Scan & Go system. Detailed in Table 3 are the various options – respondents could choose more than one option and so the data does not total 100%.

The most common option was to require users to have a company loyalty card to access the Scan & Go system (62%). This was then followed by a verified mobile telephone number (21%) and a verified email address (21%). In this instance, ‘verification’ means that the retailer carried out some form of check to authenticate the data provided by the prospective user. The next most common response was that there was no registration process required – simply anybody could access the Scan & Go device and use it to carry out their shopping (19%).

Another way to assess this data is to group respondents into those that did or did not validate the data provided by prospective Scan & Go users (Table 4). For the purposes of this analysis, unless another form of verification was used alongside Company Loyalty Card, it is assumed that this approach is not a form of verification.

A significant majority of retailers utilising a Scan & Go system do not have any form of data validation in place (71%) – just 29% checked, be that a postal address, a mobile telephone number and/or an email address. As previous ECR research has shown, Scan & Go systems can generate a significant amount of loss, much higher than that found with Fixed SCO system16. In addition, current approaches available to control losses associated with this type of SCO are relatively limited, typically restricted to the beginning and end of the shopping journey17. As such, imposing some form of verification step would seem a sensible crime deterrence strategy – reducing offender anonymity is often regarded as an effective risk amplification method, particularly when there are so few alternatives available18. In addition, having some form of registration in place is also a fundamental requirement for operationalising any form of algorithmic audit selection programme, particularly if previous shopping history and behaviour is to be taken into consideration.

Payment Options

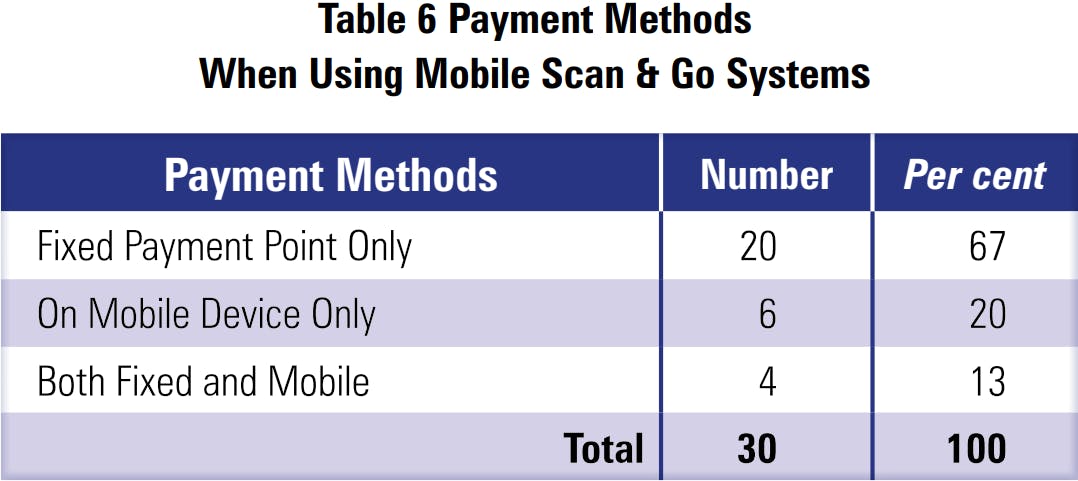

Respondents using both Scan & Go and Mobile SCO were also asked about how users could make payment at the end of their shopping journey.

Scan & Go

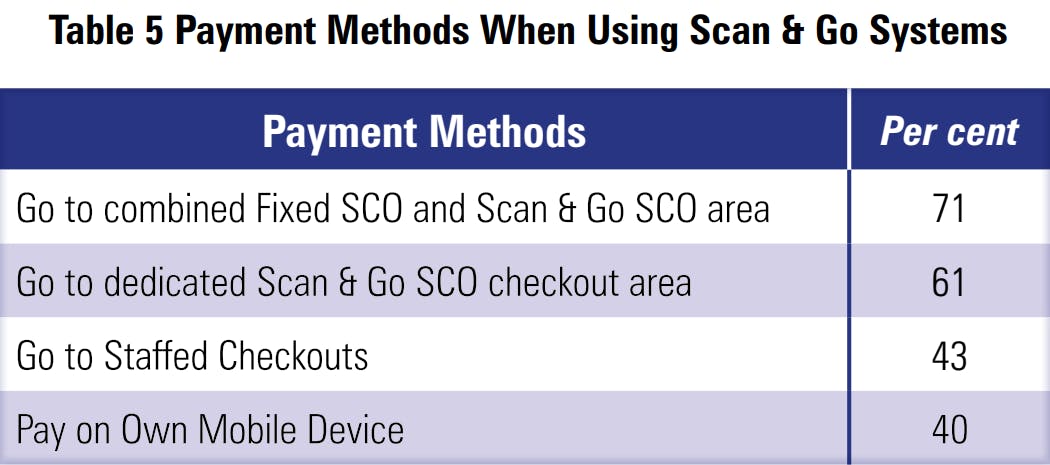

Table 5 summarises the various approaches provided by retailers for their Scan & Go users – respondents could choose more than one option.

The most common option was to provide users with options to pay at a combined Fixed SCO and Scan & Go payment area (71%). Some 61% stated that they offered an exclusive area just for Scan & Go users while two in five enabled them to pay at a staffed checkout (43%). Interestingly, nearly the same number also said that they offered users the option to pay via their mobile device, presumably utilising some form of linked company App (40%).

Further analysis showed that 62% of Scan & Go retailers offered more than one way to pay; Most frequently offered was a combined Fixed SCO/Scan & Go area and the option to use a staffed checkout (24%). Just 10% of respondents offered all 4 options to consumers.

Mobile SCO

In terms of Mobile SCO, three options were available for this type of technology: require users to go to a fixed point to make payment; enable them to pay on their device anywhere in the store environs; or the option for both (Table 6).

Over two-thirds of respondents offering some form of Mobile SCO required users to go to a fixed point to make their final payment (67%). Just one-fifth allowed users to checkout and pay anywhere in the store (20%) and a small minority provided both options (13%). As discussed above, this type of SCO option is potentially very risky, offering the retailer remarkably few ways to actively control the behaviour of users. As such, requiring users to go to a fixed point for payment would seem sensible given that it offers retailers the opportunity to impose a modicum of risk amplification, not least through the threat of a credible audit check.

Impact of SCO Systems on Retail Losses

The second part of the global survey of retailers was interested in understanding how respondents viewed the impact various types of SCO systems were having upon retail losses. The survey focussed upon three areas. First, estimates of the extent to which SCO losses were generated by malicious activity – users looking to abuse the system for their own benefit, such as non-scanning some or all items, switching or mis-scanning items, usually to receive more expensive items at lower prices, and exiting stores without paying for anything (walkaways19). In addition, respondents were asked whether their estimates were based upon any form of inhouse validation research. Secondly, the survey asked about the extent to which retailers thought the problem of SCO-related losses was getter better or worse. Finally, respondents were asked to estimate what proportion of all their in-store losses were a consequence of their SCO systems, and whether they had carried out any research to validate this number.

