Understanding High Shrink Stores

Developing an understanding of what makes some retail stores vulnerable to shrinkage

Table of Contents:

- Abstract

- Introduction

- Background

- Understanding Risk: The Hot Concept

- - Hot Products

- - Hot Processes

- - Value of Understanding the ‘Hot’ Concept

- Hot Stores Research Project

- - Background

- - Research Objectives

- - Research Methodology

- Findings: The Profile of Store Losses Across Europe

- - Individual Company Store Loss Distribution Profiles

- Findings: What Makes a Store Hot (High Loss)

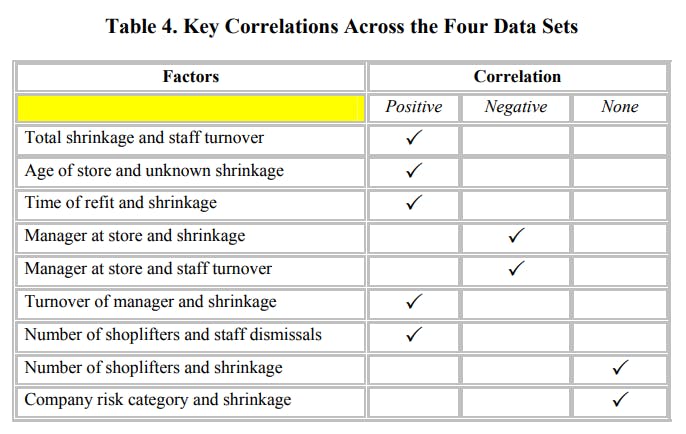

- Key Factors that Drive In-Store Loss

- - Staff Turnover

- - Role of the Manager

- - Fabric of the Store

- - Offending Behaviour

- - Company Risk Categorisation

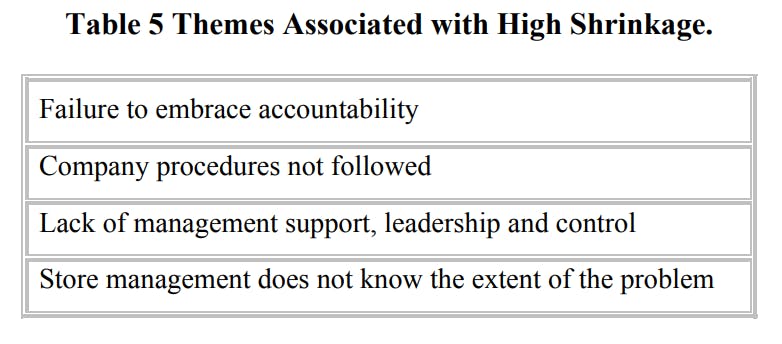

- Themes Associated with High Shrinkage

- - Failure to Embrace Accountability

- - Company Procedures Not Followed

- - Lack of Management Support, Leadership and Control

- - Store Management Does Not Know the Extent of the Problem

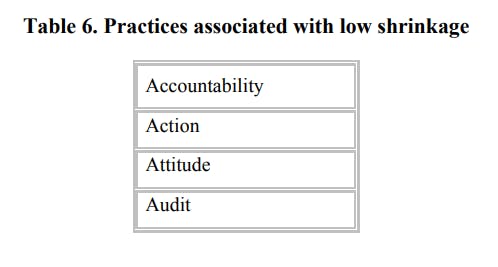

- ‘The 4 ‘A’s to Preventing Stores Becoming Hot’

- - Accountability

- - Action

- - Attitude

- - Audit

- Conclusions

- Recommendations

- - Hot Store Identification Tools

- - Identifying Non-Theft Hot Products and Hot Processes

- - Identifying Hot Managers

- Appendix I: Research Instrument

Languages :

This report, which was published in 2003, presents results from a study focused upon developing a better understanding of the factors that make particular stores within a retail estate more vulnerable to shrinkage – the ‘hot store’ phenomena.

The study is based upon a survey of retailers and a series of retailer case studies, including visits to retail stores, and interviews with key personnel in four companies.

The study concludes that the role of the store management team seems extremely important in explaining the difference between high and low performing stores – evidence highlighted key differences in the style and approach adopted, the importance of longevity of service and the need to build staff morale and confidence.

Four key areas were identified in low shrinkage stores: Accountability, Attitude, Action and Audit. Better performing stores had managers who took accountability for the issue of shrinkage. They recognised it as a critical part of their job and prioritised it accordingly. Similarly, good stores had managers whose attitude was focused on developing their staff and seeing them as key members of the team – they were keen to work with their staff to improve their skills and generate positive staff morale. Moreover, low shrinkage stores were characterised by a strong adherence to procedures – managers took action to make sure that staff constantly complied with them and took pride in the appearance of all parts of the store. Lastly, managers in better performing stores recognised the need to constantly monitor and measure the problem of shrinkage – they prioritised the role of audit and used data to help them develop shrinkage reduction strategies appropriate to their context.

The report also found that environmental factors cannot be excluded from the equation as well. The nature of the store itself was found to play a role in explaining some of the differences between good and bad stores and areas with high levels of social deprivation, particularly high crime rates are likely to attract more customers and staff likely to steal. However, the study found no evidence which showed a statistical link between levels of shoplifting and rates of shrinkage, although there was some evidence that rates of staff dismissal and shoplifting were associated.

The overall conclusion from this study is that the way in which a store is managed is the key factor in explaining why some stores have higher rates of loss than others. While the environment within which the store is located does play a role, good management teams recognise this and develop strategies accordingly to meet the challenge they face.

Abstract

This report, which was published in 2003, presents results from a study focused upon developing a better understanding of the factors that make particular stores within a retail estate more vulnerable to shrinkage – the ‘hot store’ phenomena.

The study is based upon a survey of retailers and a series of retailer case studies, including visits to retail stores, and interviews with key personnel in four companies.

The study concludes that the role of the store management team seems extremely important in explaining the difference between high and low performing stores – evidence highlighted key differences in the style and approach adopted, the importance of longevity of service and the need to build staff morale and confidence.

Four key areas were identified in low shrinkage stores: Accountability, Attitude, Action and Audit. Better performing stores had managers who took accountability for the issue of shrinkage. They recognised it as a critical part of their job and prioritised it accordingly. Similarly, good stores had managers whose attitude was focused on developing their staff and seeing them as key members of the team – they were keen to work with their staff to improve their skills and generate positive staff morale. Moreover, low shrinkage stores were characterised by a strong adherence to procedures – managers took action to make sure that staff constantly complied with them and took pride in the appearance of all parts of the store. Lastly, managers in better performing stores recognised the need to constantly monitor and measure the problem of shrinkage – they prioritised the role of audit and used data to help them develop shrinkage reduction strategies appropriate to their context.

The report also found that environmental factors cannot be excluded from the equation as well. The nature of the store itself was found to play a role in explaining some of the differences between good and bad stores and areas with high levels of social deprivation, particularly high crime rates are likely to attract more customers and staff likely to steal. However, the study found no evidence which showed a statistical link between levels of shoplifting and rates of shrinkage, although there was some evidence that rates of staff dismissal and shoplifting were associated.

The overall conclusion from this study is that the way in which a store is managed is the key factor in explaining why some stores have higher rates of loss than others. While the environment within which the store is located does play a role, good management teams recognise this and develop strategies accordingly to meet the challenge they face.

Introduction

The purpose of this White Paper is twofold: to introduce the shrinkage reduction work of ECR Europe from 1999 – 2002 to a wider audience; and to present findings from new research carried out on behalf of ECR Europe in 2002-3. This focused on developing a greater understanding of the factors that make particular stores within a retail estate more vulnerable to shrinkage – the so called ‘hot store’ phenomena. Traditional thinking on this topic has tended to focus on the nature of the environment within which the store operates as being the key determinant in explaining levels of shrinkage – areas with high crime and unemployment levels together with relatively poor housing and social cohesion are much more likely to play host to stores with above average rates of loss. Others however, have suggested that the means by which a store is managed, particularly the way in which staff are motivated and controlled, and the extent to which the management team understand the problems present within the store, may be more influential in predicting rates of shrinkage than social and economic geography.

The former traditionalist view depicts the store as a victim of its circumstances, unable to resist the incessant tide of criminality washing through its doors, while the latter revisionist interpretation reflects a more interventionist proactive approach to understanding the problem, recognising the importance of people, process control and problem management. Through the use of original research undertaken across Europe, this report presents a fresh approach to understanding the hot store phenomena and seeks to enlighten the debate over the relative importance of these often polarised views.

The paper begins by reviewing the context within which this research took place, particularly the problem of shrinkage and its management, and the existing research that has been carried out to date on the concept of non-randomised distribution of risk (such as crime hot spots, hot products and hot processes). It then charts the methodology adopted by the authors to complete the study. It continues with a detailed review of the findings from the research focusing on the data collected from across Europe and from the four case study companies. It concludes with a summary of the key findings together with recommendations for future work in this area.

