Fix Broken Inventory Records to Grow Sales by 11%

Previous ECR Retail Loss research (click here) with a sample of eight retailers revealed that sales could grow by 4-8% when wrong inventory records were corrected and made accurate. In a follow-on study, the academic team looked at just one of those retailers in more depth to reveal new insights and outcomes from fixing wrong records.

This new leg of the work studied data from 11 stores of a major UK grocery retailer with over 24,000 SKUs. The key findings and insights are as follows.

1. Prevalence and Nature of IRI

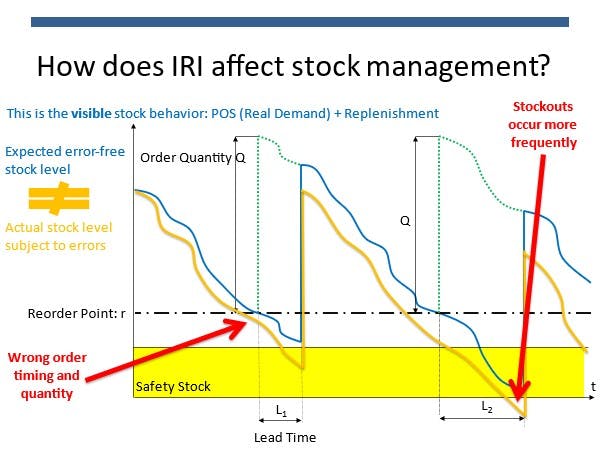

The study finds that approximately 65% of SKUs suffer from Inventory Record Inaccuracy (IRI) with a median discrepancy of +4 units for overreported items and -3 units for underreported ones. It found that negative IRI (where system inventory exceeds actual inventory) is more common and more damaging, as it leads to stockouts and missed sales opportunities.

2. Drivers of IRI

Four main operational factors were identified as significant drivers of IRI:

- Average Inventory Level: Higher stock levels are strongly associated with greater IRI, likely due to increased complexity in shelf management and backroom storage.

- Restocking Frequency: More frequent replenishments correlate with higher IRI, as they introduce more opportunities for errors.

- Perishability: Perishable items are more prone to IRI due to their shorter shelf lives, need for FIFO rotation, and frequent markdowns or removals.

- Promotional Activity: Contrary to expectations, promotional items exhibit lower IRI. This is attributed to the increased scrutiny and operational oversight during promotional periods.

3. Impact of Audits on Sales

A quasi-experimental study comparing two matched stores—one undergoing a full inventory audit and one not—revealed that audits led to an 11% increase in store-wide sales over the following two months. However, this uplift was not uniform:

- Sales Gains Concentrated on Negative IRI Items: Only items with negative IRI saw significant sales increases post-audit. Items with positive IRI or accurate records showed no meaningful change.

4. Strategic Implications for Retailers

- Reframe Audits as Revenue Drivers: Rather than viewing stock audits as a cost, retailers should consider them a strategic tool to boost sales, especially for perishable and high-risk items.

- Targeted Auditing: Full-store audits may not be necessary. Retailers can achieve similar benefits by focusing audits on SKUs with high IRI risk—particularly perishable items and those with frequent restocking.

- Data-Driven Audit Scheduling: Is there an opportunity to use historical IRI patterns and machine learning to help predict when and where inaccuracies are likely to occur? Could this then enable more efficient audit schedules? This is currently being explored with new research that will be published in 2025. Click here to learn more about this research.

This research was commissioned by the IRI working group, if you are a retailer or CPG and would like to know more and to participate in future working group meetings or just read more about our research and blogs, click here.

Finally, if you would like to access the full (43 pages) academic paper, please click here

Jun 9, 2025

Main office

ECR Community a.s.b.l

Upcoming Meetings

Join Our Mailing List

Subscribe© 2023 ECR Retails Loss. All Rights Reserved|Privacy Policy