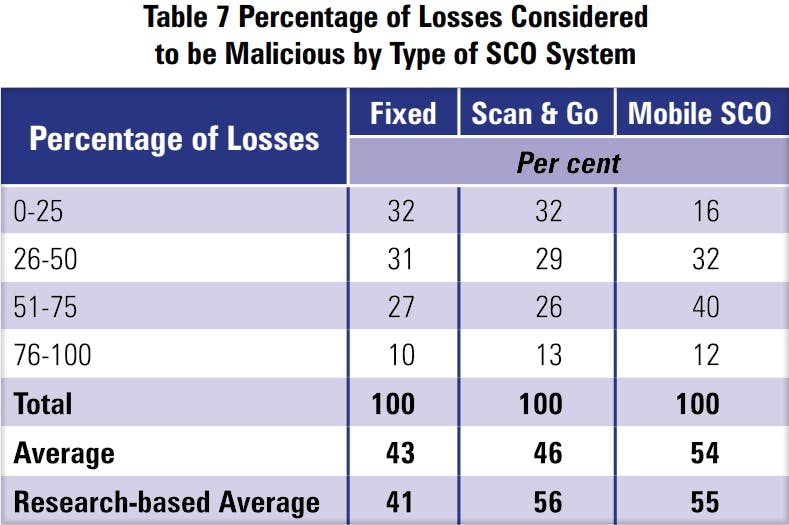

Malicious Losses by Type of SCO

Table 7 provides a summary for the three most common forms of SCO system covered by this survey: Fixed, Scan & Go, and Mobile SCO. For each type, estimates have been grouped into quartiles together with an overall average and an average from only those respondents that stated they had carried validatory research.

In terms of Fixed SCO, the most common response for the percentage of losses that were due to malicious behaviour were between 26-50%. However, a significant proportion (37%) believed it was above 50%. For Scan & Go, a similar picture emerged: the largest single proportion of responses believed that malicious losses were between 0-25%, but 39% thought it was above 50%. Mobile SCO produced the highest estimate for malicious losses – 52% of respondents believed that more than one-half of all losses relating to this technology were malicious.

The overall averages reflect this trend. When all responses are combined, 43% of Fixed SCO losses are believed to be caused by malicious behaviour, 46% of Scan & Go and more than one half of all Mobile losses (54%). When the data from only those respondents that claimed they had carried out research on this issue is analysed (32% for Fixed; 10% for Scan & Go, and 8% for Mobile), the overall average for Fixed SCO is similar but slightly lower (41%), significantly higher for Scan & Go (56%) and virtually the same for Mobile (55%). When all forms of SCO were combined, malicious forms of loss were estimated to account for 48% of all SCO-related losses.

This data is interesting for at least two reasons. First, if the research-based averages are more accurate, then for Fixed SCO, most losses are regarded as non-malicious – system, product, and user-driven errors account for most losses. Secondly, for both Scan & Go and Mobile, most losses are regarded as being malicious in nature – users taking advantage of the known theft opportunities that both these systems offer. Previous research has highlighted the risks associated with these systems and this data goes someway to validating this view20.

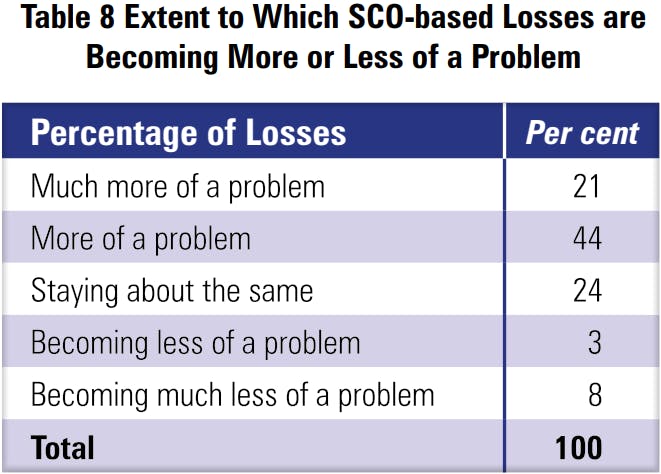

Overall Impact on Losses

All respondents were then asked to consider the extent to which the problem of SCO-related losses was becoming more or less of a problem (Table 8).

The predominate view of respondents was that the problem of SCO-related losses was becoming more of a problem – two-thirds were of this view (65%), with one-fifth believing it was much more of a problem. In contrast, just one in nine thought it was becoming less of a problem (11%), with the remainder (24%) thinking that it was staying about the same. These views were consistent across type of retailer, but there was a significant difference by region21. North American respondents believed that the problem was getting much worse compared with other respondents – 91% of North Americans thought it was getting worse while 54% and 56% of European and Australasian respectively were of this view.

This growing concern could be due to a number of factors, including: a larger proportion of transactions being processed through SCO; systems being deployed into riskier retail environments; new forms of SCO being deployed that are viewed as presenting a greater risk (such as Mobile SCO with the option to pay anywhere in the store); growing user awareness of the various ways in which SCO systems can be abused; declining confidence in the capability of existing SCO control interventions; and better measurement/visibility of the SCO problem.

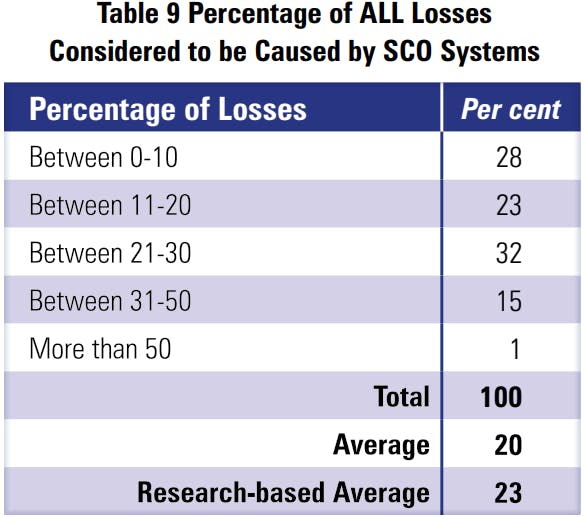

Respondents were also asked to estimate what proportion of their businesses total unknown store losses (shrinkage22), were due to their SCO systems (Table 9).

The largest proportion of responses (32%) considered SCO to account for between 21-30% of all unknown store losses, followed by 28% of respondents who thought it was lower – between 0-10% of store losses. Overall, the estimate for all respondents was 20% of unknown store losses (shrinkage) were due to SCO systems. As with earlier data in this section, respondents were also asked whether they had carried out any research to validate this number. One-third stated that they had (32%) and when only their data was analysed, the overall average increased to 23%. No statistically significant differences were found by geographic region nor type of retailer.

While based upon respondent perception rather than hard evidence, the data is roughly in line with earlier ECR research that showed that SCO systems do generate considerable losses for the retailers deploying them – the losses are real and profound – between one-fifth and nearly one-quarter of all unknown store losses.

Controlling SCO-related Losses

The final section of this Report focuses upon the ways in which respondents are trying to manage and control the risks associated with the SCO systems they are operating, both in terms of what is currently deployed and what is being trialled or planned soon. Data is presented for each of the three main types of SCO under consideration in this Report: Fixed SCO, Scan & Go, and Mobile SCO.

Fixed Self-checkout

Use of Interventions

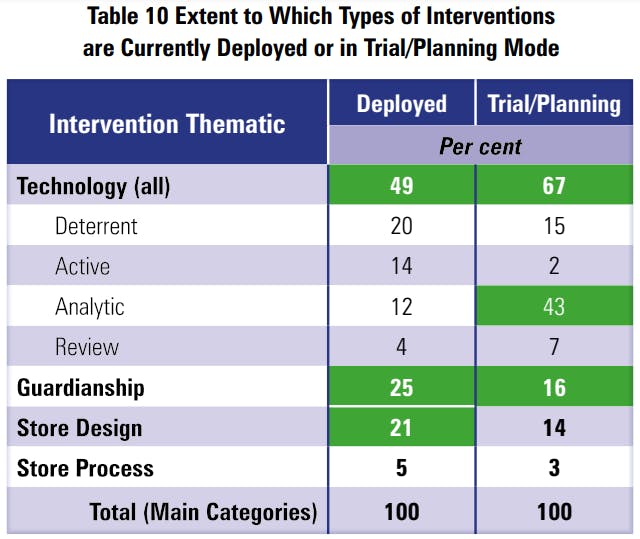

The 2018 ECR report on measuring the losses associated with SCO identified four thematic approaches to the control of Fixed SCO systems: Guardianship, Technology, Process and Design23. Within these overall categories, through preliminary discussions with retailers, intervention suppliers and an extensive literature review, 16 types of intervention were identified. Respondents were asked to review the extent to which they were currently using or planning to utilise these interventions in their organisations. Table 10 provides an overview based upon the four thematic areas comparing current deployment with those on trial or in planning mode.