Commissioned by the ECR Retail Loss Group, this research makes use of quantitative data collected from eighteen European retail companies together with richer, qualitative information from field research conducted in four of these companies. The authors are grateful to the company staff who contributed their time, expertise and knowledge to assist in this research and particularly appreciate the assistance of the staff in the four case study companies and the members of the ECR Retail Loss Group.

Background

The ECR Retail Loss Group has been active in addressing the issue of shrinkage since 1999. This group acts as a steering committee to the research commissioned by ECR Europe over this period. To this end it has proposed, supervised and supported work that has: defined shrinkage, understood its root causes; developed a methodology for addressing this problem; and conducted a series of case study applications of this methodology. A précis of the understanding gained through to this work is presented below.

Understanding Shrinkage

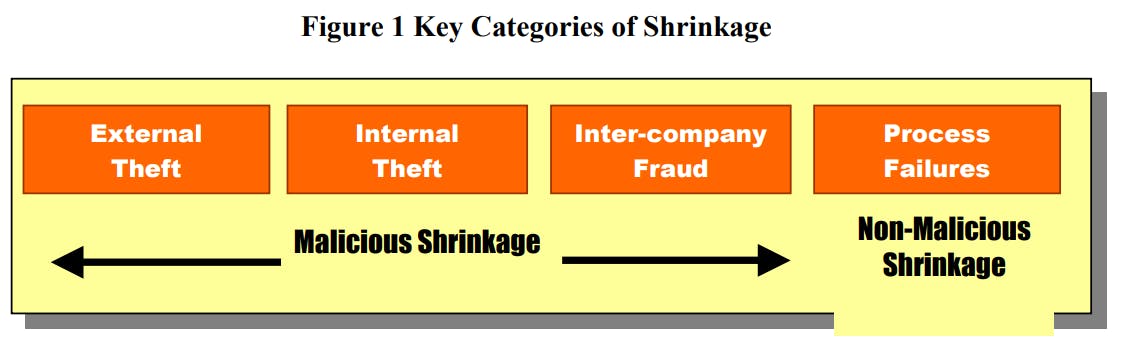

The rather euphemistic term ‘shrinkage’ is used by the business world to describe the losses that occur while they attempt to complete the deceptively simple task of producing, distributing and eventually selling goods to consumers. The term covers an enormous gamut of events, which can for the most part be broken down into two types: malicious and non-malicious. Malicious events represent those activities that are carried out to intentionally divest an organisation of goods, cash, services and ultimately profit. Non-malicious events occur within and between organisations that unintentionally cause loss, through poor processes, mistakes, bad design and so on. Like the former, this has a dramatic impact upon the profitability of an organisation.

The importance of perceiving the intentionality of a shrinkage occurrence is the impact it has upon the approach adopted to tackle it. Malicious losses are intentional and occur deliberately with a degree of forethought. To a certain extent such losses occur when existing systems have been found to be vulnerable – sometimes by accident, often by ‘probing’ – and are duly ‘defeated’ by the offender. As such, remedial action to deal with some types of malicious activity will have a ‘half life’1 where their effectiveness deteriorates over time as offenders find new ways to overcome them. Remedial actions can also lead to displacement where offenders target different products, locations, times or methods2 .

Unintentional shrinkage is usually less dynamic and more responsive to lasting ameliorative actions. For example, damage caused by loads shifting during transport can be addressed by employing new methods of pallet stacking and methods for restraining loads inside the vehicle. While they may require similar levels of vigilance (for instance to make sure staff are continuing to follow procedures) they are less liable to be anything like as evolutionary in nature as their malicious counterparts.

Defining Shrinkage

Opinions vary on a definition for shrinkage. Some take a very narrow perspective and limit it to the loss of stock only, choosing to exclude the loss of cash from an organisation, or consider it to relate only to the losses that cannot be explained – ‘unknown losses’ as they are usually referred to3 . At the other end of the spectrum, some argue for a much more inclusive, broad ranging definition which encompasses both stock and cash, as well as the losses that result from shrinkage events – ‘indirect losses’ – such as out of stocks4 caused by shop theft, the sale of stolen goods on the ‘non-retail’ market5 or the production of counterfeit products. In addition, some feel that the expenditure incurred responding to stock loss should also be included when calculating the overall cost of shrinkage.

The recent work by the ECR Europe Shrinkage committee has developed a definition that has received relatively broad acceptance, which strikes a middle ground between the two, driven in part by the current limitations imposed upon the ability to accurately measure the impact of shrinkage upon organisations. It is based upon four categories of shrinkage encompassing both stock and cash and made up of external theft, internal theft, inter-company fraud and process failures. The first three can be regarded as malicious and intentional, while the fourth is nonmalicious and an unintentional, but highly regrettable consequence of ineffective business processes, procedures and practices.

Size of the Problem

Recent research has once again demonstrated the extent of the problem of shrinkage for retailers and their suppliers throughout the world. In 2001, research sponsored by ECR Europe into the Fast Moving Consumer Goods sector (FMCG)6 calculated that the annual bill for shrinkage was 2.31 percent of turnover: 1.75 percent for retailers and 0.56 percent for manufacturers7 . This equated to €18 billion for the industry as a whole, based upon an annual turnover of €824.4 billion8 .

A similar study in Australasia, using the same methodology found that losses from shrinkage accounted for 1.73 percent, and amounted to Aus$ 942 million9 . In the USA, work by Hollinger has estimated that shrinkage costs the retail sector US$ 30 billion a year, a figure equivalent to one-quarter of annual retail profits10. In some respects, there is nothing new about attempting to quantify the overall cost of stock loss11 to the business world; the annual British Retail Consortium retail crime surveys provide a detailed breakdown on the extent and cost of the problem of crime against retailers in the UK, while similar initiatives in other European countries have tried to measure the problem as well12.

While the definition of what constitutes ‘shrinkage’ or ‘stock loss’ varies between studies undoubtedly impacts upon their respective findings, the overriding conclusions are (1) that the extent of the problem is enormous and (2) that shrinkage is an issue which seems for the most part, extremely resilient to ameliorative actions. As one trading director recently put it, “We have had the same problem for twenty-five years – it doesn’t get any better, it only seems to get worse13.”

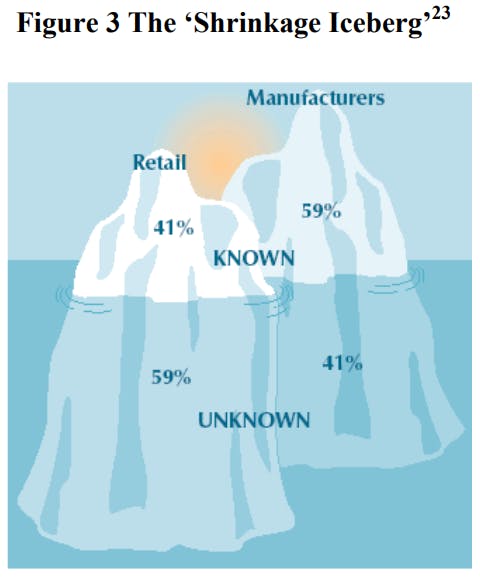

Trying to gather accurate data on the magnitude of different types of shrinkage has proved beyond current methodologies designed to measure the problem. This is because for retailers, the majority of losses remain unknown – losses are discovered after the event, usually through annual or biannual stock audits, making it impossible to answer the critical questions of what caused the loss, where did it happen and when. In the recent ECR survey, fifty-nine percent of retailer losses were unknown, while for manufacturers, the comparable figure was forty-one percent.

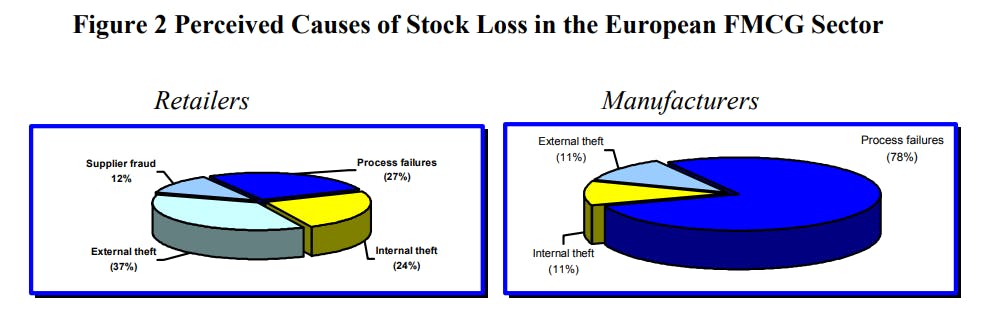

Given the lack of information linking losses to particular causes, most shrinkage measurement methodologies rely upon respondents, “Using their knowledge and experience to estimate what the breakdown between each type of loss might be14.” Clearly this moves any estimates of the causes of stock loss from the realms of hard data, usually provable and based upon evidence, to ‘soft’ data, something that is not based upon fact but reliant upon impressions, opinions and personal bias. This is an issue that this paper will return to below when managing shrinkage is considered. Whilst acknowledging this significant problem in determining the causes of stock loss, the 2001 ECR Europe study found that retailers and manufacturers allotted significantly different weight to the different categories of loss, as shown in Figure 2 below.