As can be seen, the most frequently deployed type of interventions is those based upon some form of Technology (49%), be that Deterrent (such as video displays), Active (such as product weight checking), Analytic (such as non-scanning alerts), and Review (POS overlay on video). The next most frequent form of intervention deployment is Guardianship (25%) (such as enhanced staff training) followed by Store Design (21%) (such as using a Corral layout) and then Store Process (5%) (such as closing Fixed SCO machines at off-peak times).

A different picture emerges when consideration is given to the different types of intervention currently being trialled or planned. While the overall order of prioritisation remains the same, the most significant difference is in the extent to which analytic-based technologies feature – 43% of all interventions are of this type. It could be that other interventions appear less frequently because of already being deployed, but the data clearly point towards a significant trend towards retailers utilising this type of intervention in the future.

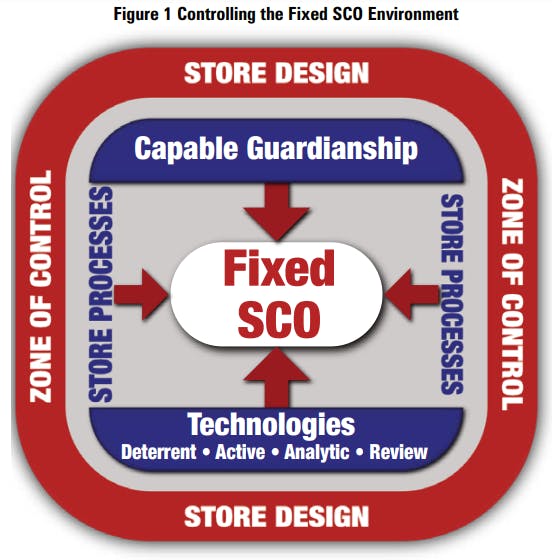

Figure 1 provides a general overview of how retailers are approaching the control and management of Fixed SCO technologies, highlighting the important interplay between Guardianship, Technologies, Design and Processes.

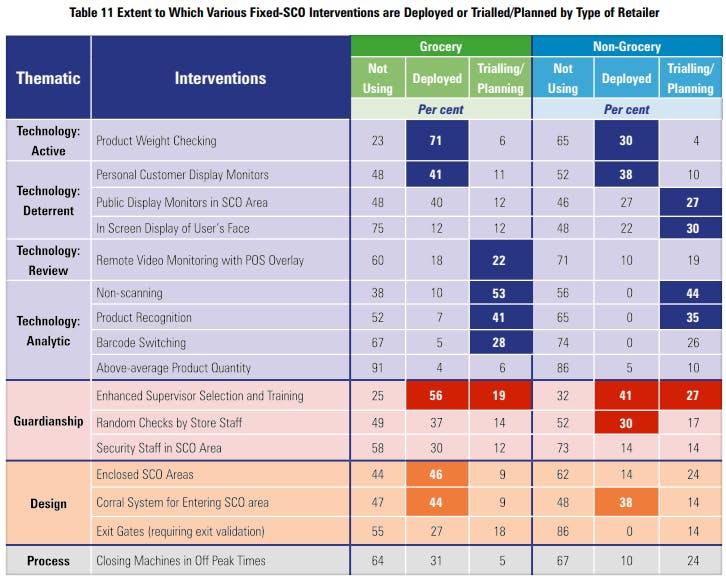

The next set of data provides more detail on the extent to which specific types of intervention are being used and how this varies between Grocery and Non-grocery retailers (Table 11). A full description of each of the interventions can be found in Appendix II.

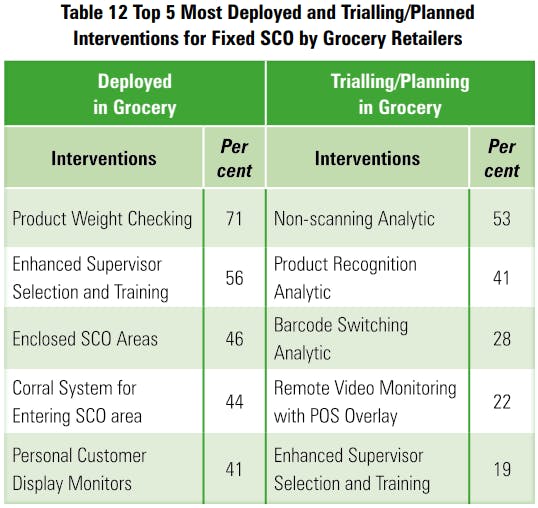

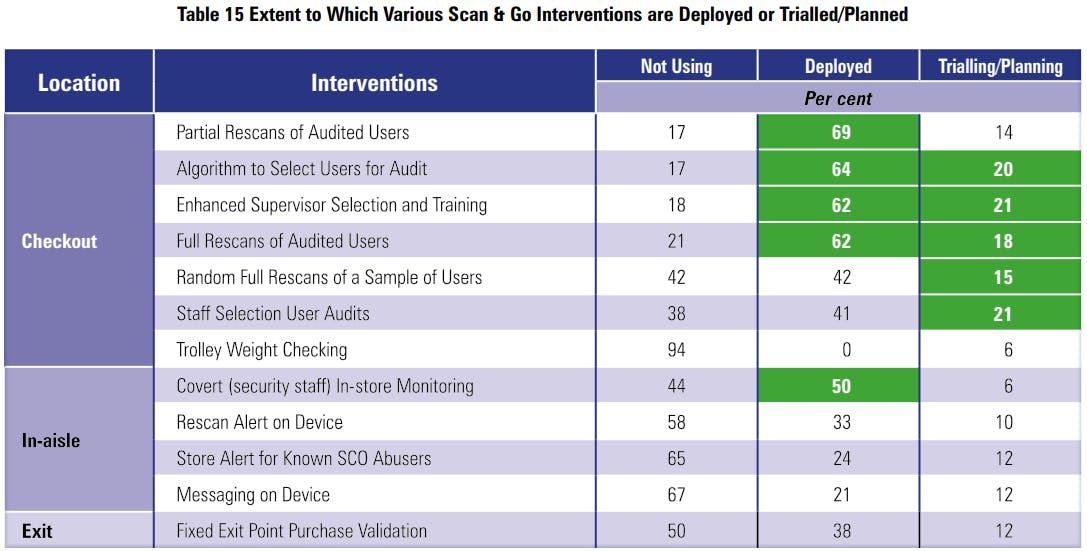

For Grocery retailers, the most deployed intervention was product weight checking (71%), perhaps not surprising given that it is probably one of the most longstanding and established approaches to try and restrict non-scanning by users. The next most frequently used intervention was some form of enhanced selection and training for SCO supervisors (56%), followed by two forms of Design intervention: enclosed SCO areas (46%) and some form of Corral system for managing the movement of customers (44%). The use of different types of video monitors was also relatively common: 41% of Grocery respondents were using Personal Display Monitors at each Fixed SCO machine and 40% were utilising Public Display Monitors in their SCO areas. The least currently deployed interventions were various types of Analytic-based approaches (such as nonscanning, product recognition and barcode switching analytics).

A very similar picture was found with the use of interventions by Non-grocery retailers, although the rank order was slightly different and there was a lower overall level of utilisation. The most common approach was enhanced selection and training for SCO supervisors (41%) followed using a Corral design (38%), Personal Display Monitors (38%), random checks by SCO supervisors (30%), and product weight checking (30%). Hardly any were currently deploying some form of technology-based analytics discussed above (just 5% had deployed an above average product number analytic24).

As detailed earlier, a different picture emerged with regards to the interventions that were being trialled or were planning to be used soon. For both Grocery and Non-grocery retailers the emphasis is clearly shifting to trialling and testing of a range of analytics, particularly those driven by some form video-based intervention. More than one-half of Grocery retailers stated that they were now in the process of trialling or planning to use analytics to try and remedy the issue of customers not scanning some or all their products (53%). The next most frequently cited analytic was product recognition (for both Grocery (41%) and Non-grocery (35%)). Grocery retailers were also focussed upon understanding how analytics could be used to identify incidents of barcode switching – something that many retailers believe is a growing concern. Beyond analytics, both types of retail respondents were also taking time to consider how they could improve the selection and training of SCO supervisors.

For the most part, this data points to a growing trend by Grocery retailers employing Fixed SCO systems to invest in a twin track approach based upon enhanced Guardianship and Analytics to supplement their existing investments in store design, store processes and various forms of technological intervention. For Non-grocers a broader ranging strategy seems apparent, cutting across the four thematic areas although this may be a function of the relative immaturity of SCO utilisation in this part of retailing – a process of catching up with the already established approaches found in Grocery

Tables 12 and 13 provide a summary of the most deployed and trialled/planned interventions by type of retail.

Perceived Value

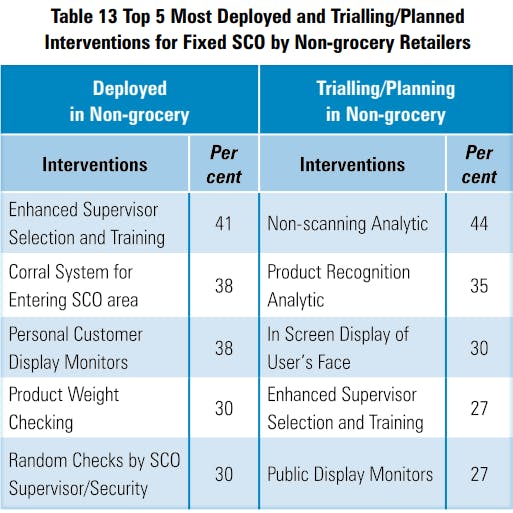

Retailers were also asked to select the intervention that they thought was having the greatest impact on managing and controlling SCO-related losses. This is not an easy question to answer and as such many respondents declined to make a choice. It is also important to note that these selections are not necessarily based upon any verifiable evaluation data – they are simply the relatively informed views of those taking part in this survey. The results from those offering a view are summarised in Table 14.

For both Grocery and Non-grocery respondents, product weight checking was scored the highest of all interventions. This is perhaps not surprising given that it is also an intervention which has probably been used over the longest period and likely to have been subject to more retail evaluations. Both groups also agreed that improving the selection and training of SCO supervisors was their second choice for overall effectiveness, followed by the emerging technology focussed upon non-scanning alert analytics. It was possible to identify three more interventions that were deemed effective by Grocery retailers: random checks by SCO supervisors, exit gates in SCO areas that require some form of proof of purchase to activate, and finally Personal Customer Display Monitors at Fixed SCO machines.

Scan & Go

Use of Interventions

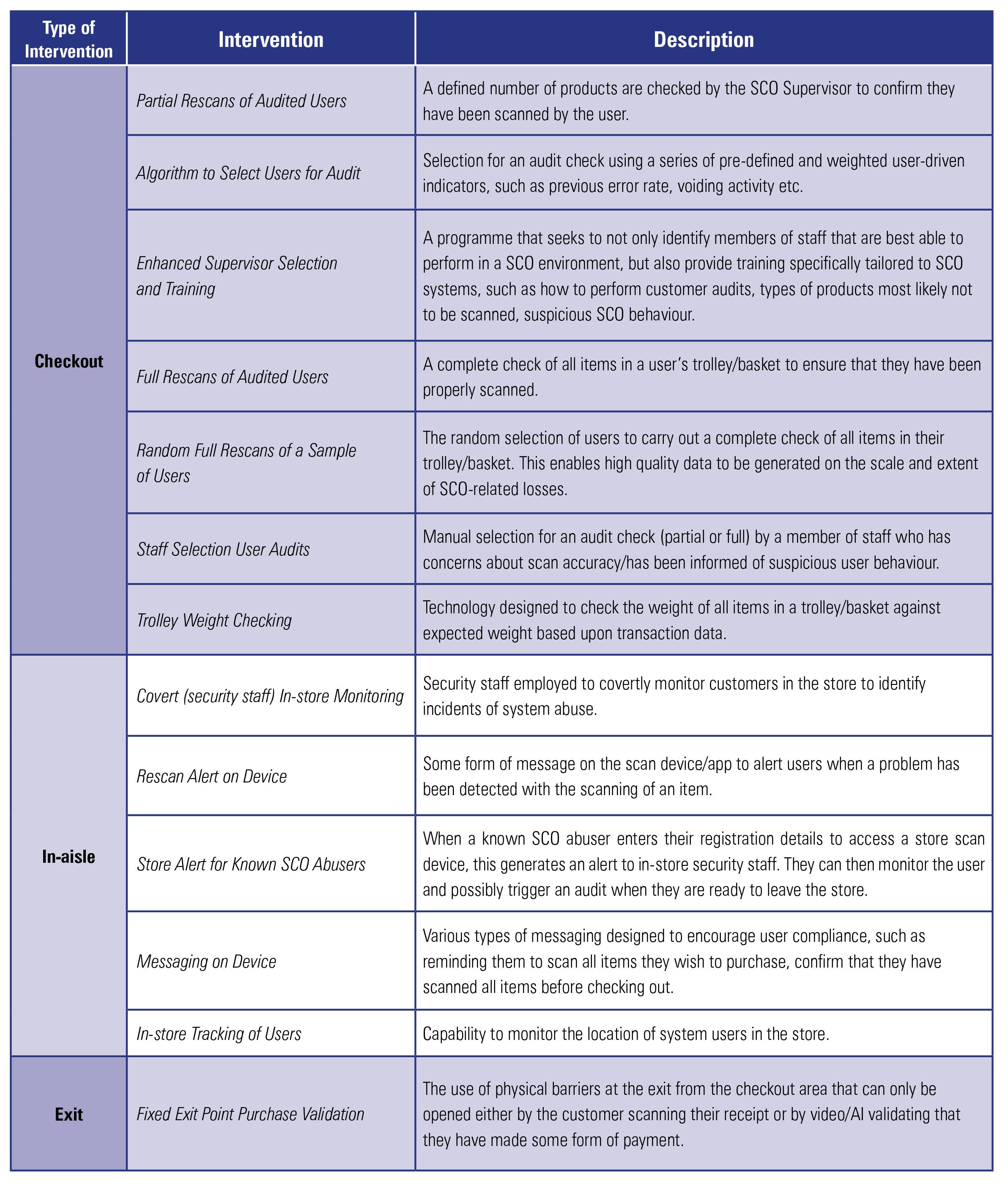

Respondents who had deployed or were trialling Scan & Go systems were asked to indicate the types of interventions they were utilising to try and manage and control the losses associated with them. Earlier ECR research has described how the operation of Scan & Go imposes restrictions upon where and how interventions can be applied25. It identified four areas where it might be possible: at the point of registration/ entrance to the store, while the user is in the shopping aisle, at the point of checkout, and when the user is exiting the store. The issue of user registration has been covered earlier in this report and so the interventions under consideration were applicable to the remaining three areas: aisles; checkouts; and exits.