For retail respondents, external theft was perceived as the main cause of stock loss (37%), followed by process failures (27%), internal theft (24%) and finally supplier fraud (12%). Taken together, theft was considered to account for nearly two thirds of all losses (61%), valued at €8 billion. In contrast, manufacturers identified process failures as the biggest culprit (78 %) of all losses. Both internal and external theft were thought to equally account for the remaining twenty two percent (11% each), although this still equates to €1 billion of losses due to malicious activities.

The differences between the two are very stark – retailers do not see any one cause as dominating their thinking, all four factors receive between twelve and thirty-seven percent of the total, while manufacturers believe that process failures dominate their stock loss problem.

Non-Malicious Shrinkage: Process Failures

It is difficult to overestimate the complexity of modern retailing and the globalisation of product manufacture and distribution. Consumers have become accustomed to having ready and almost continual access to products that originated many thousands of miles away from the eventual point of sale. In food retailing, seasonality now has little impact on availability as sophisticated and complex supply chains source products from around the globe. In addition, consumers have become more demanding in the quality and range of products they expect in their retail environment. Hence supermarkets regularly stock in excess of 20,000 SKUs15. In the case of hypermarkets the number of references stocked over a year can reach 160,000 when seasonal items are taken in to account. Clothing retailers are a good example of companies that regularly change most of their stock, this time to meet the vagaries of rapidly changing popular fashion. Arguably, all of this has made companies more profitable and given consumers an unprecedented shopping experience16. But this complex global production, distribution and retailing web comes at a price – that of organisational inefficiency in managing the myriad of processes required to make the system work.

Getting the right products to the right place, in the right condition at the right time and price, and linked to the right information, is the goal of modern retailing but when this fails it generates losses, which are defined as process failures or ‘Paper Shrink’17.

The 2001 ECR survey found that for retailers, process failures accounted for twenty-seven percent of all losses or €3.6 billion a year. For their suppliers, the percentage was much higher seventyeight percent, but accounted for the same amount of money (€3.6 billion). Taken together, in Europe’s Fast Moving Consumer Goods sector, process failures cost €7.2 billion a year, or €19 million a day. In the US, it has been estimated that for every $100 of shrinkage, $17.50 could be due to process failures18. This is a significant price to pay for organisations not getting it right.

The key elements that contribute to process failures are:

Stock going out of date: product not being sold in time because too much was ordered; it was not discounted in time; or stock was not rotated properly.

Price reductions: stock being sold below the price originally envisaged; too much was ordered; stock had not been rotated properly; or expected sales targets had been overly ambitious.

Damage to stock: caused by the methods used to store and distribute products. This can include temperature sensitive produce such as foods.

Delivery errors: a combination of the wrong products being delivered to the wrong places at the wrong times. This can include the failure to record products transferred between stores.

Pricing errors: the incorrect pricing of product, either below the planned price or incorrectly discounted in connection with product promotions.

Scanning errors: store staff incorrectly scanning products on the shelves causing errors in the inventory; checkout staff forgetting to scan products; or incorrectly entering the product identification code

Incorrect inventory checks: staff mis-counting product in the warehouse, in the storeroom or on the shelves, causing errors in the expected and actual levels of stock.

Product promotion errors: products being sold at promotional prices when they should not be; associated products being sold at discounted prices when they should not be; or incorrect multibuy discounts being applied.

Master file errors: incorrect entry of product type or quantities on the master inventory file. This can lead to companies thinking that they have more or less of a particular product than is currently in the supply chain.

Returns: products that have been legitimately returned by customers not re-entering the supply chain correctly.

Intra-company transfers: products being misplaced as they move between different parts of the organisation, such as between different retail stores.

Common to most process failures is that they are a consequence of two types of problem: a failure to collect information accurately and a failure to communicate information accurately and timely about the products currently within the supply chain. They are a failure to answer two simple questions: ‘what products do we have?’ and ‘where are they?’ Answers to these questions then enable the key questions of ‘what products do we need?’, ‘where do we need them to be?’ and ‘what price should we be charging for them?’ to be answered.

Process Failure and Opportunities for Malicious Loss

Perhaps one of the most important findings from our research is to highlight the link between process failure and malicious loss. The previous section contains a list of ways that a supply chain can go wrong. This list is far from conclusive. Indeed our fieldwork revealed hundreds of ways that supply chain processes can fail. Whilst these failures are innocent and non-malicious, every failure provides an opportunity for malicious loss. The opportunity is twofold as process failure provides:

- Opportunity for theft or fraud to occur

- Opportunity for the theft or fraud to go undetected

An example of this occurs when returned products are legitimately brought back to a store by customers but fail to re-enter the supply chain correctly. This situation regularly happens in good faith, for example because a store has started to stock more non-food lines, such as clothing. New categories such as this can have many more times the number of returned items than traditional categories but it is often the case that new processes and staff training are not introduced at the same time in anticipation of changes in shopper behaviour.

The failure to deal with returned products in a controlled manner results in items going astray. That is they are stored in the wrong places, miss their key selling season or become soiled. This confusion provides the opportunity for internal thieves to exploit the system. Theft of uncontrolled items is made easy as the loss of items is not noticed – it is simply normal for things to go missing so no-one suspects there is a theft problem. Because losses are not detected or are expected to occur no-one acts to follow up events and determines what is going wrong. This allows theft and fraud to continue without interference. This situation can continue indefinitely as long as it remains at a tolerable level. The skilful thief is therefore a person who understands where the threshold of tolerance lies. To help them, many organisations are kind enough to have rules such as, ‘2% losses are acceptable’ or, ‘losses under US$500 are not cost effective to investigate’. Although rarely published, these rules generally permeate through an organisation and are widely known.

The important causal relationship where non-malicious shrinkage provides the opportunity for malicious shrinkage to occur should be borne in mind when considering malicious shrinkage, in the section below.

Malicious Shrinkage

Malicious shrinkage is made up of the three elements of:

- Internal theft

- External theft

- Inter-company fraud.

These three elements are discussed below.

Internal Theft

The ECR survey estimated that for retailers twenty-four percent, and for manufacturers eleven percent of all losses were due to internal theft, which accounts for just over €3.7 billion of loss each year. Despite this, companies, stock loss practitioners and indeed researchers have continued to largely ignore it as an area of concern19, choosing to focus more on the other problems affecting the sector, particularly external theft. This happens because there is a lack of data, a tendency for unattributable loss to be apportioned to those outside the store or company team, a realisation that it is often easier to target more identifiable security problems, a perception that focusing on staff dishonesty may be bad for staff morale and a belief that if high levels of staff dishonesty are uncovered, it may reflect badly on the image of the company and its managers. Taken together, these factors can all lead to theft from within the company being side-stepped as a major area of concern.

Looking at the specific threats presented by staff, four areas are of concern are highlighted below:

Theft of Stock: members of staff removing goods from the premises, for example by hiding it in their personal belongings, placing them outside the building ready for collection at a later date or using the internal mail to post it to their home or some other location. This also includes theft by delivery staff, who remove stock from their vehicles.

Grazing’: staff consuming stock while at work.

Collusion or ‘Sweethearting’: members of staff, often operating the till, colluding with customers to steal products. This is usually done either by staff not scanning items at the check out or misscanning (using a code for an item that is cheaper than the one being purchased). It can also include collusion with shoppers when goods are being returned to the store (possibly stolen in the first place) or with delivery workers, suppliers and contractors.

Theft of Cash: members of staff stealing cash from the till or cash office, or short changing customers and pocketing the proceeds.

External Theft

In stark contrast to internal theft, external theft has for the most part dominated the stock loss agenda. Despite numerous studies showing that it is not the single most significant threat to organisations20, it continues to receive the vast majority of stock loss expenditure. This is partly because the industry itself is responsible for perpetuating the ‘myth’ of the problem of external theft, but they are enthusiastically assisted by security service providers who play a significant part in setting the agenda and promising quick fix, technological panaceas.

There are five main threats from external theft, which are discussed below:

Shoplifting: offenders enter a retail store and remove goods without paying for them. The goods can be concealed in many different ways, for example in bags, under clothing or secreted in push chairs and prams. This includes so called ‘sweep thefts’ when offenders take a large number of the same item at the same time, and tag switches when shop thieves replace a bar code or sales ticket with one from a product of lesser value.

Returning stolen goods: shoplifters return previously stolen items in order to obtain a cash refund. There are many variants of this, including: the purchase of the same product as the one stolen and then using the genuine receipt to refund the stolen item; using a stolen or invalid cheque book/credit card to purchase items and then returning the goods and getting a cash refund; or simply intimidating store staff, claiming that receipt-less items were genuinely purchased.

Grazing: customers consuming stock while they are in the store.

Till snatches: offenders targeting till operators, demanding or grabbing cash and usually carried out in a threatening or violent manner.

Burglary: offenders entering a building (usually by force) when it is closed, and removing goods and / or cash.