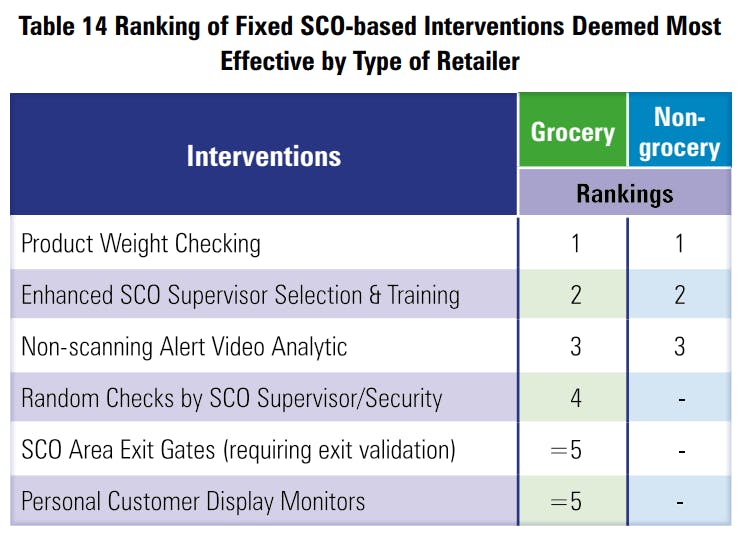

Detailed in Table 15 is the extent to which respondents had deployed or were trialling or planning to use 12 Scan & Go-focussed interventions (a description of each can be found in Appendix II). Because of the relatively small number of Non-grocery respondents using Scan & Go, it was not appropriate to compare their responses against those of Grocery respondents.

As can be seen, the checkout process currently provides the greatest number of possible interventions (7 out of 12). Within this area, partial rescans of audited users was the most frequently deployed, with over two-thirds of retailers using Scan & Go implementing this intervention (69%). In support of this strategy, almost the same number were employing an algorithm to select customers for audit (64%). A significant majority of respondents had also invested in carrying out full audits of selected users as well (62%). Undertaking these audits and achieving a good outcome for both the retailer and consumer is challenging for the staff employed to perform them, and so it was perhaps not surprising that nearly two-thirds stated that they had invested in enhanced selection and training for these staff (62%)26.

The use of approaches focussed upon when customers were using the Scan & Go system in the aisle were less common although one-half said they were using covert staff to monitor customers (50%), with 24% suggesting that they had some form of system in place to alert store staff to the arrival of a known SCO abuser27. In addition, between onethird and one-fifth had deployed forms of messaging on the handheld device provided to users – rescan alerts (33%) and ‘reminder’ messages (21%).

Finally, a significant proportion of respondents stated that they had installed some form of exit validation system (38%), requiring users to scan a purchase receipt (paper or electronic) to enable them to open the exit barriers.

In terms of interventions currently being trialled or planned to be used soon, the top five were all based around the checkout area (summarised in Table 16). Of those, four related to how the audit of customers was delivered – introducing some form of algorithm to select users (20%), enabling staff to have the option to select users they view as potentially suspicious (21%), making use of full rescan audits (18%), and finally bringing in a programme to carry out random full rescans (15%). This last option is often viewed as the most reliable way in which retailers can begin to get accurate data on the scale and extent of Scan & Go abuse by users, although it is potentially a driver of consumer inconvenience as well28. As with Fixed SCO developments, improving the selection and training of staff with responsibility for managing and controlling Scan & Go was also an approach frequently cited by respondents as something they were currently piloting or planning to use soon (21%).

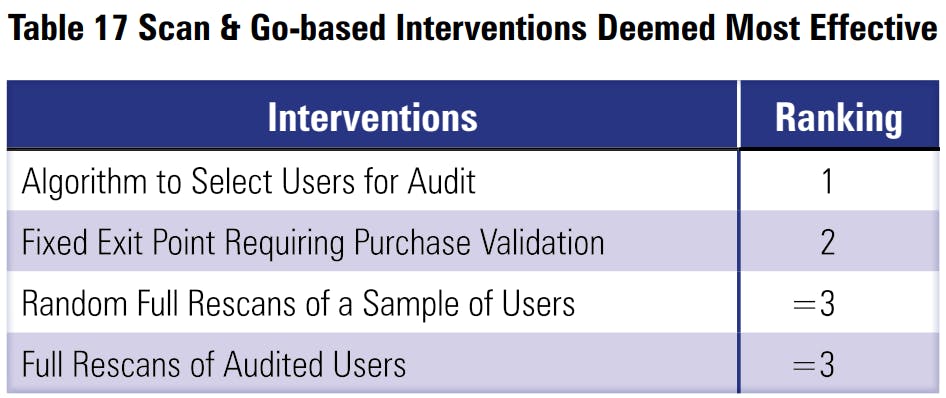

Perceived Value

Respondents were also asked to choose which of the interventions they were currently using or trialling they regarded as the most effective (Table 17). It should be noted that only a small number of respondents felt able to complete this question (n=29).

By some considerable margin, respondents were of the view that deploying an algorithm to select users for an audit was the most effective intervention currently available to them. This was then followed by introducing some form of exit control that required users to scan a purchase receipt to open the exit barriers. The third most common options were those relating to full audits – bringing them in and using them for generating better data on Scan & Go losses.

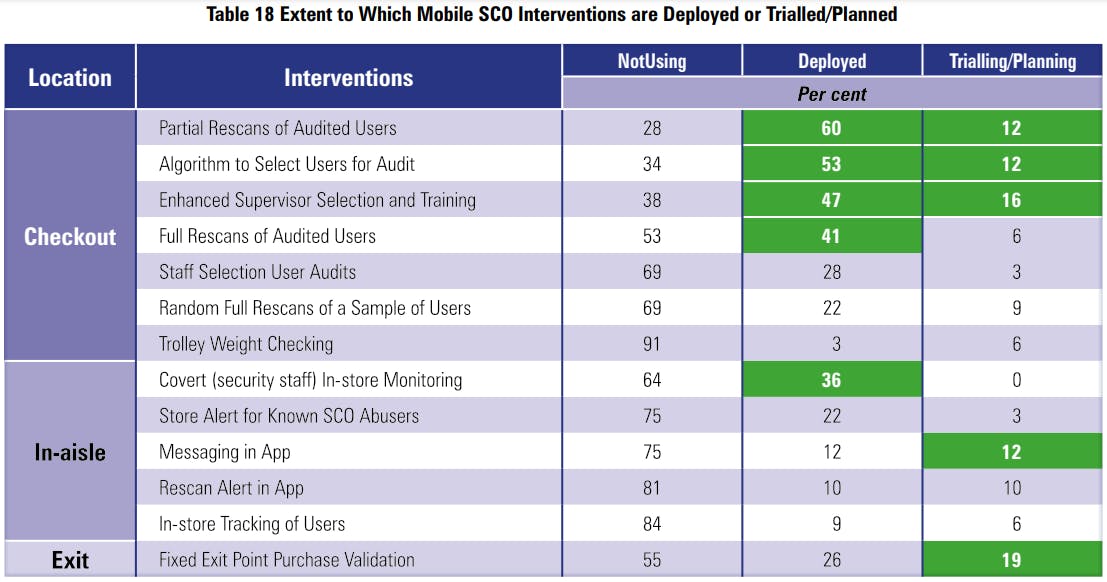

Mobile SCO

Use of Interventions

Respondents who had currently deployed or were trialling some form of Mobile SCO system were also asked which interventions they had either deployed or were trialling or planning to use soon (Table 18).