Inter-company Fraud

The 2001 ECR Europe study on stock loss identified that for retailers twelve percent of all losses were thought to be due to inter-company fraud, which equates to €1.6 billion a year. Intercompany fraud is defined as the losses due to organisations, or their agents, deliberately shipping or returning fewer goods than are eventually charged for. This includes supplier, retailer and contractor fraud and the losses due to discrepancies in the goods supplied by third parties and not from companies’ own distribution centres. The main areas of fraud are:

Under/Over Delivery: suppliers delivering less goods than the retailer ordered, but charging them for the full amount, or deliberately sending them more goods than they ordered and billing them for the new amount.

Phantom Delivery: suppliers claiming to have delivered orders when they have not.

Invoice Error: suppliers charging for more goods than delivered or retailers not paying for goods that they have received.

Returns: suppliers not crediting retailers for the full value of goods returned by them or retailers not returning goods that they are credited for.

Promotions: promotions used to mask under or over deliveries or invoice errors.

Quality/Weight of Items: selling sub-quality products (compared to those stated on the original order) or delivering products that are below the original weight stated or expected (for instance in the delivery of fresh food).

The critical aspect of many of the approaches adopted to commit fraud is that they occur at the point of exchange between organisations. This possibility exists due to two key factors: the inability of most organisations to accurately check the receipt of items to a distribution centre or store and the ‘distance’ between the point of delivery and the administrative/ordering function of the organisation. The sheer scale of transactions and deliveries between organisations means that it is almost impossible to verify, certainly at item level, that what is claimed to have been delivered has actually arrived. In addition, any disjunction between points of order, invoicing and place of delivery provides the opportunity for exploitation. For example, when the buyer does not know that the products they originally ordered have actually been delivered to the original specification, or those responsible for billing are not fully informed about what was actually delivered.

Problems of Managing Stock Loss

Responses to shrinkage suffer from a number of inter-related problems that have combined to limit its effectiveness in dealing with an issue that is costing businesses billions of Euro a year both in terms of losses and expenditure on so called ‘solutions.” Indeed, recent research has shown that if stock loss could be eliminated then profits of a typical European retailer would be fifty-eight percent higher21. The factors undermining effective stock loss management are: its perceived periphery within organisations; not being able to prioritise it compared to other duties; a tendency to be uni-dimensional, reactionary and solution driven; decision-making within an information vacuum; a lack of cross functional organisational co-operation; and a poor appreciation of the threats posed throughout the entire supply chain.

Unfortunately Necessary

Shrinkage management suffers from an image problem within organisations. Too often it is not seen as actively contributing to bottom line profitability. It is seen as a regrettable consequence of doing business or a function that can be called upon when things have gone badly wrong, such as a break-in, when products have been contaminated or a member of staff has been attacked (often reinforced by finance officers). To this end, it is often seen as the task that requires the skills of those formally employed in public policing – detaining offenders and employing guards. Therefore, its poorly perceived profile inevitably leads to its relative marginalisation within the business.

Juggling Priorities

The roles and responsibilities of security/loss prevention departments are often many and varied, ranging from issues of health and safety, through monitoring contract guarding companies, to responding to kidnap attempts on senior members of the organisation. This myriad of often competing duties, some of which may be a statutory requirement and could incur significant liability if non-compliance or negligence is proved, means that prioritising stock loss and shrinkage can be difficult for those tasked with its management.

Solutions Searching for a Problem

Many of the methods and approaches currently adopted by shrinkage managers can be characterised by a prioritisation of one particular problem: shoplifting, coupled with an almost obsessive belief that the answer can be found in a quick fix technological panacea (usually electronic article surveillance). As the data presented above has shown, retail shrinkage managers themselves suggest that only about one-third of loss is caused by external theft, and yet as one senior manager put it, “Tackling shoplifting accounts for about ninety-five percent of our security budget22.”

In addition, security providers have to a considerable extent driven the stock loss agenda, in particular those offering technology-based products. This has caused shrinkage management to be led by a ‘we have a solution, can we now find a problem’ approach to stock loss. The danger with this is that companies can become locked into relationships with technology suppliers whereby more and more (expensive) technology is seen (with ‘evidence’ often provided by the technology suppliers) as the answer to the shrinkage problem.

Living in a ‘Data Desert’

One of the most fundamental problems currently facing security managers is a lack of relevant, timely and accurate data on stock loss. As detailed earlier, retailers in the European FMCG sector cannot account for fifty-nine percent of their losses, while their suppliers are unaware of fourtyone percent of their shrinkage. Put another way, €10 billion of loss in this sector is simply unaccounted for, as illustrated in Figure 3 where the analogy with an iceberg is employed.

Without doubt, a paucity of data plays a pivotal part in producing poor product protection. Not knowing means not understanding, which means that any response will inevitably be piecemeal, partial and poorly defined. As the ECR report on shrinkage highlighted:

“In theory, the concept of stock loss reduction is simple. It can be described in terms of the three following steps: make stock highly visible so that loss is immediately noticed; quickly identify the causes of the loss; and implement preventative solutions to resolve the cause of the loss and prevent reoccurrence.”24

What is almost totally absent is the data required to make the first step possible. Good decisions and effective threat assessments rely upon having high quality, reliable information25. Those currently tasked to tackle the problem of shrinkage are virtually operating behind a blindfold, dramatically inhibiting their decision-making capabilities.

In Splendid Isolation

If security managers can be described as working in a ‘data desert’, then they can also be considered to be there very much alone. The ECR survey found very low levels of both inter and intra company co-operation on resolving the problem of stock loss. Very few organisations have recognised the value of co-operating across company functions to develop more integrated and strategic approaches. Functions such as buying and marketing, IT and human resources were found to be rarely involved in security management issues and yet they have much to offer both in terms of identifying future problems and helping to implement potential solutions. Likewise, cooperation between companies throughout the supply chain was found to be largely absent. As the ECR report found, ‘Shrinkage is a problem that transcends company boundaries – it is something that requires genuine partnership and co-operation if it is to be managed efficiently and effectively’.26 To date this has not happened to any great extent.

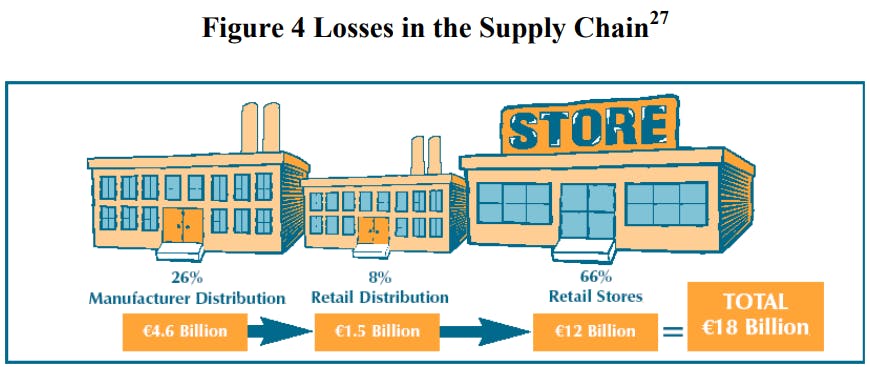

Myopic Management

The final factor affecting shrinkage practitioners is a tendency to see the problem as only occurring at the end of the supply chain, that is after the products eventually reach the store. This is in part a function of the prioritisation of shoplifting as the primary cause of stock loss. The store is the point at which customers are allowed to interact with the products and where many of the current technology ‘solutions’ are most easily applied. But as the ECR survey found, up to one third of loss takes place before the goods have reached the retail outlet, as illustrated below in Figure 4. This finding highlights the need to look at losses of goods in transit and while being stored in distribution centres.

Certainly the stores are a very vulnerable part of the supply chain, but they are very much a part of the chain and stock loss practitioners need to look beyond the retail outlet and recognise that good loss prevention is about securing the entire supply chain.

The ECR Europe Shrinkage Reduction Roadmap

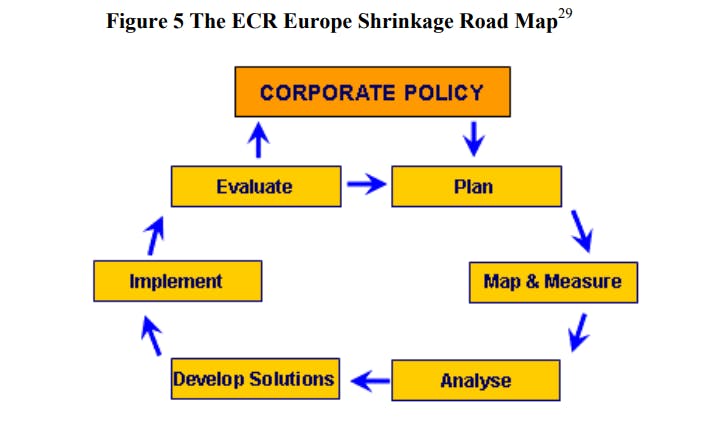

As detailed in their report on shrinkage28, the ECR Europe team put forward a ‘road map’ on responding to the problem. The Roadmap consists of a number of critical steps that need to be completed before a solution is selected, not least the collection of context-specific data on the nature of problem and careful analysis of the underlying causes. Only after these steps have been completed can suitable solutions be selected. Even then, they need to be rigorously evaluated to measure the true impact they are having. These steps are shown in the diagram in Figure 5, below.