A very similar picture to that found with Scan & Go was found when it came to the types of interventions that had been deployed. Once again, those focussed upon the checkout area were the most adopted: partial rescans (60%), the utilisation of algorithms to select users for a check (53%), full rescans (41%) and enhanced selection and training of supervisors with responsibility for these systems (47%). Slightly over one in three (36%) had deployed covert security staff to monitor users and just over one-quarter (26%) had introduced some form of exit validation system for Mobile SCO users.

In terms of interventions that were currently being trialled or in the planning phase, the most common was the use of an exit point validation process (19%). This is perhaps understandable given the nature of a Mobile SCO system and especially so if users are given the opportunity to pay anywhere in the store. Imposing any form of control in these circumstances is extremely difficult and so the introduction of an exit validation process would seem an understandable strategy to adopt although it may prove challenging to deliver in some retail environments.

Like with the Scan and Go systems, the utilisation of audits was also dominant, such as using an algorithm to select users for a check (12%) and bringing in some form of partial rescan process (12%). In addition, there was evidence that some respondents were also looking to make use of their Mobile App interface to send messages to users to reinforce appropriate behaviour, such as reminding them of the importance of scanning all items (12%). Finally, as with all the other forms of SCO system in this report, respondents were keen to prioritise improvements in the selection and training of those tasked with managing and controlling them (16%). The most deployed interventions together with those being trialled or planned for future use are summarised in Table 19.

Perceived Value

As with the other SCO systems, those using or trialling Mobile SCO were asked to select the intervention that they considered to be the most effective (Table 20). Once again, this data should be treated with some caution given the relatively few respondents that felt able to offer an opinion (n=23).

The results were very similar to those offered by users of Scan & Go systems. The most effective was thought to be the use of an algorithm to select users for an audit check. This was followed by using some form of exit validation process, such as scanning a receipt to enable exit barriers to open. In contrast to Scan & Go users, the third most regarded intervention for Mobile SCO was the use of partial rescans of audited users followed by random full rescans for a sample of users. Overall, it is interesting to note the dominance of the checkout and exit zones as points at which those deploying Mobile SCO believe they can impose control upon this system.

Concluding Comments

This survey of global retailers utilising various forms of SCO technologies has drawn a spotlight upon a number of key issues and developments relating to them, not least the types of systems most commonly used, the way in which they are organised, the degree of concern retailers have about their impact on losses, and perhaps most importantly of all, the various ways in which interventions are being applied and pursued in order to better manage and control SCO-related problems.

Utilisation of SCO

As the data shows, Fixed SCO is by far the most dominant form of SCO technology currently being used by all forms of retailing – all Grocery and most Non-grocery respondents had invested in this approach. In many respects, this is understandable – it is a technology that closely resembles previously staffed iterations of checkouts, offering some degree of familiarity to the consumer. It also provides retailers with a way to significantly reduce their labour costs – one member of staff can now supervise the transactions that would have required perhaps 5-10 staff to process in a pre-SCO world. In addition, its design and operation provide the retailer with several opportunities for routinised control and monitoring – supervisory staff can be on hand, control systems can be integrated into the hardware, and the retail environment can be shaped to amplify risk and modify consumer behaviour. In terms of the spectrum of SCO systems available, Fixed SCO probably provides the retailer with an operating environment that offers the best range of opportunities for control.

The survey also showed the extent to which other forms of SCO were being used as well, albeit at lower levels of penetration. Scan & Go is certainly becoming relatively commonplace within Grocery – two-thirds of respondents representing this sector stated that it was either already in use or at the trial/planning stage. Within Non-grocery, its use was much less common, with Mobile SCO being a more preferred option. Both Scan & Go and Mobile SCO have attractions: for retailers, they are a relatively cheap investment option compared with Fixed SCO. For consumers, they offer greater flexibility in how they can scan and pay for their goods – Scan & Go offering greater convenience for larger transactions, such as being able to ‘shop to bag’ to speed up the checkout process, while Mobile SCO can make the purchasing of a few items a superfast almost friction-free endeavour.

But both offer considerable challenges in their control and management – by their very nature, they give the user considerable discretion in how they are used and abused, particularly compared with Fixed SCO. The opportunities for amplifying risk are much more limited, with the transaction end-point a defining moment for imposing some form of control. However, for those retailers opting to enable their Mobile SCO users to checkout out anywhere in the store, very often this opportunity for risk amplification is lost, making the control of this type of SCO hugely problematic.

The two other types of SCO under consideration in this study: Whole Store SCO and Smart Trollies, were much less evident although a reasonable minority of Grocery respondents were embarking on a learning curve to understand what value they may bring in the future. Whole Store SCO is a particularly interesting development – while Amazon Go has long captured the headlines around this type of SCO, several Grocery retailers are now actively carrying out trials of similar types of system. To date, little is publicly known about the reliability of these systems nor their cost. Consumer feedback would seem to be highly positive, indeed what is there not to like about a retail store that simply allows you to pick up products and walk away without having to engage in any form of checkout transaction? In this context, the concept of most forms of shop theft may almost become redundant – if the Whole Store SCO system has not registered that you have taken a product and left the store without paying for it, who is liable – you the consumer, the retailer employing the technology, or indeed the technology provider? No doubt as this technology becomes more widespread and more evaluations are carried out, then these and other questions will be answered.

Concerns about SCO

There are few significant retail business choices that have no downsides – moving to open display of products in the early part of the 20th Century brought participating retailers a significant growth in retail sales, but it also spawned a dramatic increase in shop theft as well. Getting rid of routine till/cash register audits saved money on staff costs but it also facilitated an increase in cash theft by staff. The same is true for the introduction and use of SCO. In the early days of the latest wave of SCO use, many of the technology providers tried to argue that it was a win, win, win for the retailer – lower labour costs, happier customers, and lower levels of unknown loss (shrinkage) – the proverbial ‘no brainer’ when it came to business choices. Of course, the reality has proved to be somewhat different – while the labour savings for many have been profound, the road to customer happiness has been somewhat rockier and, as the seminal ECR research paper on the scale and extent of losses associated with SCO found, retail losses have gone in the opposite direction to that claimed by the SCO providers29.

For those tasked with managing retail losses, early concerns about the extent to which SCO systems provide increased opportunities for both malicious and non-malicious forms of loss, and that these opportunities are now available to a much larger proportion of the shopper population, were well-founded. The current research captured this ongoing concern about the impact of SCO systems on retail losses – two-thirds of respondents thought it was becoming more of a problem to their businesses – only 1 in 9 were of the view it was becoming less of a problem.

This growing concern is likely driven by the ongoing growth in the use of SCO systems – numerous respondents participating in this research commented on their organisation’s aspirations to drive 80% or more of their transactions through them in the next few years. In addition, a generation of shoppers have now become extremely familiar with this technology, likely moving from being wary and risk-averse to seasoned and opportunity-aware users – the archetypal self-scan defence of: ‘I thought I had scanned it’, now becoming engrained in the shopper psyche30.

This concern was reflected in estimates of the amount of store losses that may be accounted for by SCO systems. The survey found that perhaps between one-fifth and one-quarter of all store losses may now be due to SCO, with some respondents believing it could be even higher. Of course, many of the organisations investing in this technology may well have enjoyed a labour cost-reduction dividend to offset this increase in retail losses. But past savings can soon be forgotten, and so inflated unknown losses are likely to draw increased attention towards how these systems can be better managed and controlled to ensure that they remain a business choice that continues to make a positive contribution to profitability.