The Roadmap uses corporate policy to direct loss prevention and asset protection efforts as well as employing the findings from projects to inform and refine top management thinking. The case studies supported by ECR Europe find that the roadmap overcomes the tendency of most practitioners to skip the preparatory steps and base their solution selection on gut instinct and security providers’ often extravagant claims. Accordingly, notable success in reducing losses has been achieved by those following the roadmap.

Understanding Risk: The Hot Concept

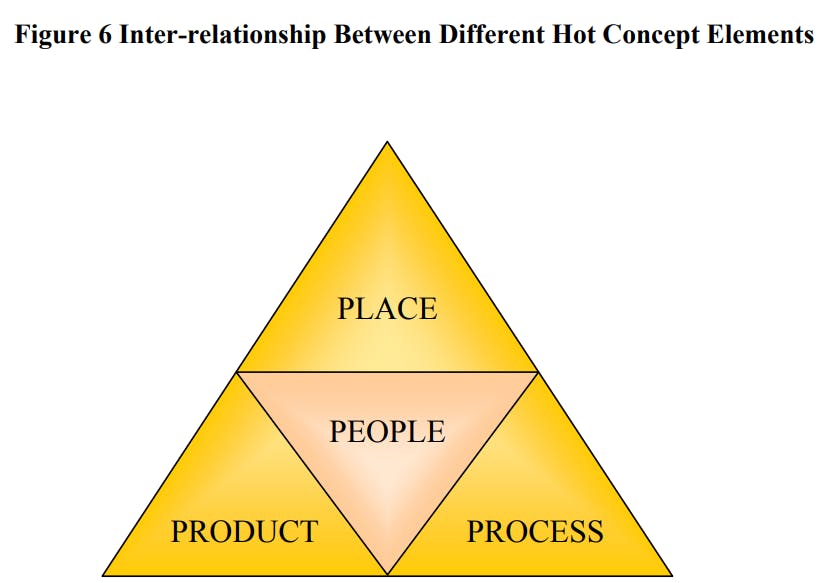

Risk is not homogeneously spread in time, space and location. Neither is it evenly distributed between demographic groups in society or products on sale. Particular places, products, processes and indeed people are much more vulnerable to loss than others. The inter-relationship between these different elements is depicted below in Figure 6 and the manner with which these factors come together is important to understand in order for organisations to respond appropriately to the problem of shrinkage.

Considering the various elements that constitute the hot concept, most people are intuitively aware of places that we consider to be more risky to visit at night because they may increase our likelihood of criminal victimisation. Similarly, retail organisations are becoming much more aware that certain types of product are more likely to be stolen or damaged than others and that particular types of process, such as unsupervised deliveries are more likely to cause shrinkage. This nonrandom distribution of risk has been the subject of considerable empirical study, albeit it primarily focused upon non-business related crime. Criminological research in the USA and elsewhere has consistently found that certain parts of urban areas record significantly higher rates of crime than other areas, particularly inner city areas and poorer housing developments. For instance, one study in the USA found that just 3 percent of the geographic area of one city accounted for 50 percent of all recorded crime, while repeated sweeps of the British Crime Survey in the UK have highlight the clustering nature of incidents of burglary and street violence30.

In order to be effective in loss prevention and asset protection organisations need to focus on the critical threats, the vital few rather than the trivial many. Effectiveness in this sense implies maximising shopper satisfaction in the first instance whilst maximising profits through increased sales and minimised losses. By understanding the impact of hot products (differentiated by type of shrinkage), processes robustness and the attitude and motivation of people, companies can begin to develop stock loss strategies that are context specific, highly targeted and ultimately effective in reducing the impact of shrinkage.

Existing research is less readily available when the issue of shrinkage clustering is considered. The most significant recent developments in this field have been on understanding the varying risks of theft associated with different types of product – Hot Products31 – although little is understood about types of products prone to non-theft shrinkage. Similarly, there is relatively little critical research on the issue of hot processes within organisations – those activities within a company that induce shrinkage to occur. Detailed below is what is currently understood about these two issues.

Hot Products

Intuitively, most loss prevention professionals understand that certain products are lost more than others. The same thoughts continue to be voiced by people across the supply chain, from production through to store and from managers to shop-floor operators and colleagues.

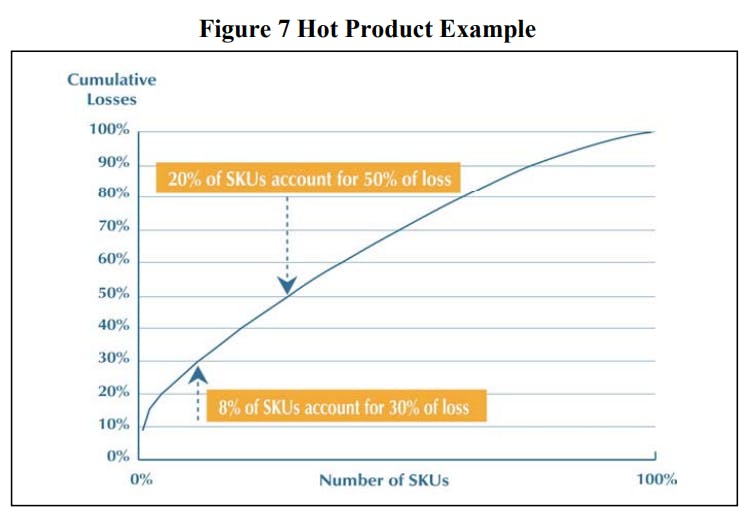

Significantly, the general view on which products are most at risk is based on assumptions and opinions and rarely by robustly derived data. Where such data is made available it becomes clear that the opinions are close, but not close enough to be effective. For example, a study of shrinkage in alcoholic drinks found in-store staff responding to unacceptable loss in that category by defensively merchandising high value items such as single-malt whiskeys and brandy. An analysis of losses by individual line item (references/SKU) revealed the high value items suffered little loss. An illustration of this phenomena is shown in Figure 7.

Instead of losses being evenly spread it was a few popular, mid-price brands that were incurring the majority of the loss. Focusing efforts on these items would deliver significantly higher returns32.

Those products that are much more at risk than others have been termed ‘Hot Products’33. The term is generally associated with products that suffer excessive loss through theft. However given that theft occurs when opportunity arises and opportunity results from poor control it seems appropriate to extend this concept to include products that are lost through process failure.

Susceptibility of Products to Theft

Clarke’s seminal work on stolen goods identified the key aspects that made particular types of item (especially those stocked by retailers) far more susceptible to theft than others34. He developed an acronym to describe the facets of vulnerable products: CRAVED, which represents Concealable, Removable, Available, Valuable, Enjoyable, and Disposable. In Clarke’s view highly stolen products are concealed so that possible apprehension is reduced; easy to remove and available, such as from open display in a store; relatively valuable making them worth stealing; and enjoyable and disposable, appealing to a readily identifiable black market where both demand and resale prices are high. Classic examples of hot theft products include CDs and DVDs, some health and beauty products such as razor blades and face creams and small electrical items such as batteries, replacement films and printer toner cartridges.

Clarke’s seminal work on stolen goods identified the key aspects that made particular types of item (especially those stocked by retailers) far more susceptible to theft than others34. He developed an acronym to describe the facets of vulnerable products: CRAVED, which represents Concealable, Removable, Available, Valuable, Enjoyable, and Disposable. In Clarke’s view highly stolen products are concealed so that possible apprehension is reduced; easy to remove and available, such as from open display in a store; relatively valuable making them worth stealing; and enjoyable and disposable, appealing to a readily identifiable black market where both demand and resale prices are high. Classic examples of hot theft products include CDs and DVDs, some health and beauty products such as razor blades and face creams and small electrical items such as batteries, replacement films and printer toner cartridges.

Susceptibility of Products to Process Failure

Process failure is a broad category into which several different causes of shrinkage converge. The link between product attributes and shrinkage through process failure operates in two ways. There are product characteristics that lead to process failure and there are those characteristics that make a product susceptible to shrinkage when process failures occur. The common link connecting these related losses is that product attributes increase either the likelihood or severity of loss when process failure occurs.

The link between product characteristics and shrinkage through process failure is broadly not well understood. This stems from a lack of recognition of the importance that process failure has in causing shrinkage. For example, the opportunity for theft-related shrinkage often exists due to failure in processes, leading to a breakdown in control. Similarly, a product may possess characteristics that make it vulnerable to shrinkage but fail to suffer loss due to robust processes, whilst a durable product may be treated inappropriately and have a high level of loss.

Against this background, there are several areas where understanding exists. The following product attributes appear important in explaining the susceptibility to process failure.

Efficacy

The efficacy of a product needs to be maintained in order for it to be able to deliver the service it is designed to provide to consumers. There is a symbiotic relationship between the design of the supply chain processes that deliver the product to the consumer and the design of product attributes in order to ensure a product’s efficacy is maintained. For example, fresh products maintain their nutritional value and food safety only for a given period of time and only when stored and distributed uncontaminated through the supply chain and only when maintained at a temperature of +3o C to +5o C. Outside of these parameters the efficacy of the product is not assured and the product poses a risk to the health of the consumer. Following the ‘fail safe’ principle to control, checks are conducted to determine whether standards are maintained. Even where safe limits have not been explicitly shown to be breached, the safe assumption is that control has not been maintained and therefore the product must be safely disposed. Safe disposal includes ensuring the product cannot be resold to consumers, e.g. by dying it an unusual colour.

Non-food products also need to maintain their efficacy. Although they can be less temperature sensitive than food products, many non-food products will fail at and below 0o C (32o F) and above 35o C (95o F), when the item or its associated packaging will be damaged. Another attribute to consider is the sterility of products, e.g. clothing or health and beauty items that come into contact with the skin or internal body cavities. Even microscopic damage to product packaging risks contamination of the product. Other environmental issues to consider include the susceptibility of a product to the presence of strong smells that could contaminate it and the consequences of the ingress of water.

Good supply chain processes are designed to ensure the efficacy of the products that pass through them. However where a product has unstable attributes then failure in the processes is likely to increase the occurrence of shrinkage incidents and the severity of the loss when an incident occurs.

Fragility

Every location where products are stored risks collision from other objects. Whenever products are being moved they risk colliding into other objects or simply dropped. It is therefore prudent to assume that products are liable to be damaged throughout the supply chain: during production, storage, distribution and at every interaction with people, including shoppers, and machinery.

The likelihood of damage occurring is reduced through good design. Visibility in warehouses is improved with good material handling equipment design and a sympathetic layout. The handling of product can be improved by considering the size and weight of shipping units from the perspective of how it will be handled throughout its journey along the supply chain. For example, pallet stability in distribution centres and warehouses can be improved through the design of effective stacking layouts. Similarly, packaging design should reflect how the product will be handled throughout the supply chain, including being merchandised on the shelf and selected by shoppers.

Good design will reduce the occurrence of incidents, however some accidents inevitably happen. The fragility of a product is an attribute that will affect how severe the loss will be in a given incident.

Appearance

Cosmetic damage during handling or storage that does not affect functionality will cause shrinkage by reducing the worth of a product. For example, dropping a shipping case in a warehouse may result in the packaging of the consumer units being slightly crushed. The consequence of the damage is dependant on the importance of the product’s appearance. For example in the case of luxury and gift items even minor damage may cause the product to become worthless to the shopper.

Interesting demographic and geographical differences exist over a shopper’s response to the appearance of a product. For example, UK shoppers consider appearance as the major attribute when buying fresh products. Other European nations consider smell and taste to be more important.

Differentiation

Difficulties in identifying one product from another leads to the wrong item being picked, distributed, sold or charged for. In a warehouse, each racking location looks the same as all the others and it is easy to put a pallet away in the wrong place. One rectangular, brown shipping carton looks much the same as another and is easily picked by mistake. One stretch-wrapped pallet looks the same as another and can easily be dispatched to the wrong store. All of these are examples of the way that poor product differentiation can contribute to failure in the supply chain.

In store, many products look the same. Fresh products are difficult to distinguish from one another, especially when they are sold loose without a barcode. This is particularly the case with seasonal fruit and vegetables that are only sold for a short period of time and with fresh meat. The difficulty in product differentiation increases the likelihood that checkout staff will charge the wrong price.

Selling Unit Quantity

Uncertainty over the number of items that constitute a sales unit leads to the wrong quantity being shipped or the wrong price charged. For example in a distribution centre a picker is asked to pick one unit of a product, however it may not be clear whether the unit consists of a shipper carton of 50 consumer items; an inner carton of 10 consumer units; or an individual consumer unit. This uncertainty increases the likelihood of failure occurring.

Promoted items can cause uncertainty in-store over what consists a sales unit, e.g. on a ‘buy one, get one free’ (BOGOF) offer. This uncertainty extends to accounting for items that remain in store after the promotion period has finished.

Obsolescence

Most products become obsolete over time following the development of superior products by the parent company or competitors. The rate at which products become obsolete depends on several characteristics, including:

- Fashion.

- Technology.

- Frequency of range change.

At the point when a product becomes obsolete it loses its worth to the shopper and its value to the retailer and manufacturer. Products that remain in store or in the supply chain after demand for that item has ceased will have to be disposed of. The shorter a product’s life cycle is, the greater the likelihood that shrinkage through obsolescence will occur. The severity of the loss is dependent upon the amount of inventory held in the supply chain when the product becomes obsolete.

Hot Processes

Case study research35 has begun to identify that the control of supply chain processes is most problematic at a few, specific points. Examples include the picking of goods in a warehouse, the receipt of deliveries into stores and the display of products in stores. These problematic points in the supply chain are termed ‘supply chain hot spots.’ Through identifying the location of these problem areas, attention can be focussed on them. By concentrating on these relatively few vulnerable points, rather than the trivial many, enables the greatest reduction in overall supply chain risk to be achieved, in the shortest time frame, for a given input of managerial effort.

To date much of the work in this area has been overlooked by the loss prevention community. However, a substantial and untapped body of knowledge exists amongst the supply chain management36, operations management37, manufacturing systems engineering38 and total quality management39 disciplines. Supply chain management provides the broad, holistic view that is so often missing from loss prevention efforts. This approach recognises that the consequences of shrinkage and the cause of the loss may exist at difference points in the supply chain and that companies are likely to have to collaborate to resolve the problem. Supply chain management also encompasses the techniques and tools needed to fix a defective supply chain for example through the disciplines of material handling, warehouse management and distribution. Above all, the aim of this approach is to ensure that the right products are delivered to the right place at the right time. The implication being that the opportunity for error is designed out and managerial control extends across company boundaries to ensure inter-firm processes are robust, which is a major requirement for loss prevention and asset protection.

Robust supply chains require that each link in the chain is operating effectively, hence the role for operations management in ensuring this to be the case. This is nowhere more developed than in best practice manufacturing where investments in making quality a certainty have led to process capability at the six sigma level, that is where quality levels exceed 3.4 defective products per million. Such high levels of process control provides both a major inhibitor to shrinkage as the opportunities for process failure has been removed and also an immediate warning when a problem occurs as it disrupts the smooth running of the operation. The techniques used to achieve these performance levels are also adaptable to shrinkage reduction efforts, as demonstrated in the incorporation of some quality control techniques into the ECR Europe loss reduction roadmap.

Hence those organisations that take a holistic view of shrinkage and recognise the impact that good supply chain and operations design and control has on reducing shrinkage throughout their supply chain will find that a multifunctional approach targeted with improving process control is likely to be of considerable benefit. The starting point for this effort is to place processes at the heart of their analysis efforts. This involves following the progress of items within particular facilities, e.g. a distribution centre or a store, and also between facilities, along the supply chain. These items may be either:

- Products

- Information

- Money

It is usually easier to begin process mapping by considering the flow of products first. Mapping the flow of a product (typically a hot product) will reveal the series of interlinked steps that enable it to progress from supplier to customer, and which underpins the success of the organisation.

All of the processes through which products, information and money pass possess the potential to become hot processes where they lack good control, either through poor design or poor management. However there are a few points that are particularly susceptible to problems:

Handling

Whenever a product is handled it risks being damaged. Handling also implies that a person is present and their legitimate interaction with the product presents the opportunity for them to abuse this situation and steal. Information can also be handled, that is it can be brought together in one place from several files or written on a document or it can be dispersed, e.g. copies of a triplicate form are split apart. Each action contains opportunities for errors to occur.

Movement

Transportation from one place to another presents another opportunity for accidental damage to happen during the journey for a host of reasons. It is also possible for the wrong item or wrong quantity to be taken from one location and delivered to the wrong destination, causing them to become lost. Movement can also allow something to move outside of a controlled space, even temporarily. For example in a store a hot product may be merchandised in a visible spot with good CCTV coverage. However having been selected by the shopper it can be transported throughout the store, including quiet ‘black spots’ where it can be hidden in a bag, unnoticed. The same is true of information, for example where emails pass from a secure environment and into the general Internet before being delivered.

Change of Form

This action contains the risks associated with handling, plus additional ones. Changing the form of an item can change those attributes that many have been vital in providing it with an identity and the ability to track it. For example during transportation most companies give the pallets an identity and track their movement during distribution. If the pallet is broken down then this identity is lost. Instead they are left with the cases that were on the pallet, whose identity and quantity may not be known.

Exchange of Ownership

Exchange of ownership occurs between people within an organisation, between different parts of an organisation, between different companies and between companies and shoppers. Often this exchange occurs at the same time as a physical movement takes place, with all the associated opportunities for loss. In addition, the exchange of ownership occurs requires that the product, information and money processes are synchronised at this point otherwise errors in knowing what to pay for can arise.