Investing in Interventions

Earlier ECR research reviewed the various ways in which different types of SCO system might not only generate retail losses, but also how they could potentially be better managed and controlled31. This study provides a more detailed review of the different approaches that have been deployed or are in the trail/planning phase. The research clearly highlights the need for significantly different approaches depending upon the type of SCO in operation – the control toolbox for Fixed SCO is quite different to the one used for Scan & Go and Mobile SCO systems. It also shows how approaches are likely to change in the future.

For Fixed SCO at the moment, a picture emerges of a multi-layered strategy, utilising elements of Guardianship (capable SCO supervisors), Technologies (weight checking, public and personal display screens) Design (use of Corrals, entrance and exit controls) and Process (controlling number of open checkouts). For Scan & Go and Mobile SCO, the emphasis is much more upon utilising controls at different stages in the shopper journey, primarily at the point of payment, but also focussing upon the point of registration/entry to the store, while the user is selecting products, and when they are exiting the store. Presently, the use of some form of audit check at the point of payment, often driven by a user selection algorithm, is the dominant strategy for these types of SCO.

Looking into the near future, the data clearly points to this multi-layered strategy for Fixed SCO being supplemented by a twin-track approach – growing investment in a range of analytic-based technologies capable of identifying malicious and non-malicious behaviour, such as non-scanning of product, mis-scanning (product switching), barcode switching and unusual product scanning (repetitive same item/low value item scanning), and investment in the selection and training of SCO supervisors. For Scan & Go and Mobile SCO the data points largely towards more of the same (utilising audits and algorithms) and an emphasis upon better Guardianship to deliver this strategy. To understand this trend further, future reports from this study will focus upon developing a better understanding of the capability of some of the interventions being used to control both Fixed and Scan & Go/Mobile SCO and the role and experiences of SCO supervisors.

The Future of Self-Checkout

This study has focused upon developing a better understanding of the use and control of a range of SCO technologies being used by retailers around the world. It seems clear that it is now, and will continue to be, a significant and growing part of the retail environment. It is highly likely for the foreseeable future that Fixed SCO will remain the dominant technology, supplemented by growing use of Scan & Go and perhaps more limited use of Mobile SCO. At this stage, it is hard to predict the extent to which Whole Store SCO systems will grow in use – it has long been stated that Amazon will open 3,000 of their Go stores around the world, but it has taken them four years to open around about 30 stores thus far, making the target currently a 400-year proposition! But several retailers are now opening trial stores, and as the technology becomes more reliable, scalable, and cost-effective, then it may become a more established part of the retail environment.

Many retailers have developed a considerable amount of experience in managing various types of SCO systems and this can now be seen in the breadth of interventions and approaches being adopted to better control them. However, there is still a real need for retailers to both better understand how they are affected by SCO-related losses – where, how, and why they are happening – and undertake rigorous and robust evaluations of the interventions they are employing – accurately assessing their Return on Investment and the context within which they can work most effectively. It is only then that SCO interventions might be relabelled from ‘interventions’ to ‘solutions’!

As with much in retailing, managing SCO effectively will be about balancing often competing priorities – improving customer service and convenience against limiting retail losses. Certainly, some of the emerging approaches can address this issue – improving Guardianship being a good example of something that can combine the two, as can some types of Analytics that can reduce the rate of false positives, improving the checkout experience. To achieve this though, it will require both a cross-functional approach and a strong dose of organizational reality that the impact of any business choices needs to take account of not only the benefits but also the negatives that may arise. If not, then like many retailers currently using SCO, those tasked with managing retail losses will be constantly playing catch up.

Disclaimer

The research for this report was supported by the ECR Retail Loss Group with an additional research grant from Everseen Ltd32. The document is intended for general information only and is based upon a review of the available literature together with primary research undertaken with retail companies and technology providers across the globe. Companies or individuals following any actions described herein do so entirely at their own risk and are advised to take professional advice regarding their specific needs and requirements prior to taking any actions resulting from anything contained in this report. Companies are responsible for assuring themselves that they comply with all relevant laws and regulations including those relating to intellectual property rights, data protection and competition laws or regulations. The images used in this document do not necessarily reflect the companies taking part in this research.

© March 2022, all rights reserved.

About the Author

Adrian Beck is an Emeritus Professor at the University of Leicester, UK. Over the last 30 years, his research work has focused on helping retailers better understand the impact of loss and how it can be more effectively managed. He is currently an academic advisor to the ECR Retail Loss Group and works with several companies and representative bodies around the world. He is extremely grateful to all those retailers and industry experts who agreed to take part in this research – their time and patience was very much appreciated.

To contact the author: bna@le.ac.uk

About the ECR Retail Loss Group

The Group is part of ECR Community, a voluntary and collaborative retailer-manufacturer platform with a mission to ‘fulfil consumer wishes better, faster and at less cost’. Over the last 21 years, the Group has acted as an independent think tank focused on creating imaginative new ways to better manage the problems of loss and on-shelf availability across the retail industry. Championing the idea of Sell More and Lose Less, the Group is open to any retailer and manufacturer to join. Its work is supported by research funding provided by Checkpoint Systems, Genetec, Retail Insight, and RGIS.

For further information: www.ecrloss.com.

The research commissioned by the ECR Retail Loss Group is made possible by financial contributions from the following organisations:

Appendix I

Smart Trolley Deployment

Operating Smart Trolley Systems

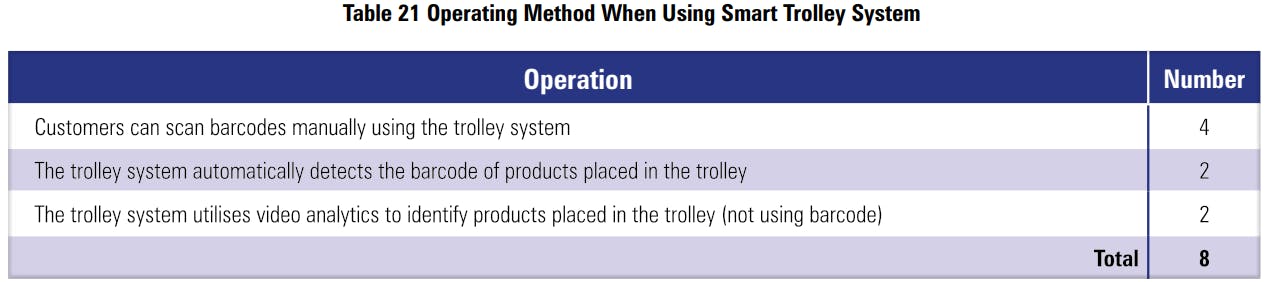

Currently, there are very few retailers that have deployed Smart Trollies into their stores although a number are carrying small scale trials to review their capability, value for money and customer experience. Presently, various types of Smart Trolley are being offered to retailers, with differing operating processes and methods of payment. The current survey sought to understand how these systems operated and how a customer went about paying for their shopping. Because this is a relatively new form of SCO option with relatively few retailers using it, questions were kept to a minimum. The first question related to how the Smart Trolley operated (Table 21) – it is based upon responses from just 8 retailers and so the data has not been converted into percentages.

As can be seen, four of the systems being deployed/trialled were based upon the consumer actively using some form of barcode scanning device attached to the trolley. The second option, which was being used by two retailers was a Smart Trolley that was designed to automatically detect the barcode of products placed inside the trolley. The third system under consideration by two retailers utilised video analytics to identify products being placed inside the trolley without recourse to barcode scanning.