Storage

Items that are not moving run the risk of becoming obsolete. A product can be damaged, superseded or go out of date. Information can also be superseded40 or become corrupted. The purchasing power of money reduces through the effect of inflation. It is also difficult to maintain control all the time. In the immediate term, the risk of shrinkage increases at night. In the longer term, changes in personnel can lead to items being mislaid or forgotten.

Each of these areas of process risk is likely to manifest itself in a different way according to the characteristics of different processes. It is also important to note that this list is not exhaustive and that other, context specific risks are likely to manifest themselves. However, it does provide a starting point for understanding the attributes that can turn a process into a hot process.

Value of Understanding the ‘Hot’ Concept

All organisations have a finite amount of resources to combat the problem of shrinkage and there is a delicate balance to be drawn between protecting product and maximising sales41. The value of understanding and employing the ‘Hot’ concept is that it allows management teams to focus their resources on the products that are most likely to suffer from shrinkage. As shown in the example portrayed earlier in Figure 6, perhaps as few as twenty percent of items can account for fifty percent of total losses. It makes good business sense therefore to concentrate efforts on the products that need the greatest protection. In addition, by focusing on the vulnerable few, the return on investment is likely to be much greater as losses will be reduced quicker. There is also some evidence to suggest that there can be a diffusion of benefits as losses related to other products are reduced by the methods adopted to protect the hot products42. For instance, Masuda found that increased management vigilance and improved process adherence for hot products reduced overall levels of staff theft for all product types43.

Simple logic would suggest that the findings from the work concentrating on hot products might also be valid for other elements of the supply chain, such as people, places and processes. Smart shrinkage management in the future will be concerned with identifying the most vulnerable products to different types of shrinkage, the likely processes that can increase this risk and the most susceptible locations. If organisations can effectively identify these hot spots throughout the supply chain then they can begin to develop a highly targeted and extremely potent shrinkage management strategy that will dramatically reduce losses within the organisation.

Hot Stores Research Project

The concept of Hot Stores is derived in part from observations made during fieldwork on other ECR Europe shrinkage reduction projects44 that showed that some stores perform better than others when it comes to minimising shrinkage. There is also strong anecdotal evidence from retailers themselves who have long recognised that some stores seem to continually under perform compared with other stores within their estate.

As described earlier, the Hot Product concept has a strong theoretical and applied basis, whereas the concept of Hot Stores lacks such rigour. It was clear that research into the topic needed to first establish whether there was empirical evidence to back up practitioner perceptions and field observations. Where the existence of the Hot Store phenomenon could be substantiated, further research would then seek to understand the factors that affect it.

Background

In part derived from industrial mythology, from unanticipated findings from other research and from the literature, there is a strong sense that some stores perform better than others when it comes to reducing shrinkage. This research sought to investigate this opportunity to improve understanding of shrinkage by harnessing the willingness of Europe’s retail community to explore this issue whilst distancing itself from the poor quality information and sentimentality used to explain the phenomenon. In doing so the objective of this research was to work with the industry and identify where evidence existed to support current perspectives and also to identify where evidence did not support them.

To frame the research, the members of the ECR Europe Shrinkage project team were polled to identify common themes in their understanding of the issues associated with shrinkage in stores. This resulted in three themes being highlighted, in no order of priority, as follows:

- Social Geography

- Management

- Supply Chain Partners (internal and external)

Social Geography

Social geography relates to the demographic and social make up of the area in which a store is located. Location impacts on store shrinkage due to the propensity of these people to use the store for shopping or as a target for criminal activity. The local population is also likely to form the labour pool from which employees are recruited. The perception of the effect of social geography on shrinkage is summarised in the belief that, “Bad areas cause high shrinkage.”

Management

Management issues affect shrinkage in two broad ways. These relate to (1) the corporate policies and practices of a retailer and (2) the manner in which those policies and practices are deployed in individual stores.

Retail chains make corporate decisions that affect in-store shrinkage. There are many areas for the corporate management team to consider, including:

- Proportion of grocery items to non-food lines.

- Store size, e.g. mini markets through to hypermarkets.

- Delivery methods, e.g. centralised distribution or direct store delivery by suppliers.

- Range of items held in store, (can vary from 5,000 to 80,000 references).

- Store autonomy, i.e. one format for every store or managerial flexibility to tailor the store.

The list of issues on which a retail chain’s corporate policy will have an effect on shrinkage is considerable. This causes a problem when researching the impact of individual decisions on the performance of the retailer, as there are too many variables to control. However it is possible to test whether there are significant differences in the level of shrinkage between retailer chains.

Researching management practices within a given retail chain normalises a considerable number of variables, as they are the same for all the stores in the chain. This allows research to be conducted into the manner in which corporate policies and practices are deployed in individual stores. It is also possible to test whether there are significant differences in the level of shrinkage between stores within the same retail chain. The perception that the abilities of individual managers can affect the level of shrinkage in a store is captured in the belief that, “Good shrinkage results follow good managers.”

Supply Chain Partners

There is a perception that shrinkage can be imported from supply chain partners. These partners may be internal or external and either customer or supplier. They are thought to have the potential to cause loss through a combination of process failure, employee theft and fraud.

These problems occur when the goods that were ordered are not received. This mistrust operates both ways in the supply chain. From a manufacturer’s perspective they feel that retailers, ‘always complain when deliveries are under but never when they are over’. Whilst from the retailer’s perspective, ‘invoices reflect what we ordered, not what they delivered’.

This issue is not just a manufacturer – retailer one. Within a retail chain, store managers may feel they are not being served well by their central distribution operation. This feeling is reinforced by evidence from some retailers where their distribution centres habitually underpick product, for example 1 percent less than planned, and end the year with a surplus of items.

There is a view that this problem does not lead to actual loss as the products remain within the retailer’s supply chain. This argument suggests that efforts to resolve this situation are not necessary and is a case of ‘chasing wooden dollars’. However such an attitude does not factor in that process failures such as this provides the opportunity to hide malicious loss.

Some of the issues described above will be common across a retailer’s estate although they also have the potential to be more significant in some stores rather than others. For example some managers may be better at addressing the problems than others. They may have better practices in place or may operate their procedures more consistently. Also some managers may report over deliveries as a matter of course whilst others see it as an opportunity to balance their perceived loses.

It was from this background level of understanding that the ECR Europe research into Hot Stores was launched.

Research Objectives

In light of the limited level of current understanding, the objective of the research in to Hot Stores was limited to answering two broad questions:

- What is the profile of store losses across Europe?

- What makes a store ‘hot’?

Research Methodology

This research was approached from the perspective that the topic lacks widespread and general understanding both within the industry and within the research team. It was therefore appropriate to design a method that reduced the sensitivity of the research to bias. Hence we chose to gather data from multiple sources to enable our analysis to be triangulated.

In order to determine the profile of loss across Europe it was necessary to gather data from multiple retailers. This was achieved using a survey that gathered quantitative data from the retailers on the amount of shrinkage per store for all stores in their estate. This data allowed an overall profile of loss per store to be derived. This data also allowed the comparison of the loss profile between retail estates.

A sample of European retailers were contacted and asked to provide data on the level of shrinkage for each store in their estate. Of the eighty-nine companies contacted sixteen responded, a response rate of eighteen percent. In total, data from 2,504 stores was collected.

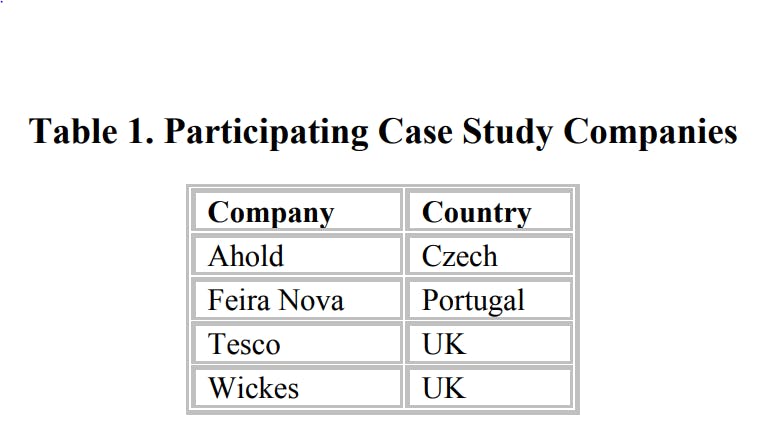

Field work was conducted in four retail chains in order to provide a greater depth of information on factors that affect the overall shrinkage in a chain and also between stores within a chain. The four participating companies are shown in Table 1 below:

A questionnaire was sent to the loss prevention manager from each company. This sought to identify the company policies and procedures relating to security (overall philosophy, types of data collected etc) store management (manager incentive schemes, degree of autonomy etc), and staffing issues (type of training given to staff, disciplinary codes used etc). In addition, each case study company was asked to provide quantitative data for each of the stores in their estate covering a wide range of issues including: staff turnover, length of time the manager had been at the store, number of shoplifters apprehended in the last 12 months, number of staff dismissed, age of the store, time since last refit etc45.

Four stores in each chain were visited in order to conduct a site review and to interview the store manager and members of staff. The purpose of the visits was to determine the causes of loss in the store. The four stores were selected to form two sets of matched pairs whose profile was similar, with each pair containing one high loss store and one low loss store. The fieldwork was designed to gather quantitative and qualitative data on the performance of each store and then to allow the comparison of findings from the two high loss stores against the findings from the two low loss stores.

The research was divided between research teams from the University of Leicester and Cranfield University, with two retailers investigated by each team. This division allowed each research team to conduct a peer review of the other’s work in order to highlight and resolve unintentional biases or deficiencies in method. A further review of method, progress and findings was provided by the ECR Europe Shrinkage Project team, who acted as a steering group for the research.

Limitations of the Methodology

There are a number of limitations to the methodology that need to be taken into account when reviewing the data presented in this report. First, the sample size of the survey of retailers in Europe is relatively small. The list was limited to those companies that had previously been contacted by the ECR Shrinkage Group and where an email address was available. It was not possible to get a response with an even geographic spread of companies to take part in the survey and so the sample is skewed towards western European companies. Similarly, the sample contains some retailers with a large number of stores, who therefore are over represented in the overall population of stores. Likewise, the data set only contains results from those companies that are able to collect information on the level of loss at store level, and are willing to share it with researchers. Arguably therefore, the sample is skewed towards those companies that have a more enlightened approach to the issue of shrinkage management. Given this, however, the purpose of the survey was to draw a broad sense of what the general distribution for European retailer might look like, and the sample average was very close to the European average recorded by other surveys46. The statistical distribution was also essentially normal, which suggests that the sample size was sufficiently large to minimise the impact of any one respondent.

Secondly, it is not possible to make any detailed comparisons between the case study companies from the quantitative data on the rate of shrinkage per outlet made available to the research team. This is not possible because each company measured shrinkage in a different way, for instance some included whilst others excluded known loss, and not all stocked the same product range (one was not a grocer for instance). Given this, the report will not seek to explain the different rates for each company, but merely reflect upon the different distributions within each case study.

Thirdly, the number of stores visited by the researchers was small – only four per company, and the sites were primarily selected by the organisation themselves (there was limited consultation with the researchers). While the research team requested to visit two stores with low shrinkage and two stores with high shrinkage, the research team was not able to check the veracity of the data upon which the host organisation made this decision. Similarly, time and travel limitations also meant that the case study stores were often relatively close to one another, again raising issues about whether the stores selected to take part in the study were representative. These factors need to be taken into consideration when reviewing the data presented below.

Findings: The Profile of Store Losses Across Europe

In answer to the first objective of this research, a profile of losses for retailers across Europe was derived from the data gathered by the survey. At a low level of granularity the data provides a profile of the loss per store by collating the data from all respondents. This data provides a reference for contrasting the relative performance of the four individual retailers that participated in the case studies. For reasons of confidentially, each retailer’s data is presented anonymously. To allow comparison between retailers with different numbers of stores the data has been normalised by converting it into percentages.

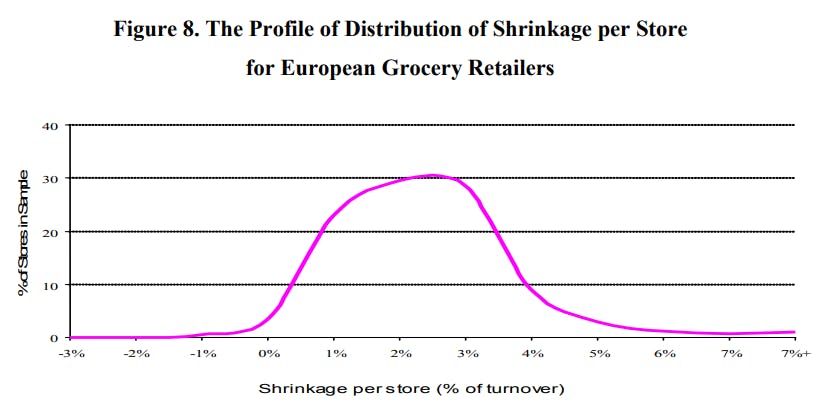

The distribution of the level of loss per store for Europe’s grocery retailers was plotted on a graph to create the profile shown in Figure 8, below.

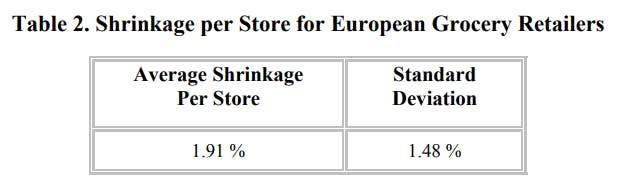

The distribution can also be described in terms of the statistics shown in Table 2.

The distribution of shrinkage per store can be seen to assume the profile of a normal distribution with a typical shape that is symmetrical about its mid point. The distribution is not however a perfect normal distribution. For example its modal point (the highest point of the curve) does not coincide with the arithmetic mean of the sample. Instead the distribution is skewed marginally to the right.

Notwithstanding the observation that the distribution is not a perfect normal distribution, it is however a good approximation and provides a useful description of shrinkage by store across Europe’s grocery retailers.

Individual Company Store Loss Distribution Profiles

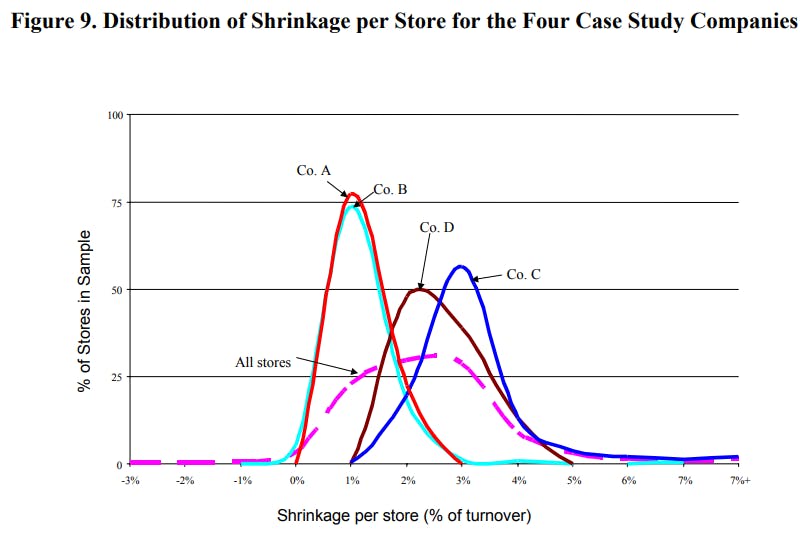

The European sample of loss per store is built up from separate data sets for the retail chains that participated in the survey. Of these chains, four agreed to be studied in greater depth. The distribution profiles of shrinkage per store for these four retailers is presented in Figure 9.

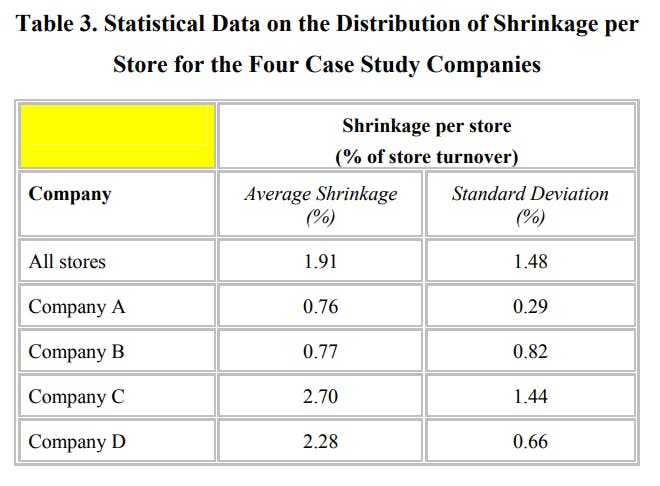

In each case, the distribution of shrinkage per store for the four case study companies reveals a distribution that approximates to a normal distribution. These individual company distributions are different from the distribution for the industry as a whole in that the spread of results is narrower. This can be seen in Figure 8 with the taller, narrower profile of the retailers’ distributions. The shrinkage distribution per store for individual estates also possess smaller standard deviations that the distribution for all stores across Europe. This is to be expected as the opportunities for difference between stores of varying format in a variety of European countries is greater than the opportunity for variation found within a given retail estate.

The distributions of companies A and B have similar profiles, in particular with respect to the average loss per store. Company C has an average shrinkage per store above that of the overall average and higher than the other three case study companies. This causes its distribution to lie furthest to the right. The distribution of Company C’s data also reflects the presence of a number of stores in the upper end of the shrinkage scale, causing the distribution to have a tail to the right. Finally the distribution of shrinkage per store for Company D can be seen to be skewed slightly to the left. This gives it an appearance that suggests it may contain results that are favourable to the distribution of shrinkage across all stores. However this observation is false, as can be determined by reviewing the statistics on the distribution of shrinkage per store for these four companies presented below in Table 3.

Examination of the statistical data presented in Table 3 confirms that Company D and Company C have average shrinkage per store greater than the average for all stores in the sample.