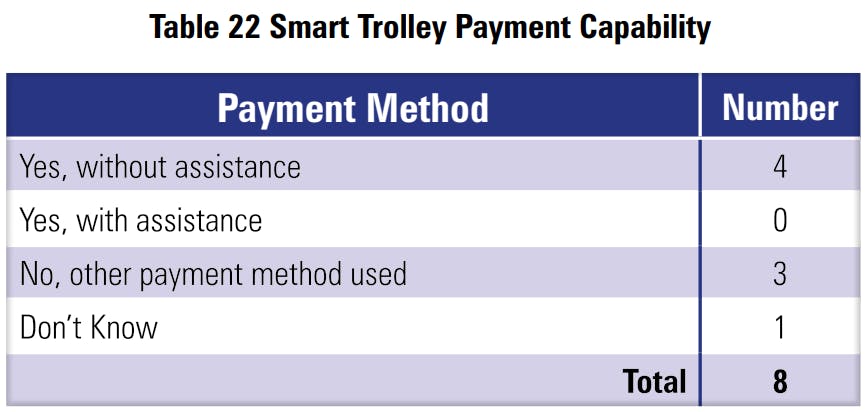

Payment

Respondents were then asked about how a Smart Trolley user could make payment (Table 22).

Four of the retailers stated that their system enabled the Smart Trolley user to make payment without any assistance from store staff, via the trolley itself. Of the remainder, one was not sure how it worked while the other three stated that payment had to be made via another system beyond that incorporated into the Smart Trolley. No doubt as more retailers undertake trials with these ‘Smart Trolleys’ more will be learnt about their efficacy and whether consumers consider them to be a viable alternative to the other ways in which they can shop and checkout in retail stores.

Appendix II

LIST of SCO Intervention

Fixed SCO Interventions

Scan & Go/Mobile SCO Interventions

NOTES

- There are various terms used to describe technologies that enable the consumer to scan and pay for the products they wish to purchase in retail stores. Some refer to them as Assisted Self-checkouts, others call them Self-scanning Checkouts, Self-service Checkouts (SSC), Self-checkout Systems (SCS) and Scan and Payment Systems (SPS). For the sake of brevity, throughout this report the acronym SCO will be used (Self-CheckOut) to refer to the range of technologies that enable retail customers to scan and pay for items largely independent from the assistance of retail staff. A description of the main types of SCO technologies under consideration in this report is provided in the Methodology section.

- Beck A. (2018a) Self-checkout in Retail: Measuring the Loss, Brussels: ECR Community Shrinkage and OSA Group; Link to Report.

- Design Against Crime Research Centre (2020) Self-checkout Loss: Increasing Participation and Scan Accuracy Through Design, Brussels: ECR Retail Loss Group; Link to Report.

- For a review of the development of SCO technologies in retailing see: Beck, A. (2018b) The Rise of Selfcheckout in Retailing: Understanding the Risk and Managing the Problem, Leicester: Erudite Publishing; Amazon Link.

- Various industry representatives sharing their views via the ECR Retail Loss sub-group focussed upon Customer Checkout have described how some of their store formats now routinely have a significant proportion of their transactions processed through some form of SCO system.

- In some markets, such as the US, these machines are often referred to as ‘robots’.

- See for instance: Mail Online (2012) ‘Shopping is getting MORE stressful! Self-service checkouts ranked as more infuriating than cold callers and junk mail’, 6 November, article link; Daily Mail (2015) Your fury over self-service tills: The Mail’s crusade against those maddening automatic checkouts has REALLY struck a nerve. Now readers vent their frustration – and store bosses should take note, 18 May, article link; Webb, A. (2013) ‘10 reasons why I hate supermarket self-service checkouts’, Love Food, 13 May, article link; Ryan. P. (2015) ‘Why I hate supermarket self-service checkouts’, Which? Conversation, 18 May, article link; Cosslett, R. (2014) ‘The machines have turned Britain into a nation of shoplifters’, The Guardian, 30 January, article link.

- Estimates vary considerably on the overall losses experienced by retailers, not least because there is no agreed industry definition on what constitutes retail loss and how it should be measured and valued: see Beck’s studies on Total Retail Loss for the Retail Industry Leaders association in the US: Link to First Report; Link to Second Report.

- Beck (2018a) op cit.

- There are some examples of retailers removing some or all of their variants of SCO systems, such as Walmart in 2018 (article link) but for the most part, SCO now seems to be an established and growing part of very many retail environments.

- The term ‘intervention’ is used to describe any form of approach, be that changes to the way in which people are used, processes designed, changes to store designs, and technologies developed to reduce the risks from SCO. It is purposefully used rather than the more generic industry term ‘solution’, to recognise that the latter assumes that it already works, when there is usually scant published evidence to support this assertion. The author believes that once an ‘intervention’ has been tested and validated to show it meets the intended objectives, and that the context within which it does this is understood, then it can be regarded as a ‘solution’.

- The remaining two responses came from Indonesia and a respondent that commented for their businesses across the globe.

- As documented later in this report, respondents were also asked about the various types of Fixed SCO they were using, including type of payment accepted, whether there was a belted option for the movement of goods and whether RFID tags could be read.

- See Beck, A. (2021) Utilising RFID in Retailing: Insights on Innovation, Brussels: ECR Retail Loss Group; Link to Report.

- See Beck, A. and Hopkins, M. (2015) Developments in Retail Mobile Scanning Technologies: Understanding the Potential Impact on Shrinkage and Loss Prevention, Leicester: University of Leicester.

- Beck (2018a) op cit.

- Ibid

- See Beck, A. (2016) Amplifying Risk in Retail Stores: The Evidence to Date on Making Shop Thieves Think Twice, Brussels: ECR Community Shrinkage and On-shelf Availability Group; Link to Report.

- The terminology used to describe the various ways in which SCO systems are being abused often varies by type of retailer, research study and technology provider. The 2018 ECR Report on SCO losses established a list of terms and definitions, which are used in this report.

- See Beck (2018a) op cit.

- X2 (4, N=74) = 11.893, p<0.05.

- Respondents were not offered a definition of what the term ‘shrinkage’ meant and so this needs to be taken into consideration when interpreting this result.

- Beck (2018a) op cit.

- This is a Point of Sale-driven analytic that looks to generate an alert when a customer scans the same type of pre-defined item more times than an average shopper would be expected to do. This is to try and identify when customers may be mis-representing cheaper items for other more expensive products. For instance, if an average shopper would typically only purchase two packs of brown onions in any given transaction, those that scan say four of five packs would be considered suspicious and an alert generated for a SCO Supervisor to come and investigate the transaction.

- Beck (2018a) op cit.

- This research did not explore in any detail what ‘enhanced selection and training’ of SCO Supervisors might entail – future parts of this research initiative intend to delve deeper into this issue.

- While the survey did not illicit further information specifically about how any interventions were used by respondents, interviews with retailers using this approach suggested that when a known SCO abuser entered their registration details to access a store scan device, this generated an alert to in-store security staff. They would then monitor the user as they went about their shopping trip and, likely, trigger an audit when they were ready to leave the store to check they had scanned all their items correctly

- All forms of SCO losses are notoriously difficult to identify and assess. The flaw in using partial rescans as a way of measuring the scale and extent of losses has been highlighted in previous ECR research (see Beck (2018a) op cit). By using a well-designed and administered random full audit programme, high quality data can be collected on the losses associated with Scan & Go and Mobile systems, as well as the types of products most likely to be not scanned or misrepresented by users.

- Beck (2018a) op cit.

- For a discussion of how shopper attitudes towards SCO may be changing see: Beck (2018b).

- Beck (2018a) op cit.

- For further information visit: Website Link.

Main office

ECR Community a.s.b.l

Upcoming Meetings

Join Our Mailing List

Subscribe© 2023 ECR Retails Loss. All Rights Reserved|Privacy Policy